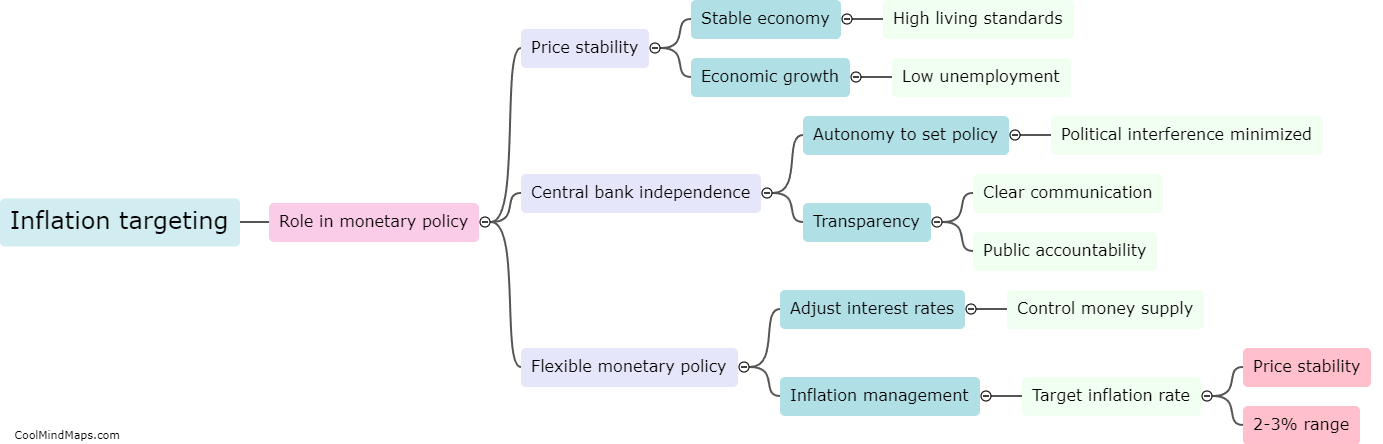

What is the role of inflation targeting in monetary policy?

