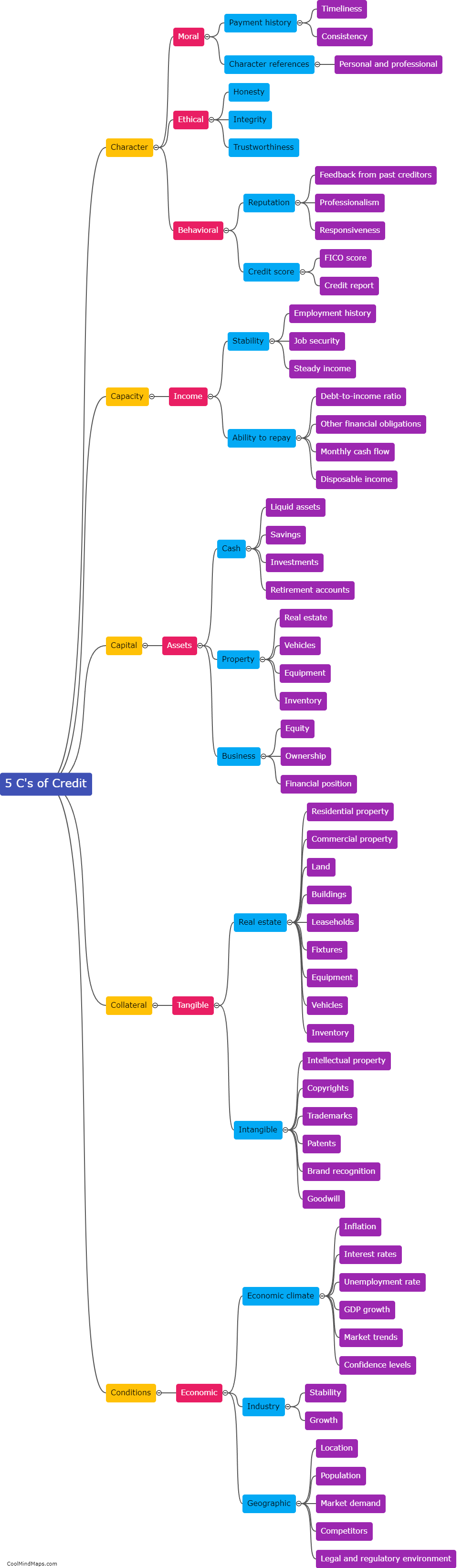

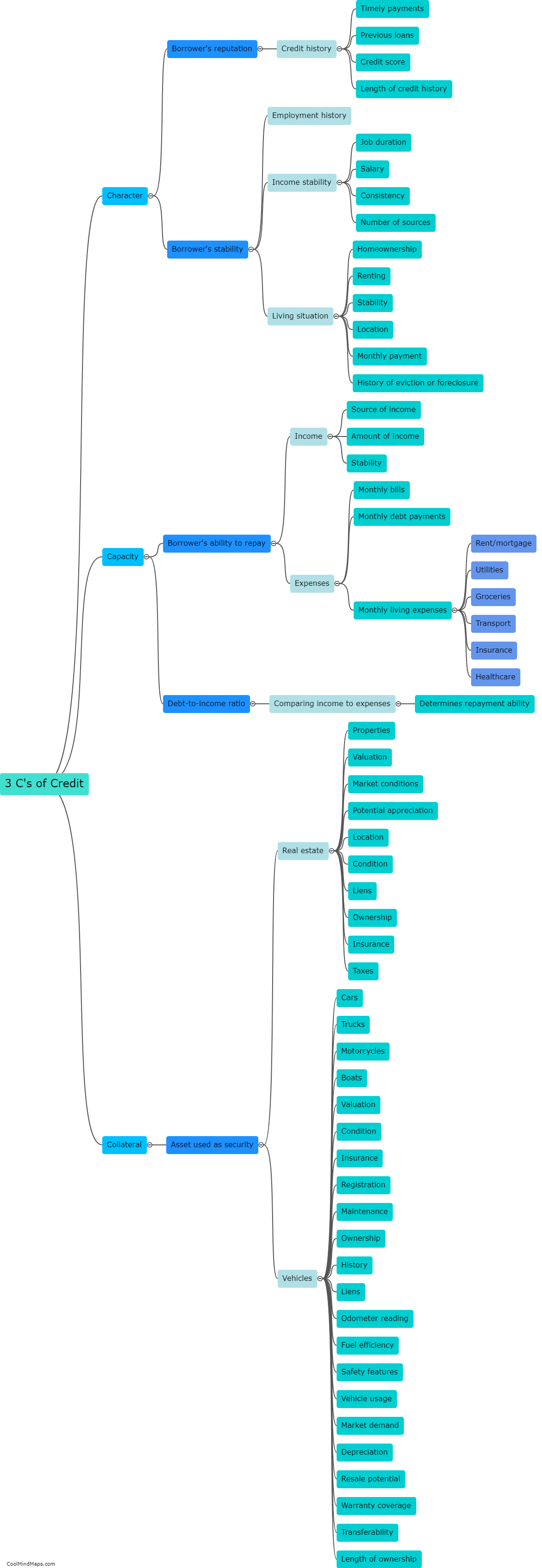

What are the 3 C's of credit?

The 3 C's of credit refer to the three factors that lenders use to evaluate a borrower's creditworthiness: character, capacity, and collateral. Character refers to the borrower's reputation for responsible financial behavior, such as their payment history and credit score. Capacity relates to the borrower's ability to repay the loan based on their income and debt-to-income ratio. Lastly, collateral refers to any assets or property that can be used to secure the loan, which serves as a backup plan for the lender if the borrower defaults on their payments. Lenders assess these three factors to determine the level of risk associated with lending money to an individual or business.

This mind map was published on 8 November 2023 and has been viewed 89 times.