How are taxes calculated?

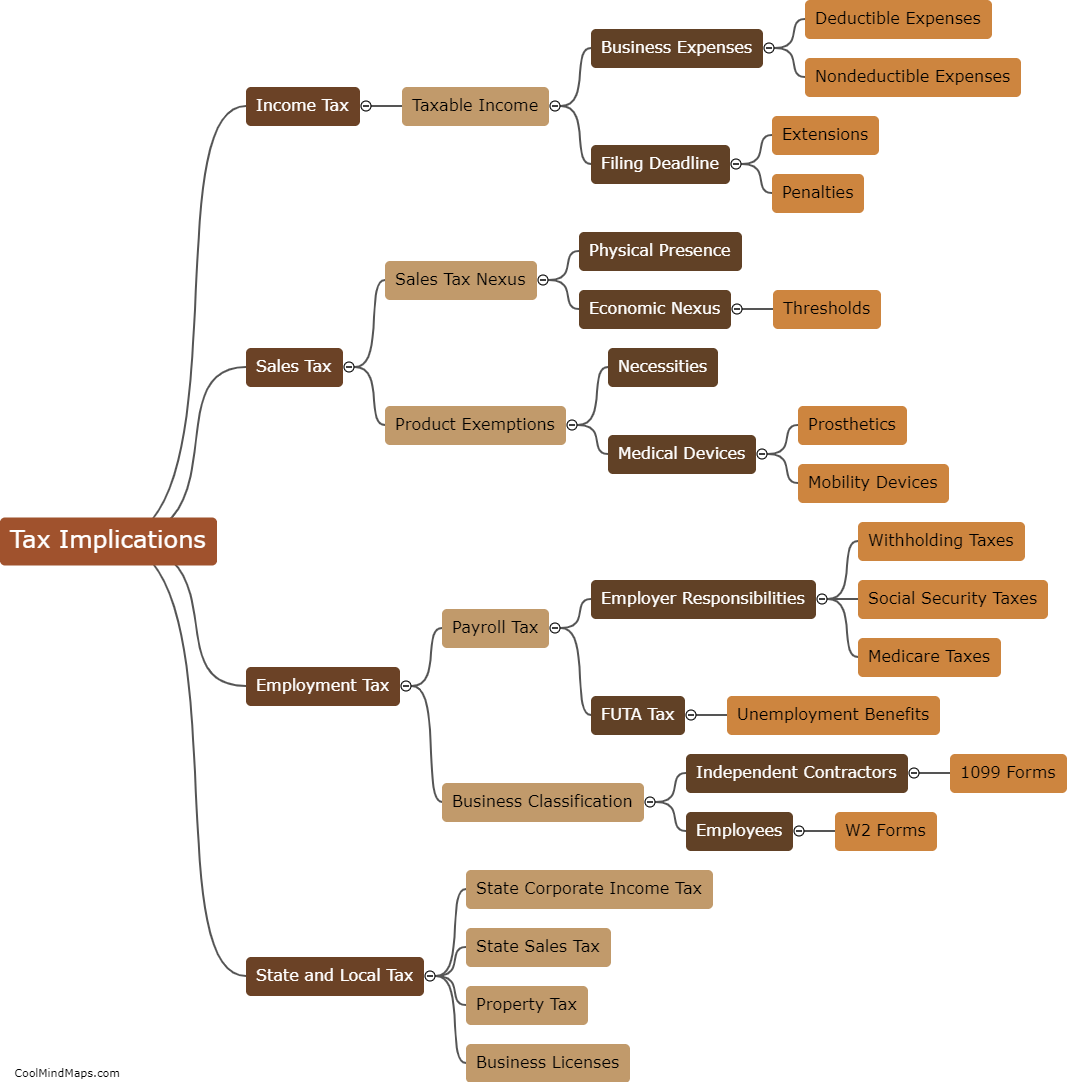

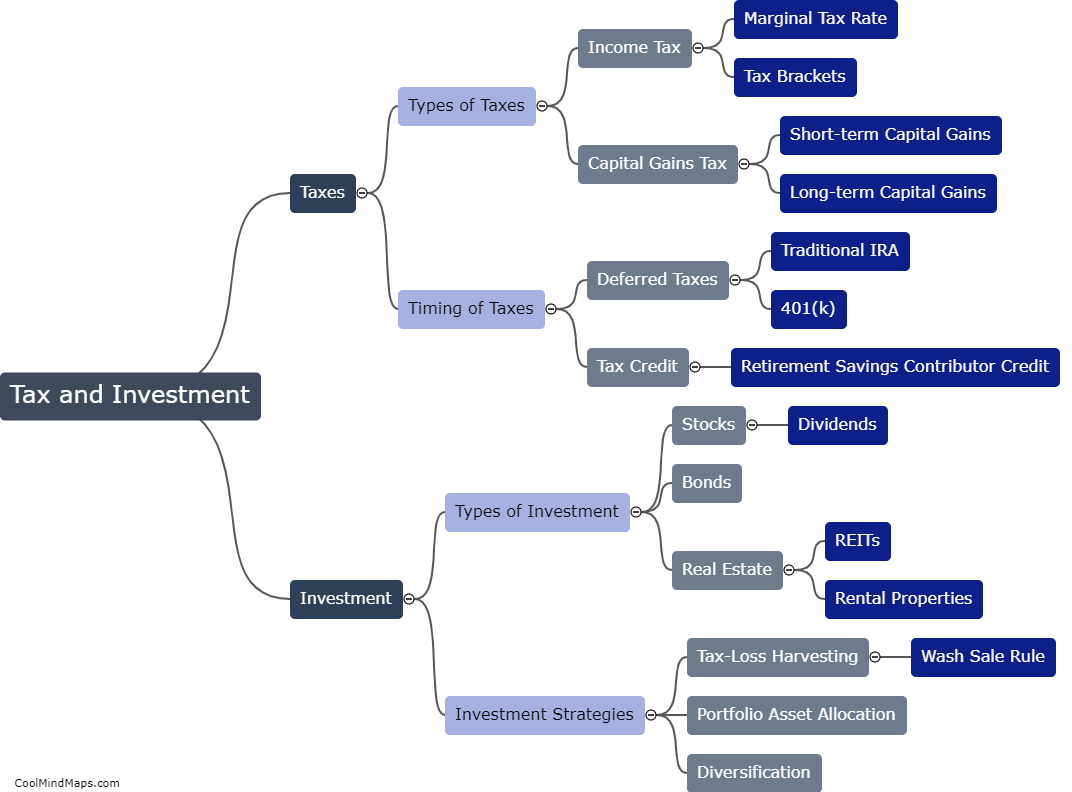

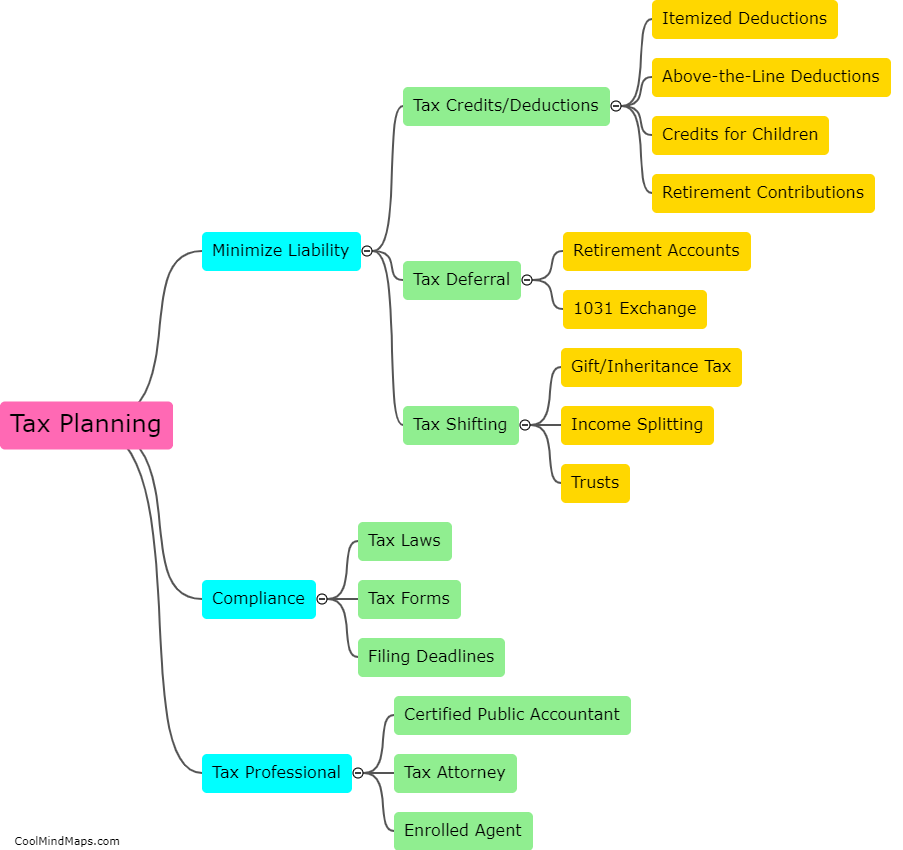

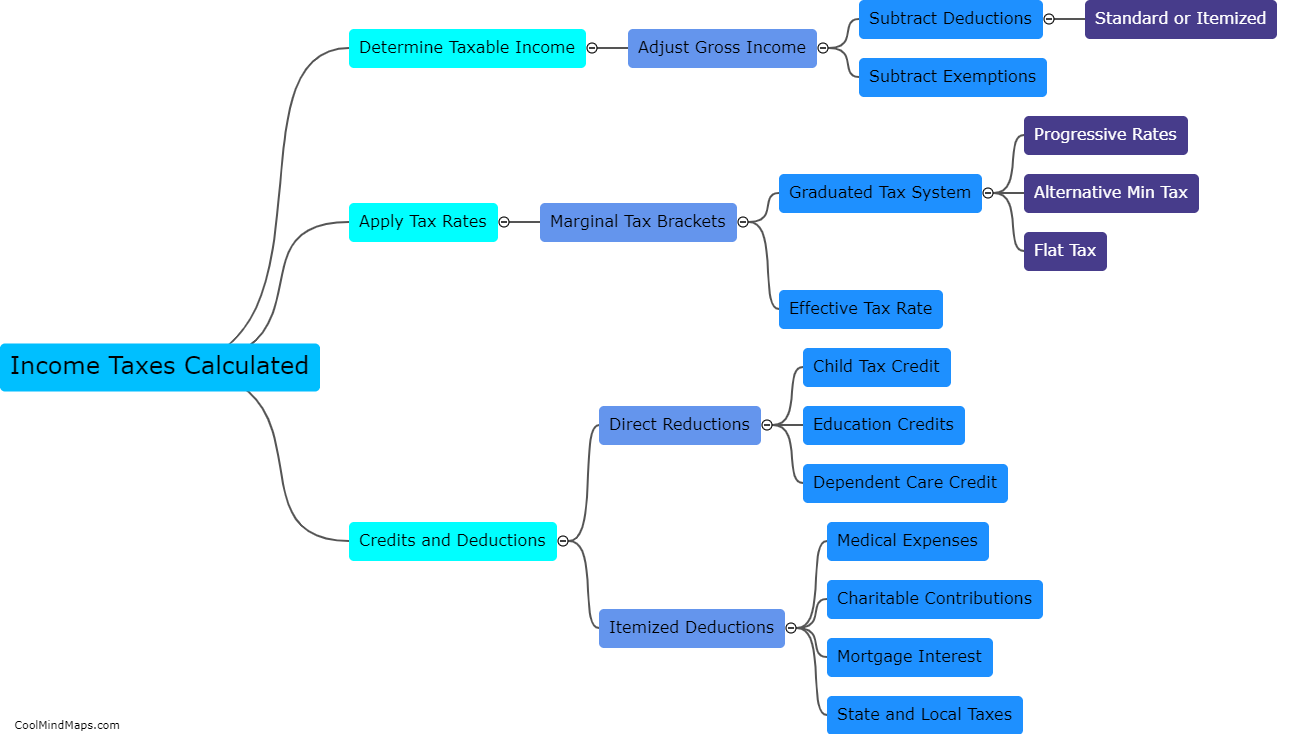

Taxes are calculated based on several factors, including income level, tax deductions, and credits. The amount of income earned throughout the tax year determines the base amount of taxes owed, which is referred to as the taxable income. Deductions and credits, such as mortgage interest, charitable contributions, and dependent care expenses, are subtracted from the taxable income to lower the amount of taxes owed. The tax rate is then applied to the remaining taxable income to determine the final tax liability. The process can be complicated, which is why many people hire tax professionals to help them navigate the system.

