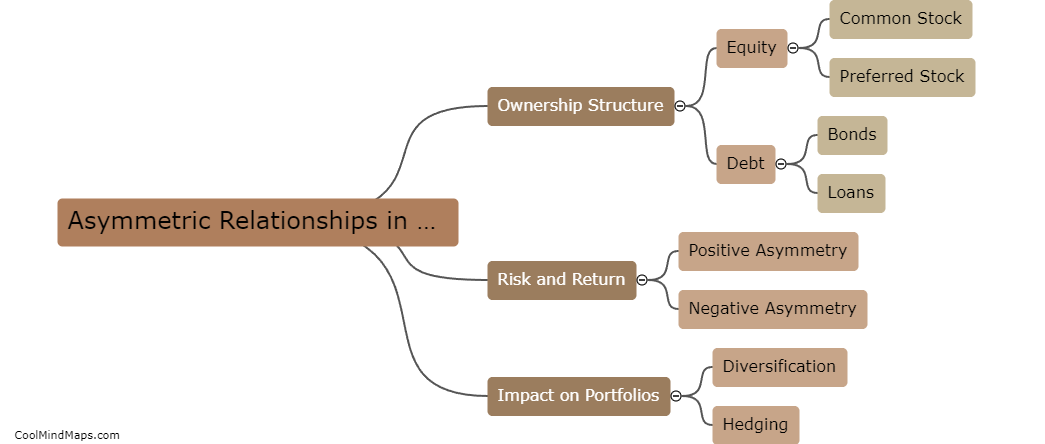

What are asymmetric relationships in financial assets?

