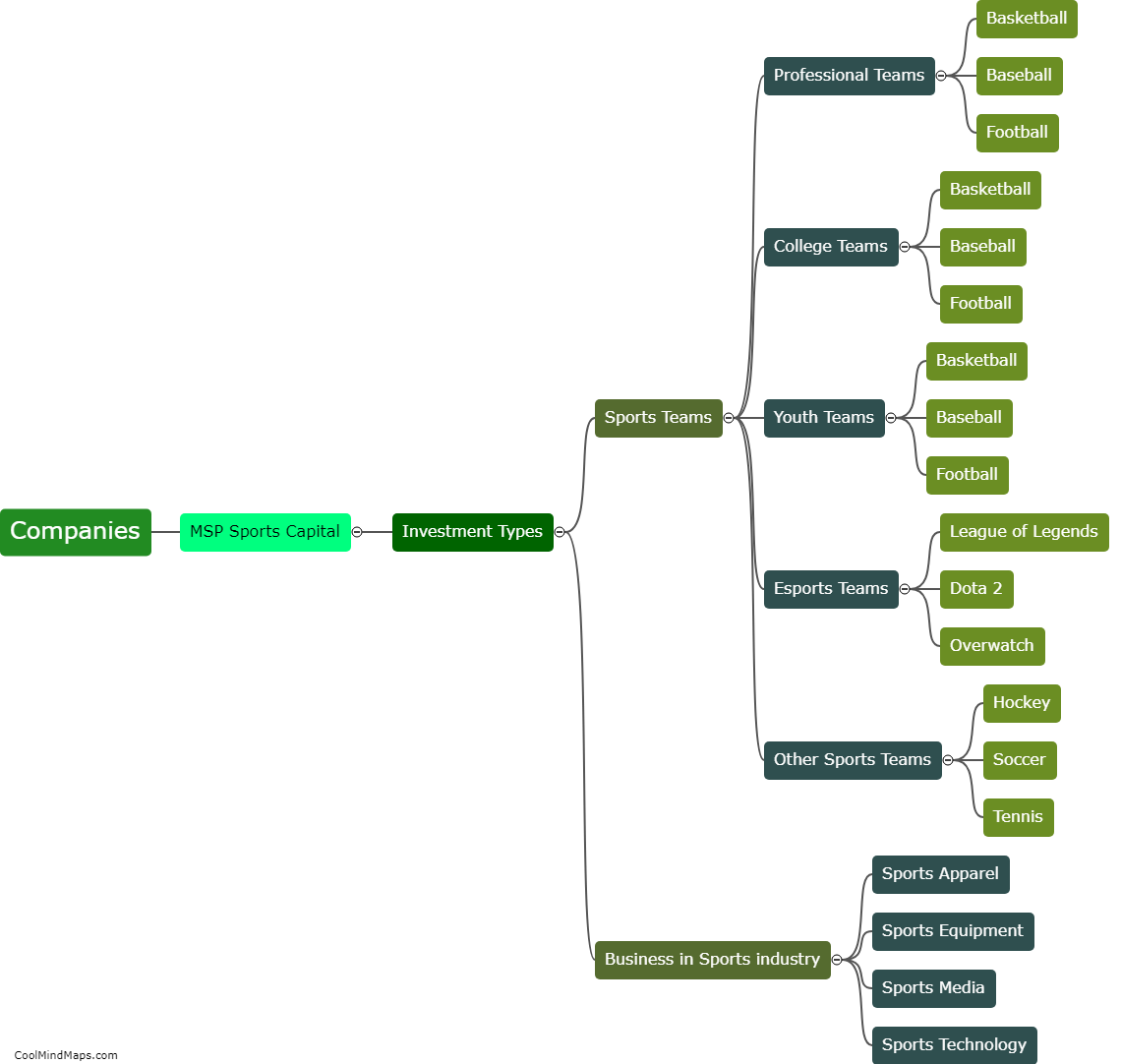

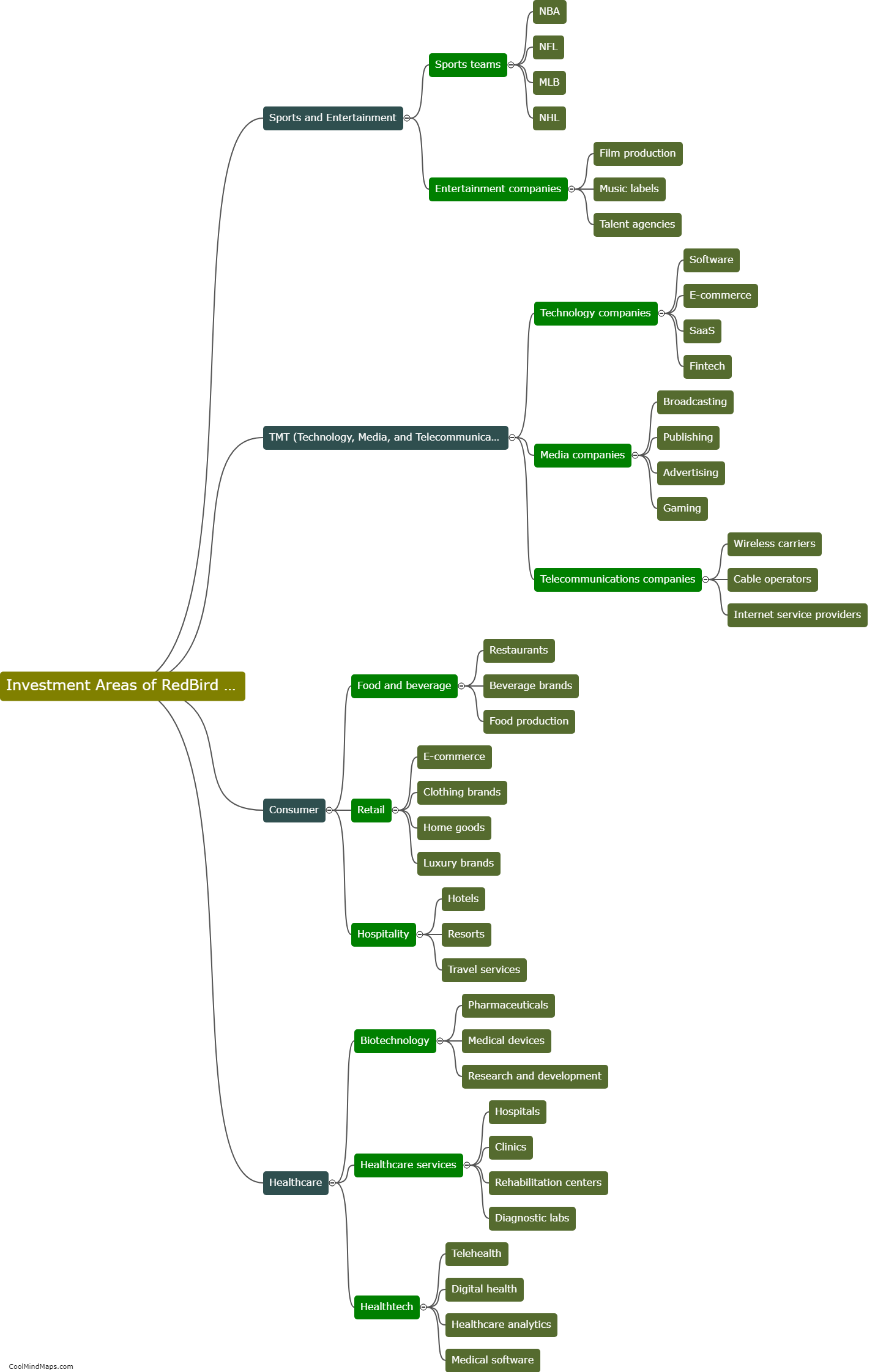

What are the investment areas of RedBird Capital Partners?

