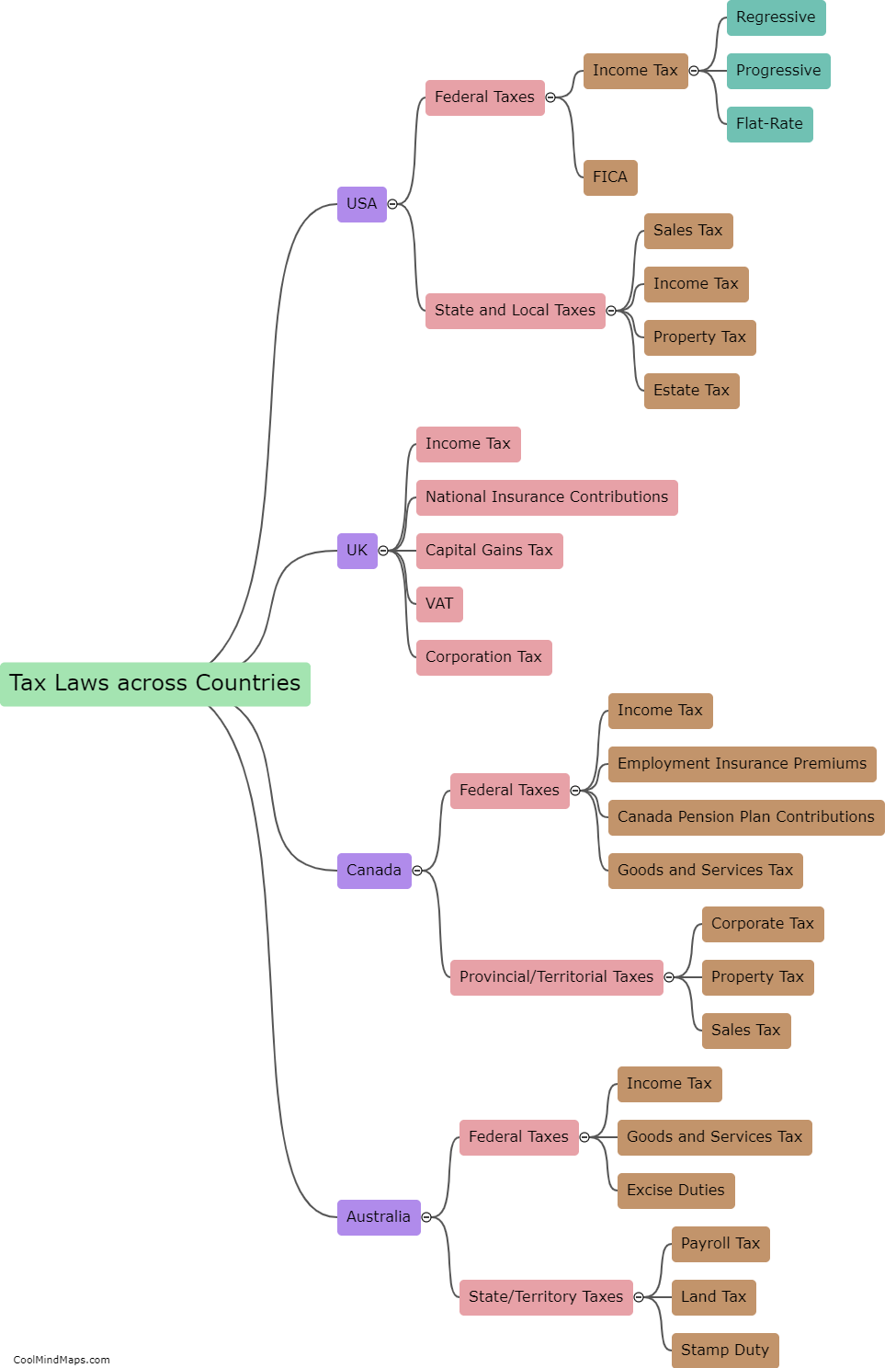

What are the different types of taxes?