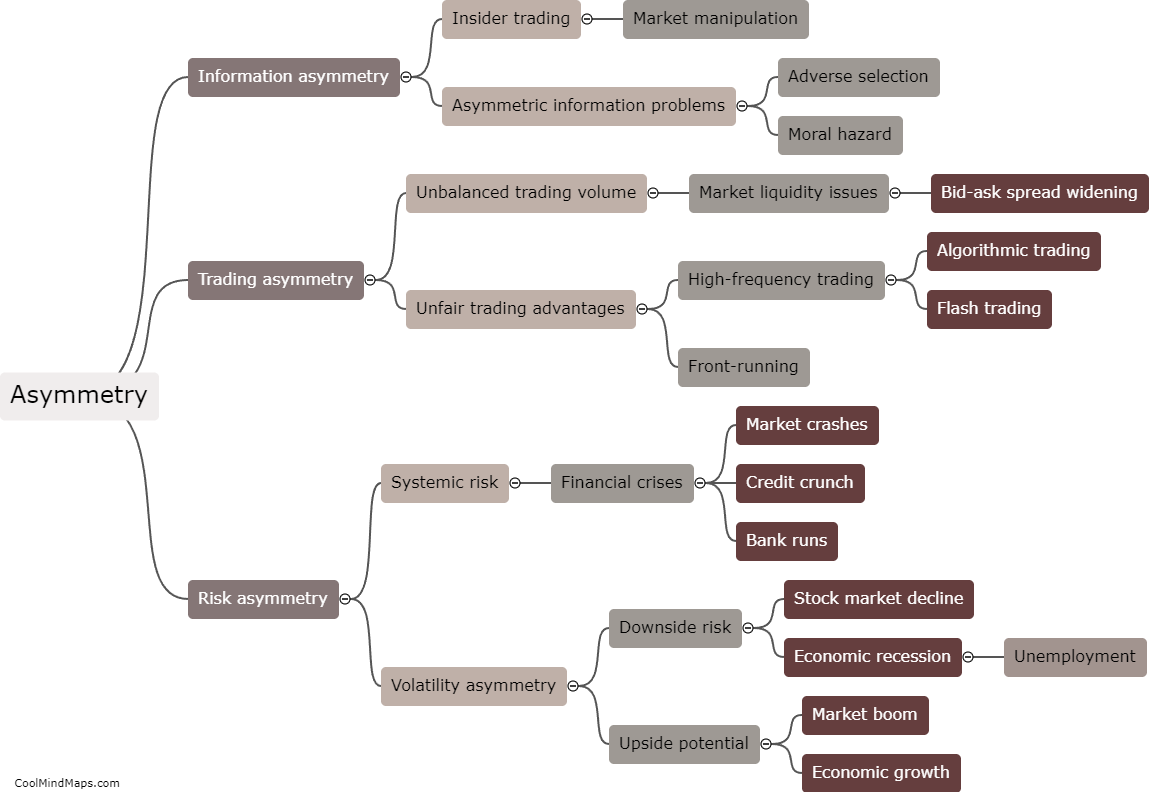

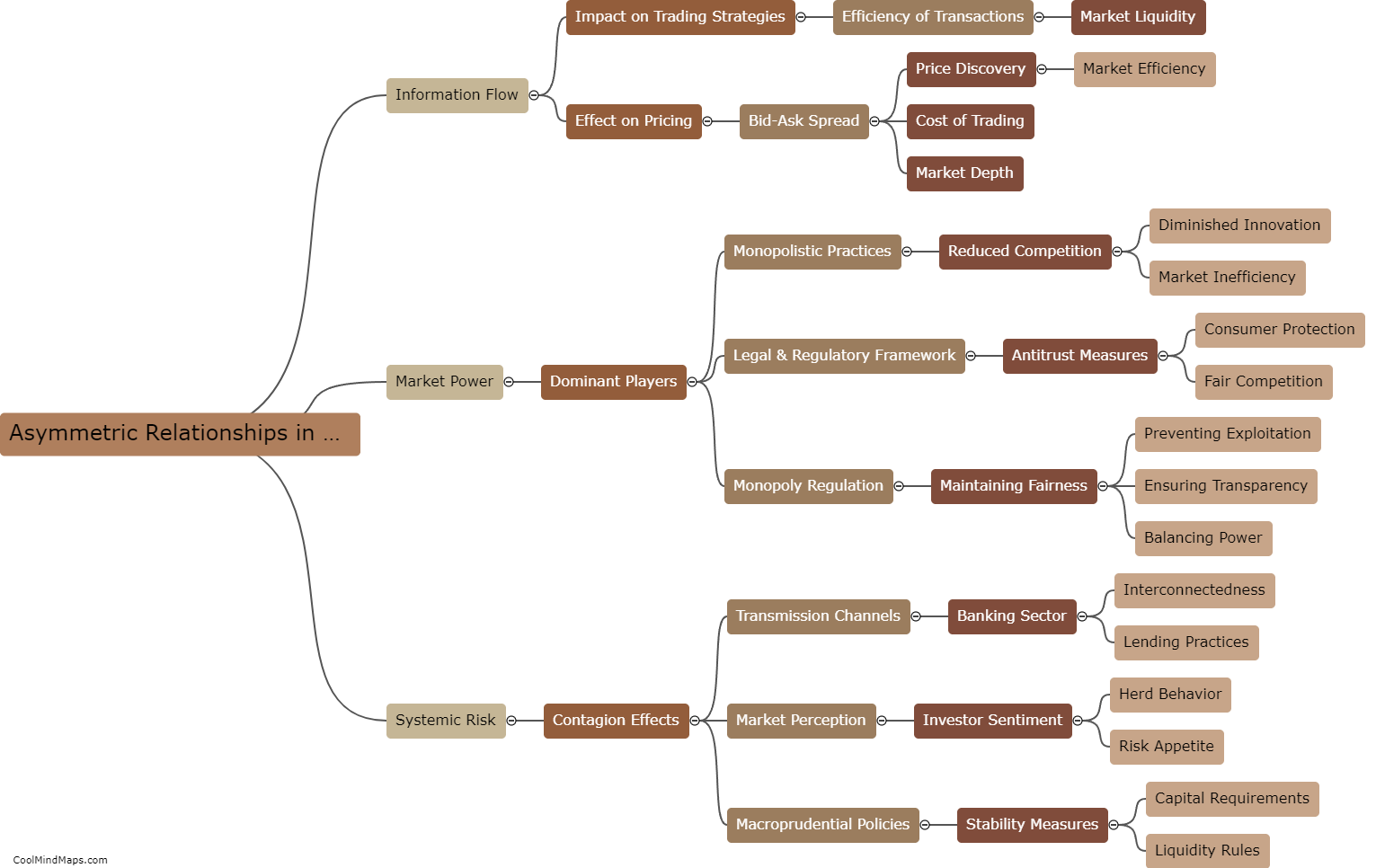

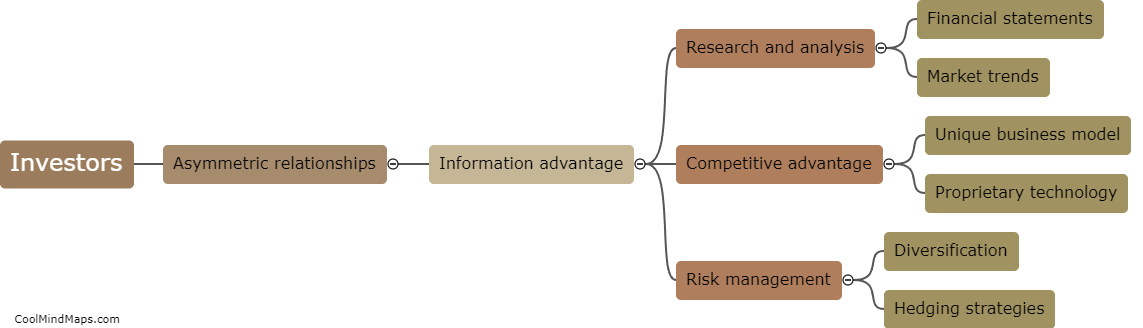

Asymmetric relationships in financial assets refer to the phenomenon where the potential gains and losses of an investment are not proportionate. In other words, the upside and downside risks associated with an asset are not equal. Typically, asymmetric relationships are observed when the potential gains from an investment are significantly greater than the potential losses. This concept is often used to describe options and derivatives, where the potential for profit is unlimited, while losses are limited to the initial investment. Asymmetric relationships can also be observed in various other financial instruments, such as leveraged investments, where a small increase in the value of an underlying asset can lead to a large return for the investor. Understanding the asymmetric relationships in financial assets is crucial for investors in assessing risk and potential returns.

This mind map was published on 21 December 2023 and has been viewed 85 times.