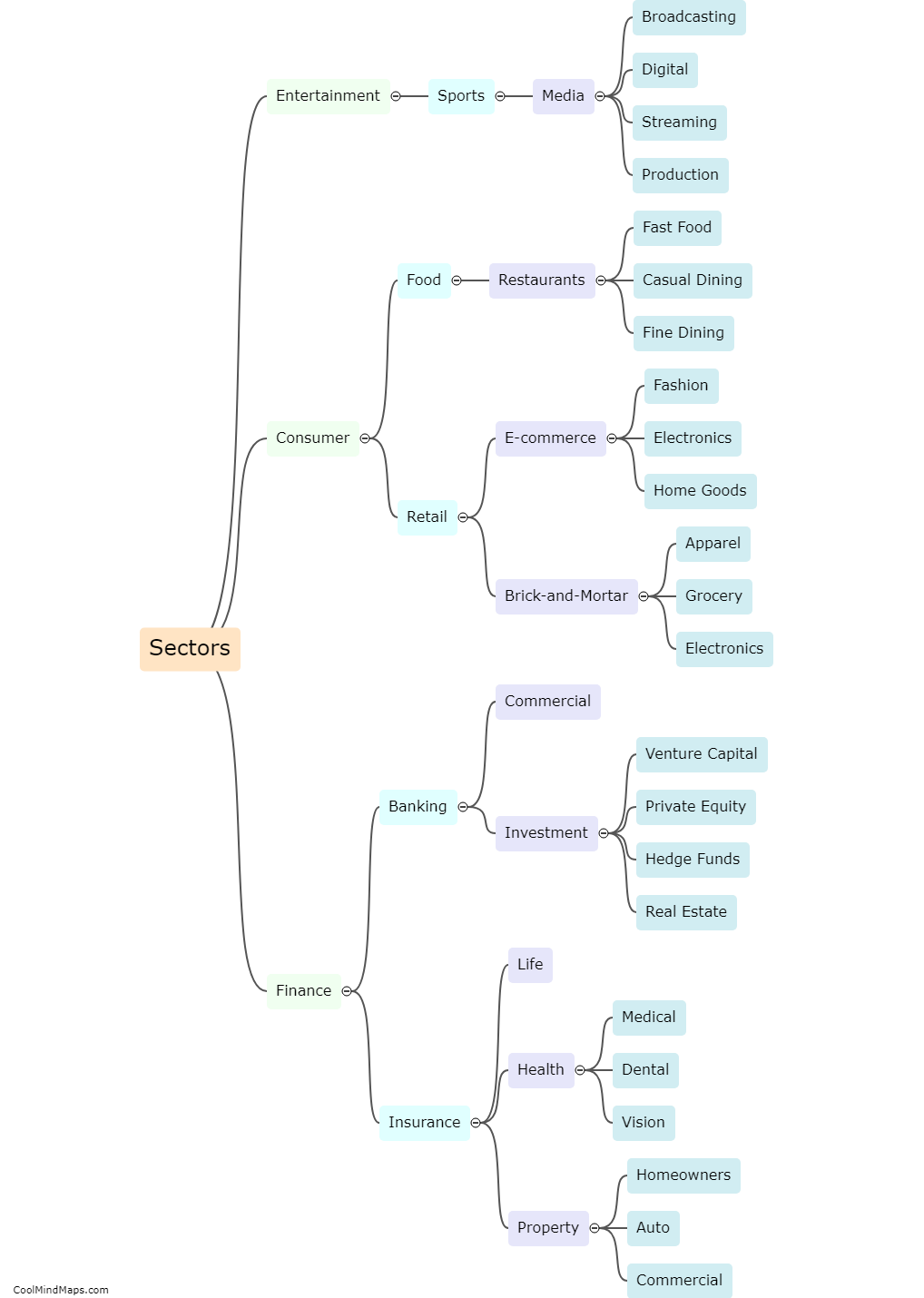

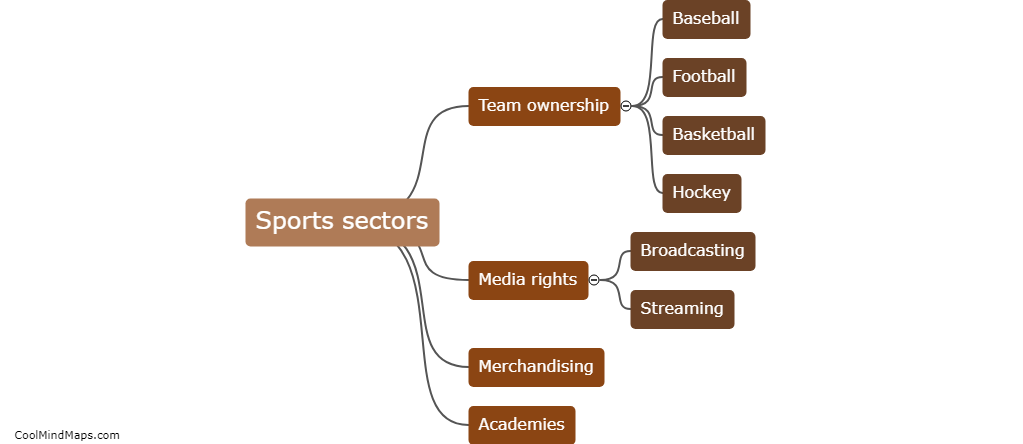

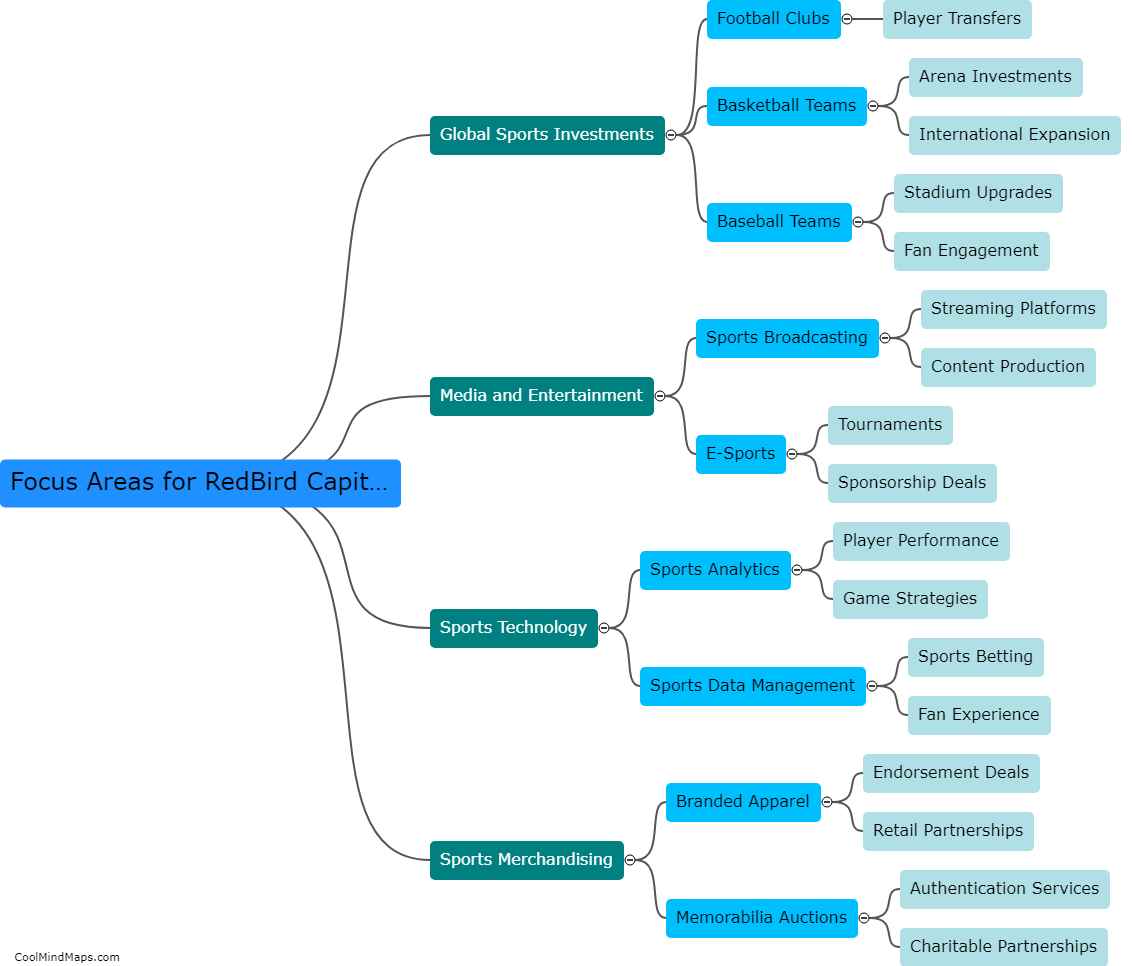

RedBird Capital Partners is a private investment firm that focuses on a wide range of investment areas. Its primary target sectors include sports, media, technology, and lifestyle. RedBird seeks to partner with exceptional management teams and companies that demonstrate strong growth potential, unique market positioning, and defensible competitive advantages. Their investments may span across professional sports teams, sports-related media properties, content production and distribution platforms, esports, consumer brands, live entertainment, hospitality, and technology-enabled services. RedBird employs a flexible investment approach and actively collaborates with its portfolio companies to drive value creation and long-term growth.

This mind map was published on 2 November 2023 and has been viewed 101 times.