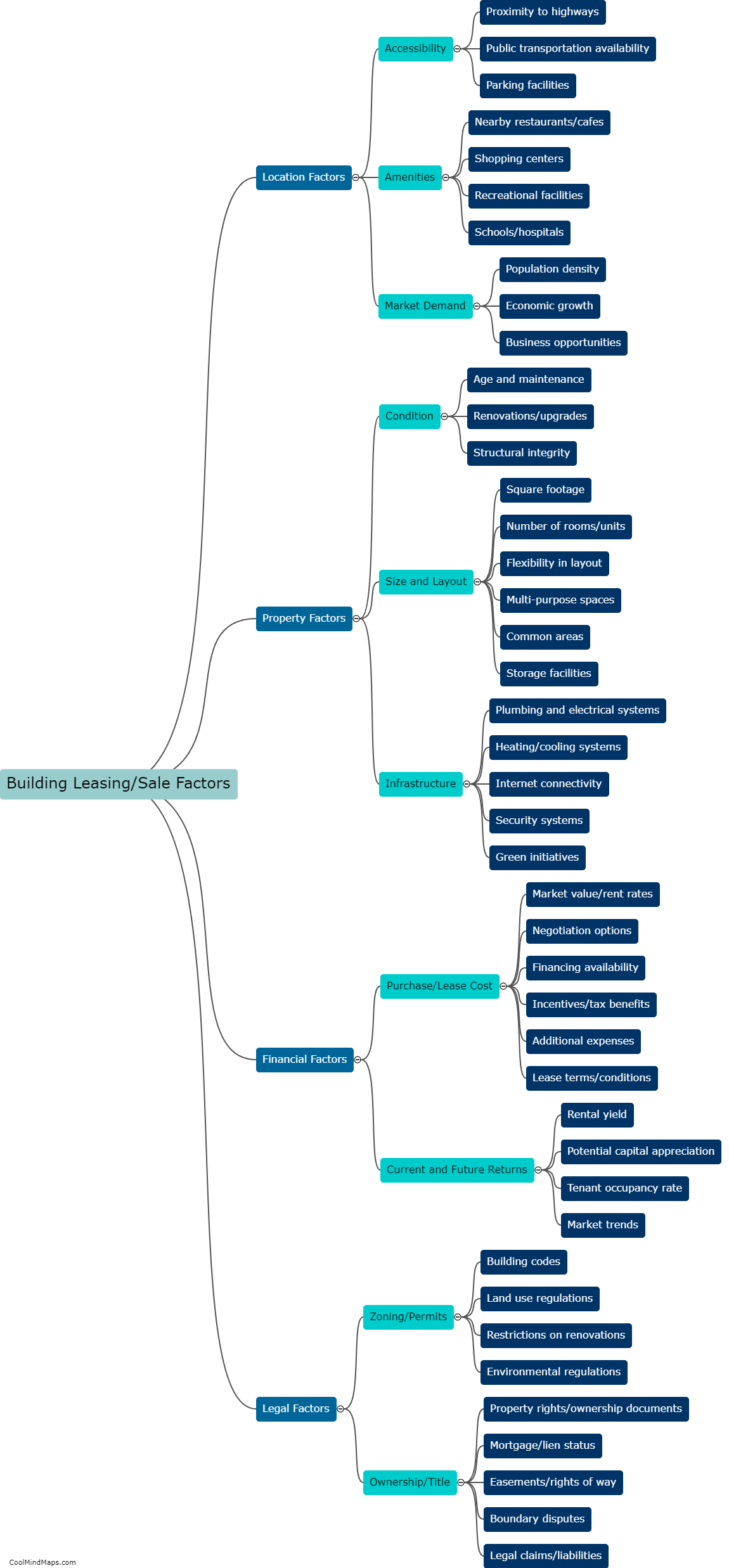

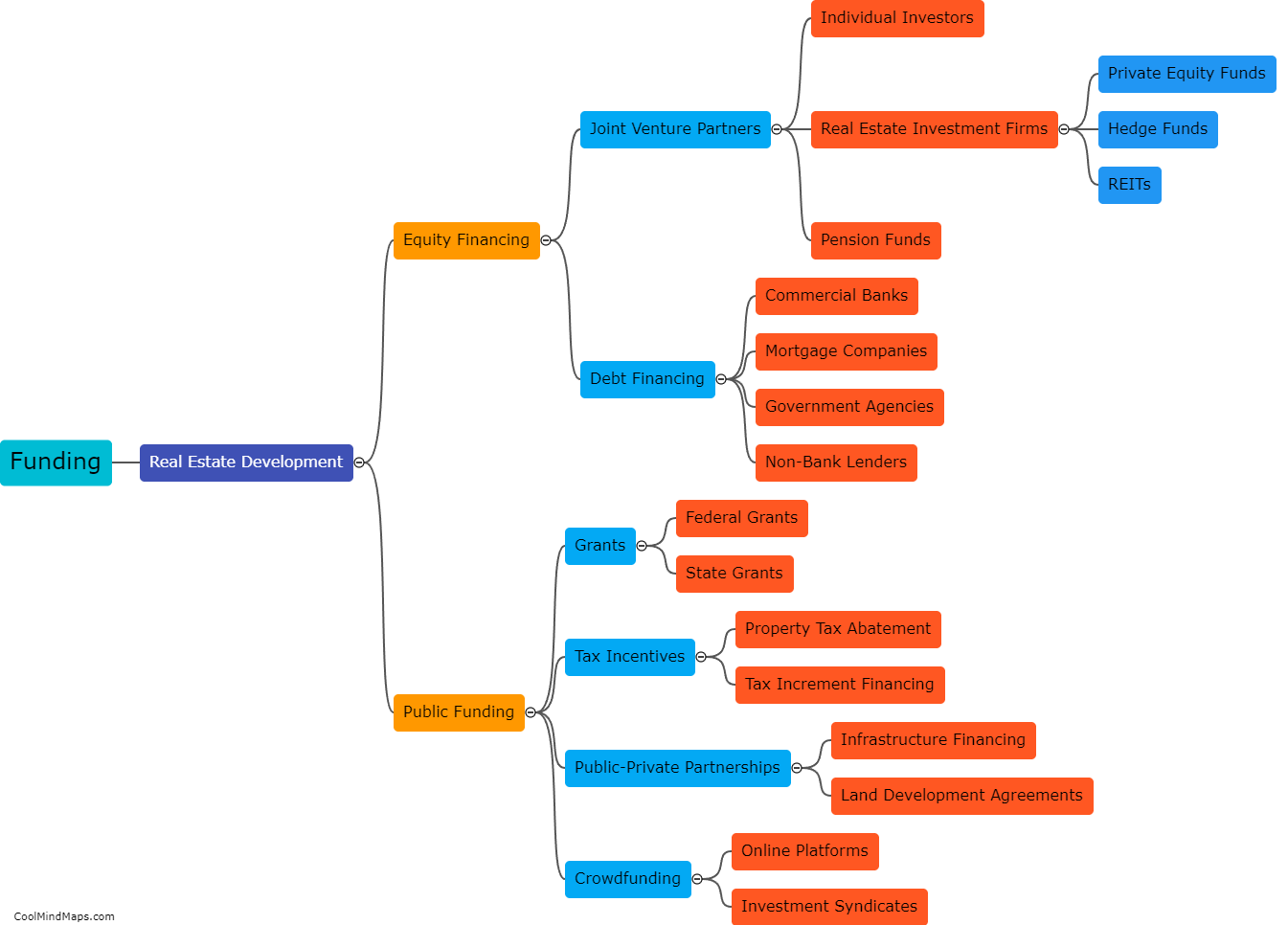

How to acquire funding for real estate development projects?

Acquiring funding for real estate development projects involves a strategic approach to attract investors or lenders for financial support. Firstly, it is crucial to create a detailed and compelling business plan that outlines the project's potential returns, market analysis, and risk evaluation. Building a strong network of potential investors through attending industry events and engaging with local real estate professionals is also essential. Additionally, exploring various financing options such as traditional bank loans, private equity firms, crowdfunding platforms, or government-sponsored programs can widen the possibilities for funding. Conducting thorough due diligence, being prepared for negotiations, and demonstrating expertise and track record in real estate development are important in convincing potential investors or lenders to provide financial backing for the project.

This mind map was published on 26 September 2023 and has been viewed 98 times.