How can non-linear causality be observed in the context of financial development and economic growth?

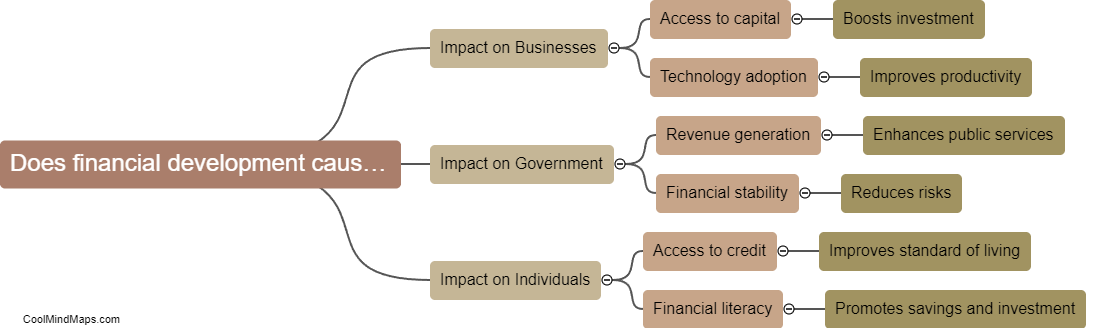

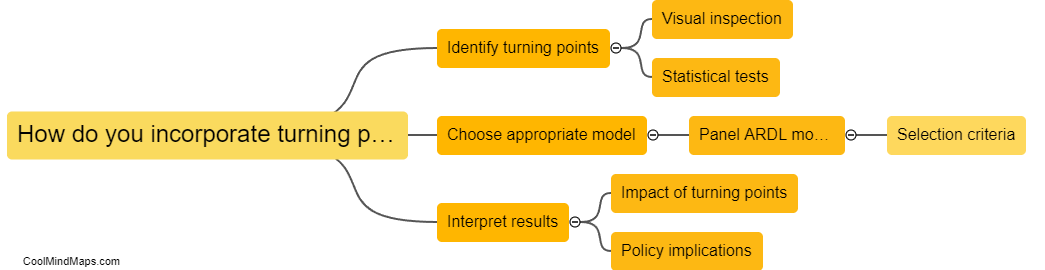

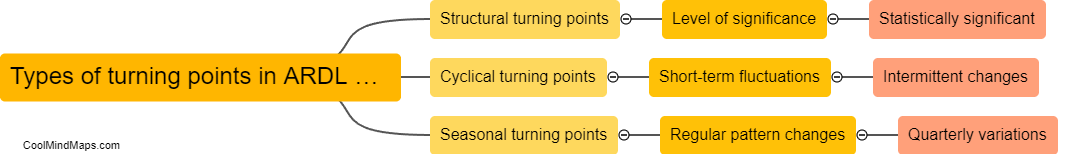

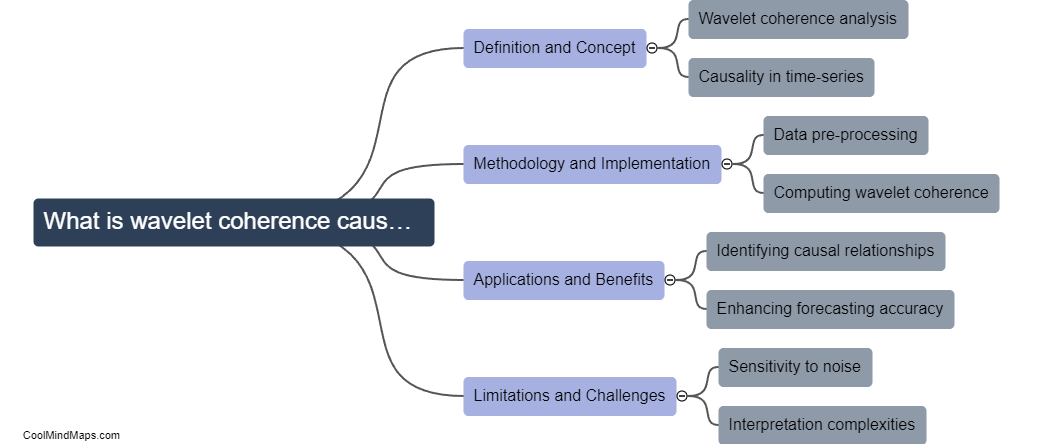

Non-linear causality in the context of financial development and economic growth can be observed through various mechanisms. For example, a sudden increase in financial development, such as the introduction of innovative financial instruments or regulatory reforms, can lead to a non-linear acceleration in economic growth by improving access to credit and capital for businesses. Conversely, economic growth itself can also have a non-linear impact on financial development, as growing economies may create new opportunities for financial institutions and markets to expand and innovate. Additionally, non-linear causality can be observed through feedback loops between financial development and economic growth, where improvements in one sector reinforce and support the growth of the other. Overall, examining the complex, dynamic interactions between financial development and economic growth can provide insights into the non-linear nature of their relationship.

This mind map was published on 21 February 2024 and has been viewed 75 times.