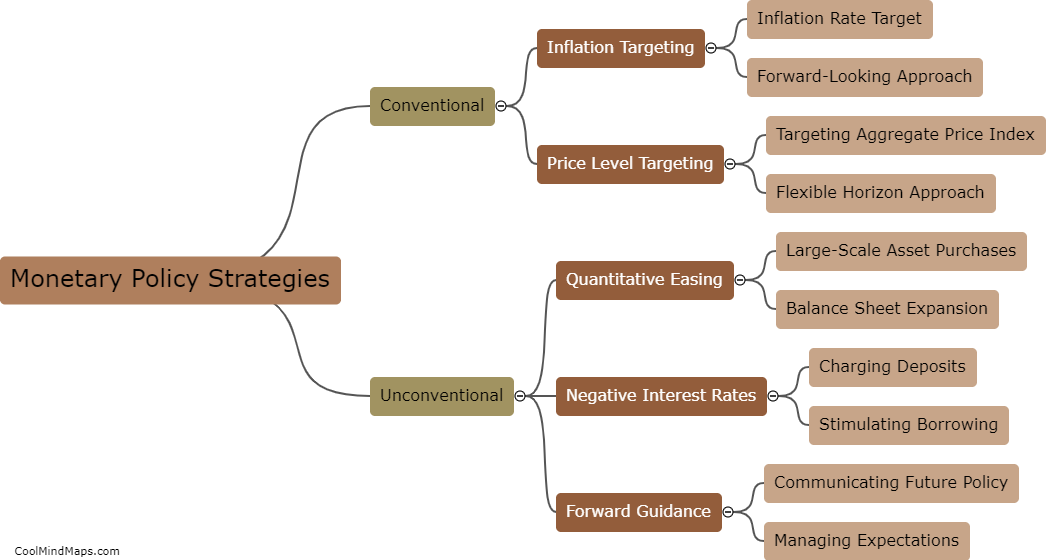

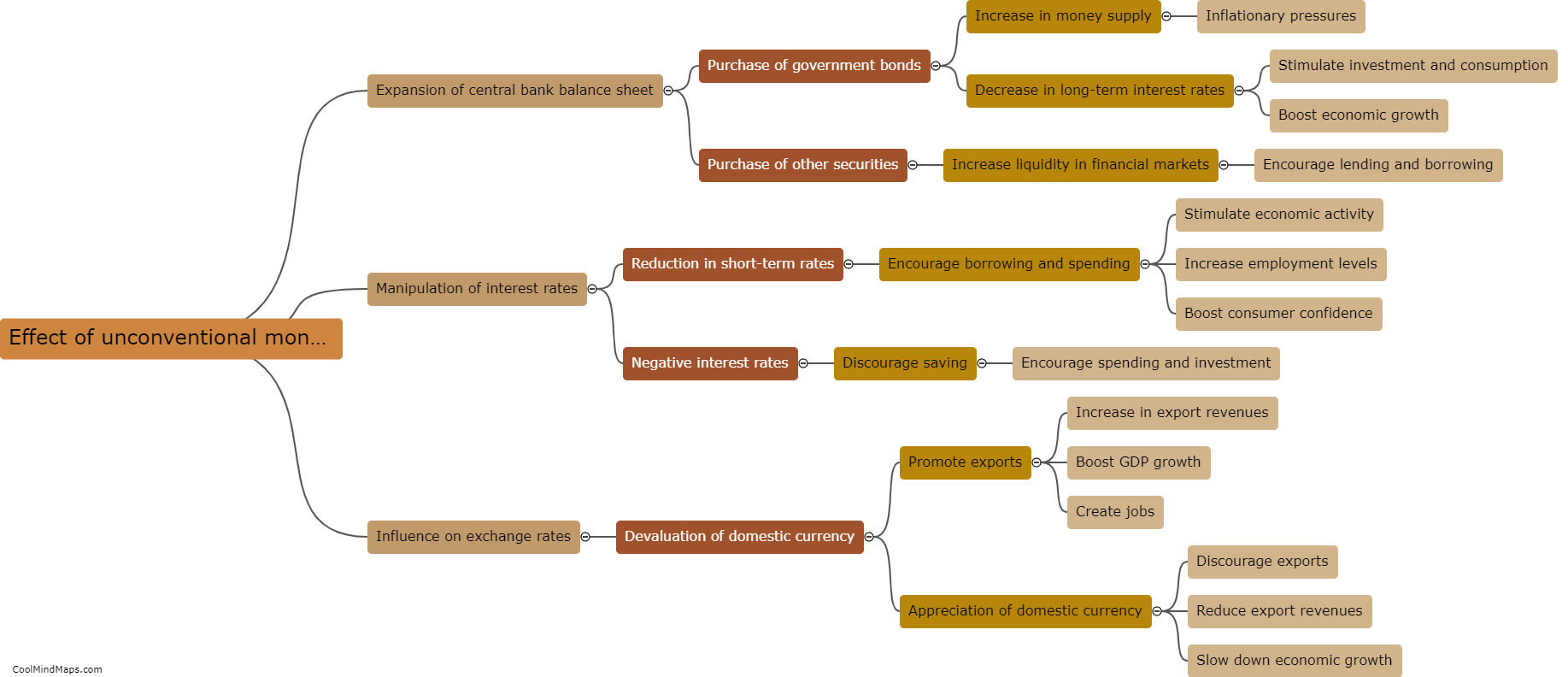

Inflation targeting is a strategy adopted by central banks to guide and control inflation rates through monetary policy. The primary role of inflation targeting in monetary policy is to maintain price stability and control inflation within a predetermined target range. Central banks set an inflation target, usually expressed as a percentage, which they aim to achieve over a specific period. By adjusting key interest rates, open market operations, and other policy tools, central banks influence money supply and borrowing costs in order to achieve their inflation target. Inflation targeting provides transparency and accountability in the conduct of monetary policy, as it guides policymakers and markets in making informed decisions based on the central bank's commitment to price stability. This approach helps to anchor inflation expectations, stabilize financial markets, and foster economic growth and development.

This mind map was published on 26 September 2023 and has been viewed 53 times.