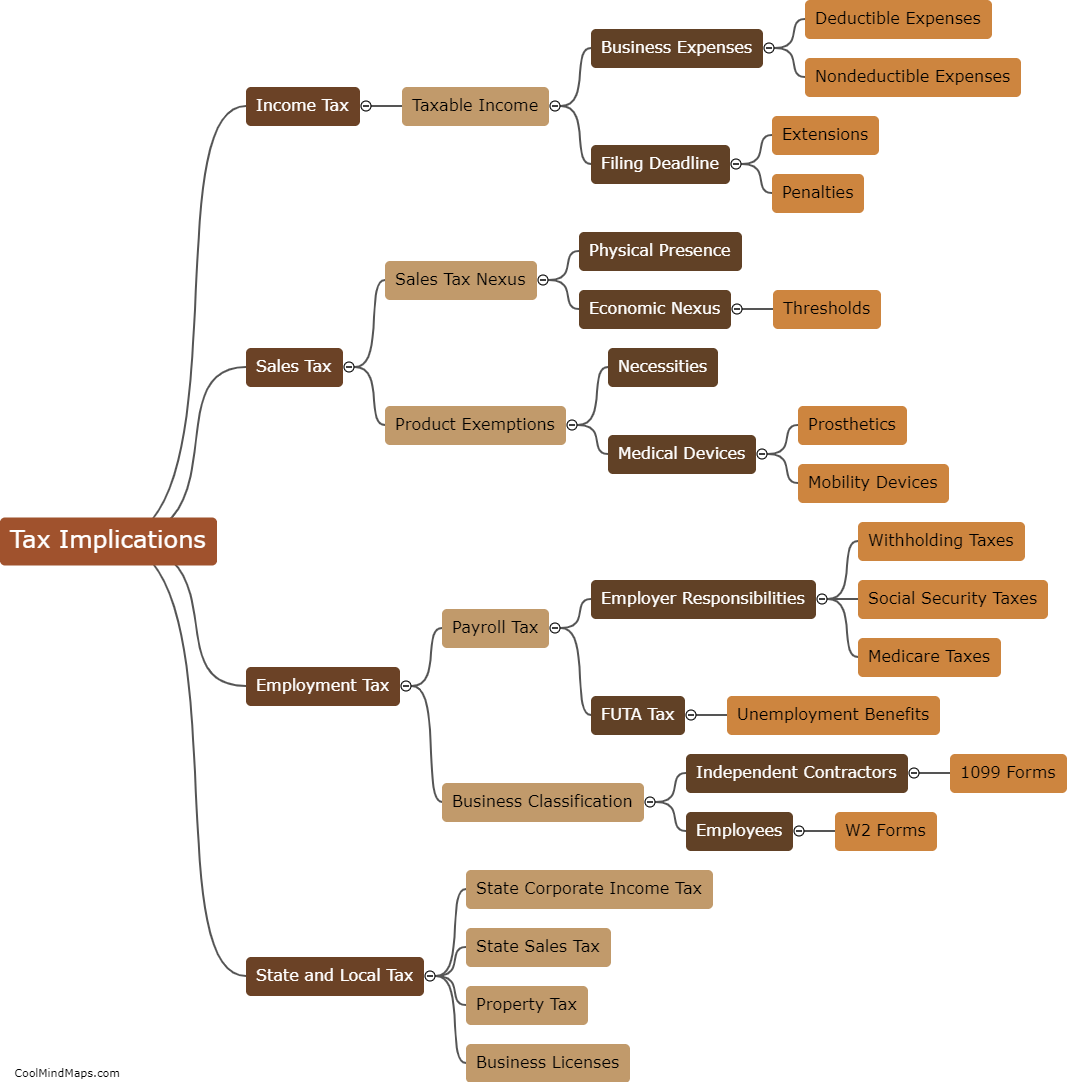

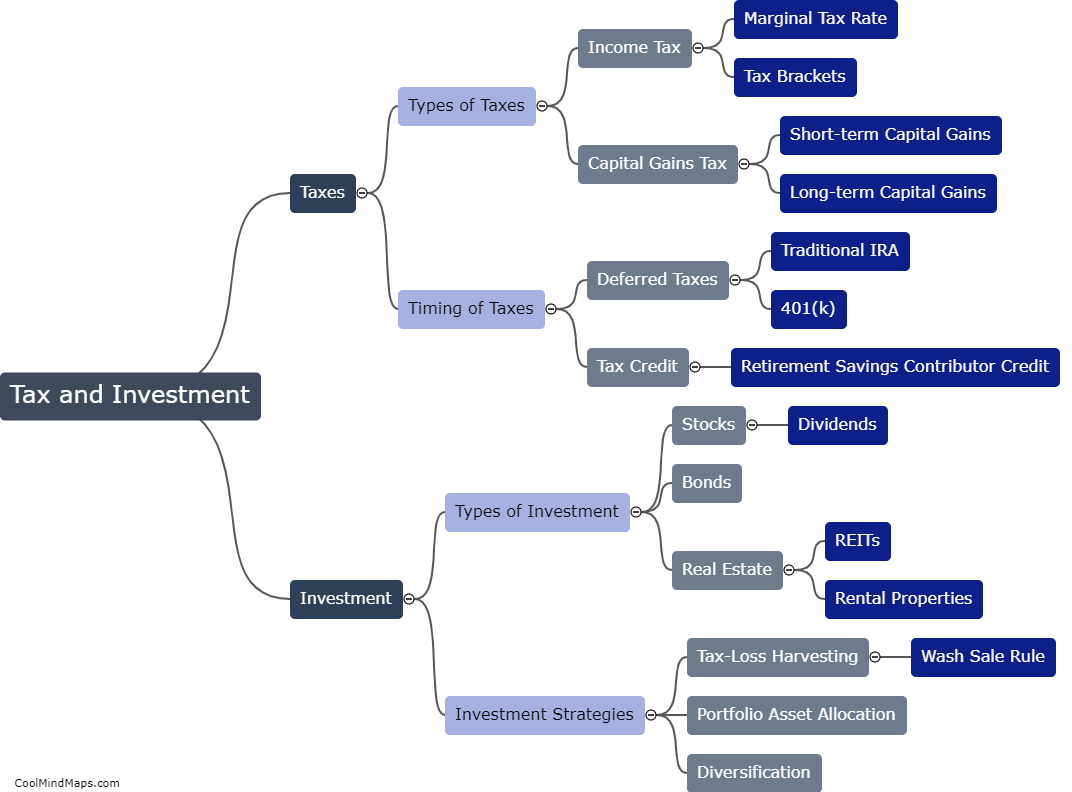

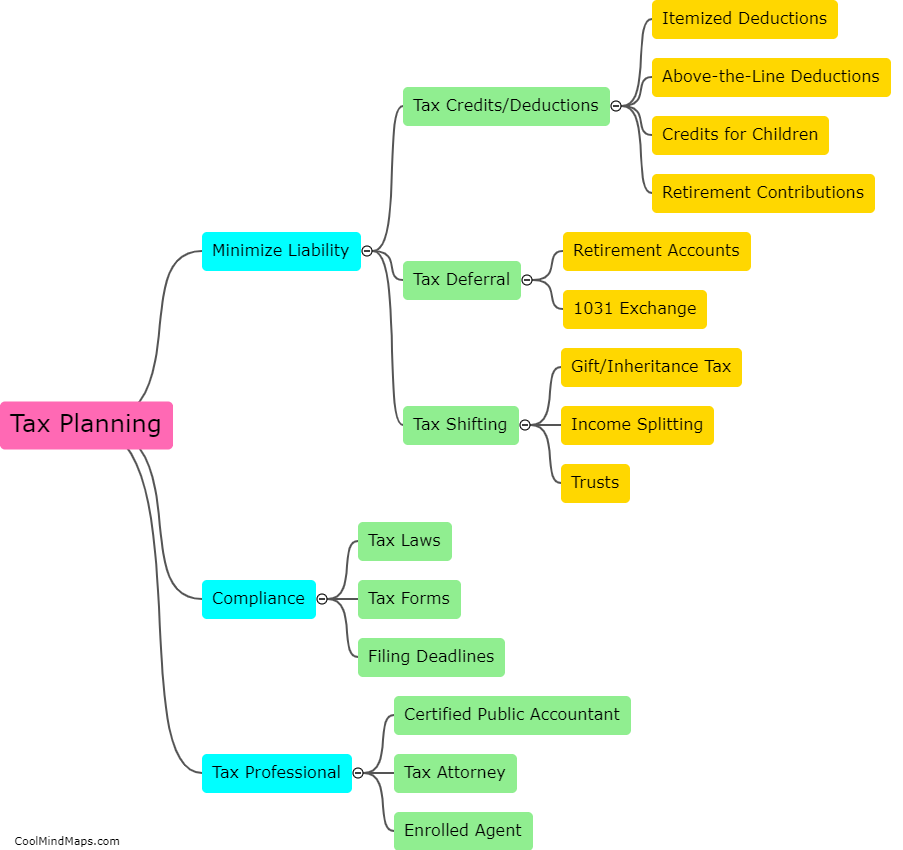

There are various types of taxes that governments impose on individuals and businesses. Income tax is the most common tax that applies to people’s wages, salaries, and profits. Sales tax is a tax on the purchase of goods and services, which is applied as a percentage of the sale price. Property taxes are applicable on real estate properties, such as homes, businesses or