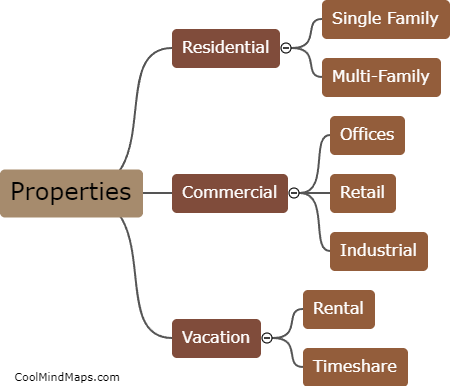

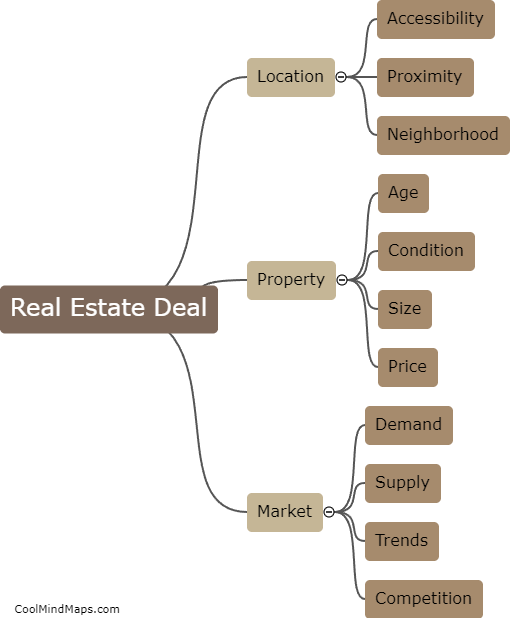

How to differentiate between a good and bad real estate deal?