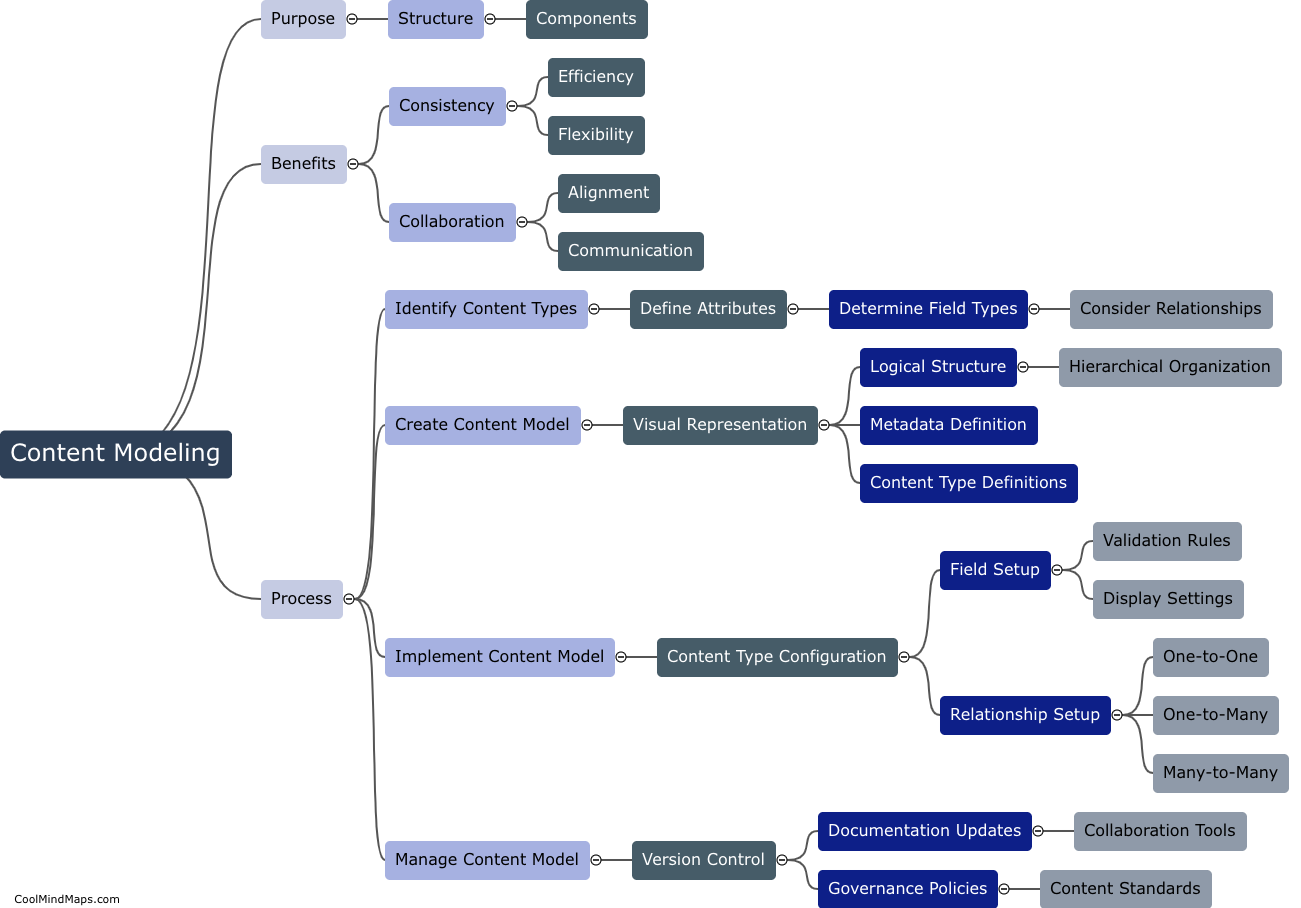

This mind map was published on 18 April 2023 and has been viewed 141 times.