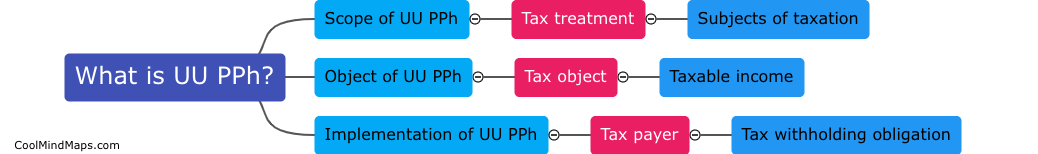

What is the content of UU PPh?

UU PPh, short for Undang-Undang Pajak Penghasilan (Income Tax Law), covers regulations related to income tax in Indonesia. The content of UU PPh includes definitions of taxable income, tax rates, deductions, exemptions, reporting requirements, and penalties for non-compliance. This law is essential for individuals and businesses to understand their tax obligations and ensure compliance with Indonesian tax laws.

This mind map was published on 14 June 2024 and has been viewed 59 times.