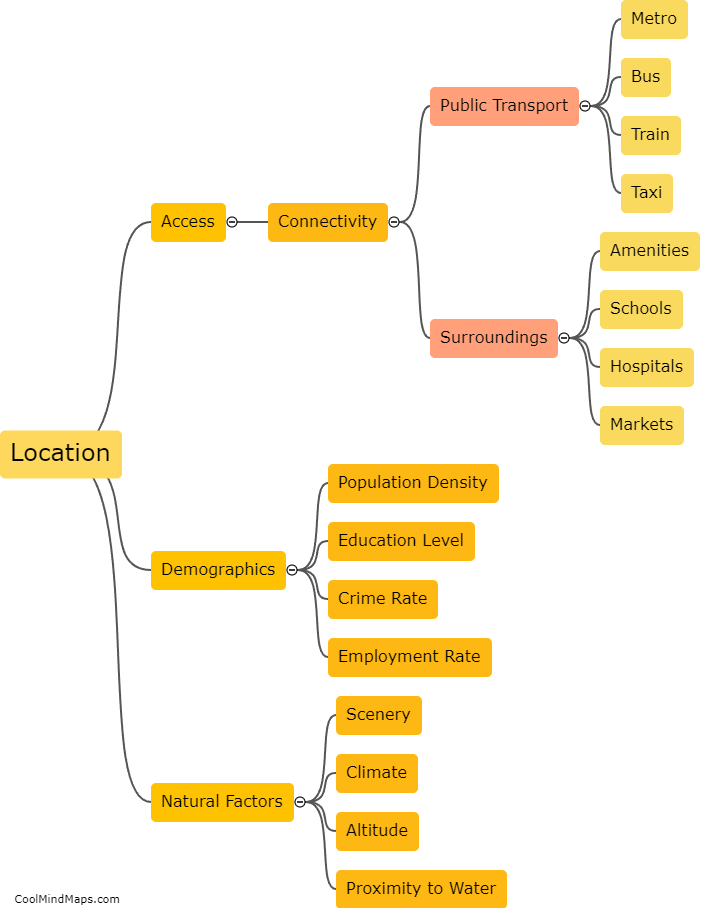

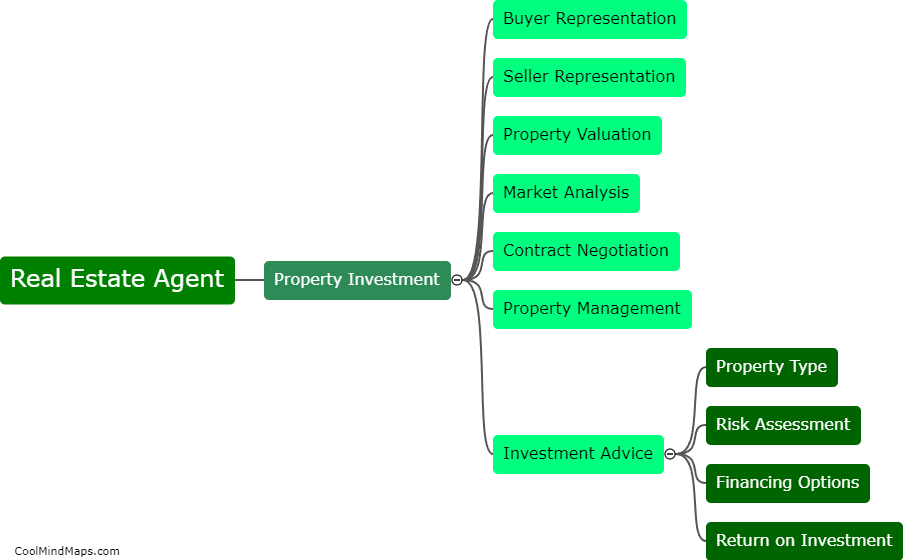

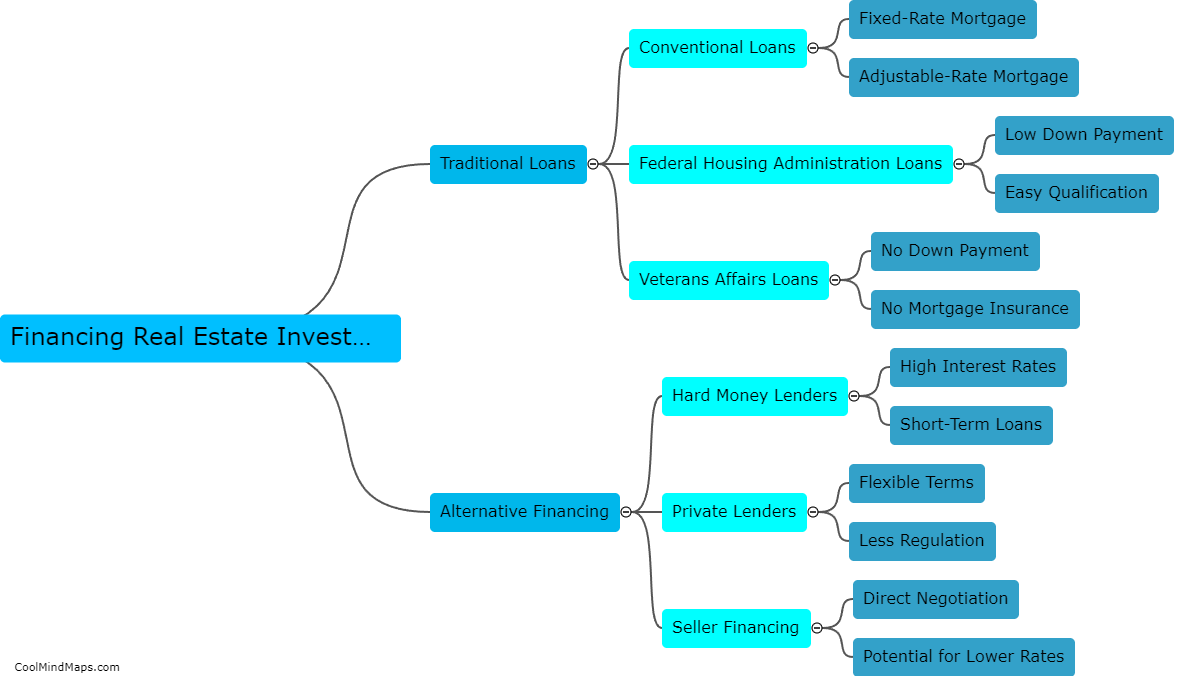

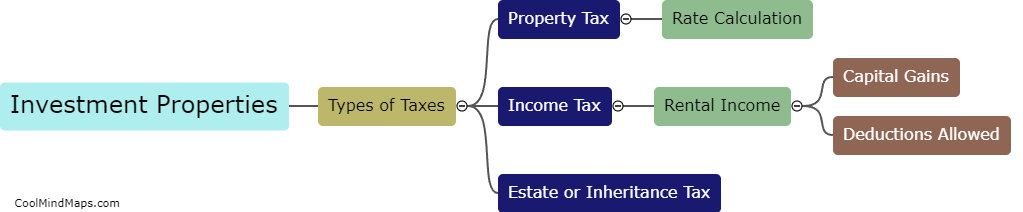

When looking for a real estate deal, it is important to differentiate between a good and bad deal. A good deal is one that offers potential for profit, is located in a desirable area, has positive cash flow, and has a good resale value. On the other hand, a bad deal may have low profit potential, is located in a less desirable area, has negative cash flow, and has a low resale value. Conducting thorough research, analyzing the current market trends, inspecting the property, and seeking professional advice can all help differentiate between a good and bad real estate deal.

This mind map was published on 19 April 2023 and has been viewed 133 times.