land. Excise tax is a tax imposed on specific goods, like gasoline or tobacco. Payroll tax applies to employers or employees' salaries, and it is used to fund programs such as Social Security and Medicare. Tariffs are import taxes imposed on foreign goods to maintain domestic producers’ competitiveness. Lastly, estate tax applies to the wealthy people’s estates after their death.

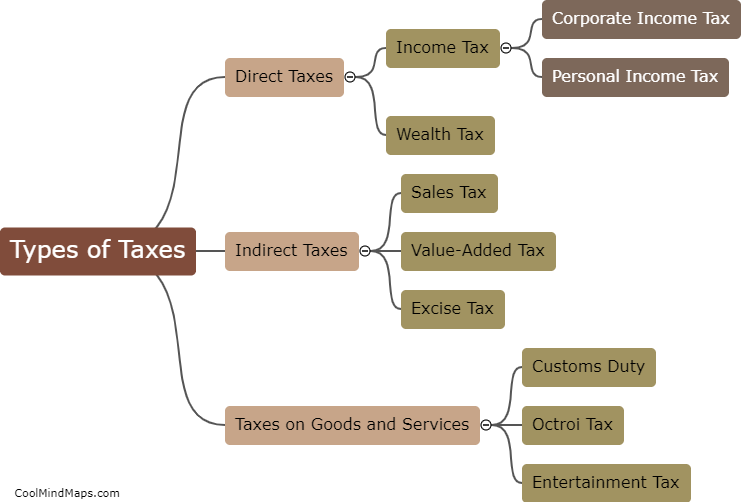

This mind map was published on 18 April 2023 and has been viewed 104 times.