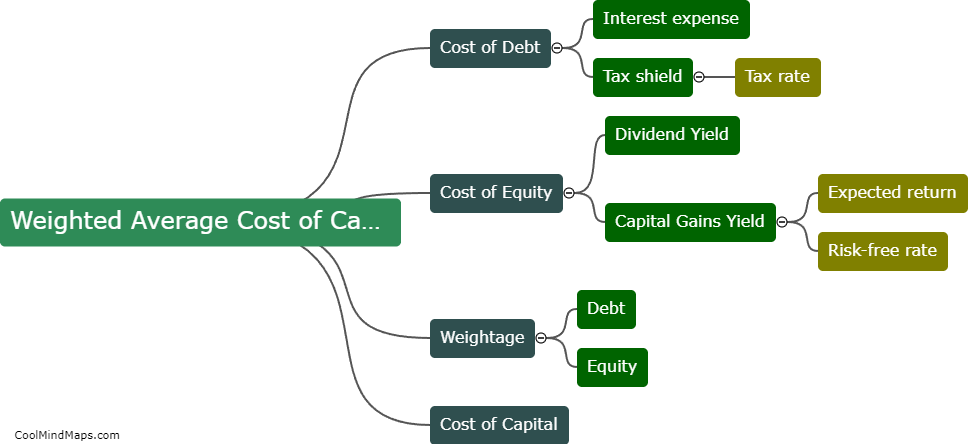

Are current liabilities considered as capital components for calculating WACC?

No, current liabilities are not considered as capital components for calculating WACC (Weighted Average Cost of Capital). WACC is a financial metric that calculates the average cost of the different sources of capital used by a company, such as equity and debt. Current liabilities are short-term obligations that are expected to be settled within a year and do not represent capital raised to fund a company's operations. Instead, they reflect the company's short-term obligations and are excluded from the calculation of WACC.

This mind map was published on 3 December 2023 and has been viewed 100 times.