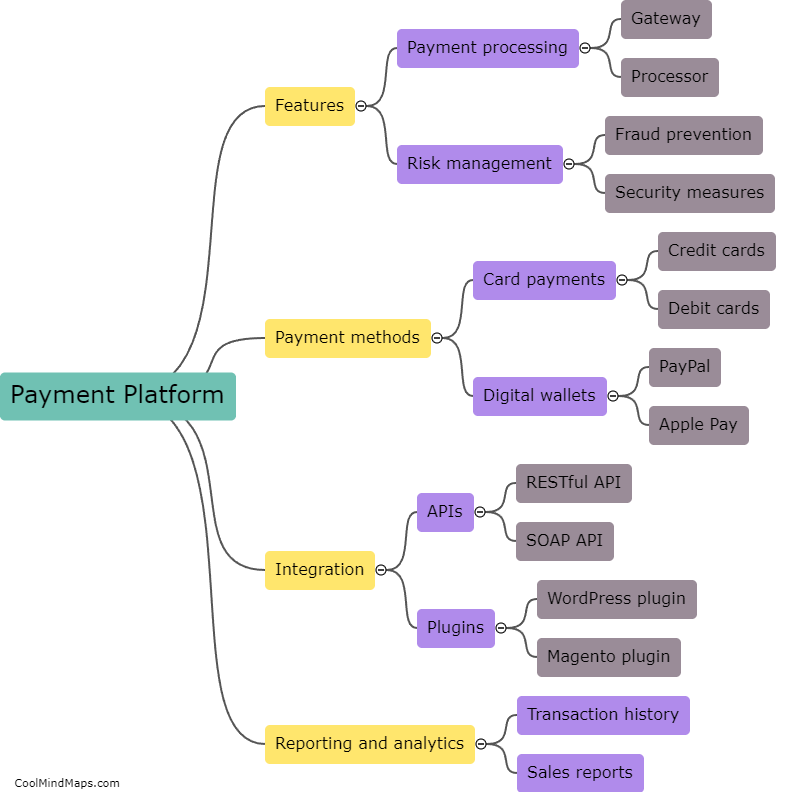

What is a payment platform?

A payment platform is a technology-based solution that enables individuals and businesses to accept, process, and manage various types of payments securely and conveniently. It acts as an intermediary between buyers and sellers, simplifying the transaction process by facilitating the exchange of funds electronically. Payment platforms offer different methods to make and receive payments, such as credit cards, debit cards, digital wallets, bank transfers, and even cryptocurrencies. These platforms often provide additional features like fraud detection, recurring billing, and reporting tools to assist businesses in managing their finances effectively. With the rise of online shopping and digital transactions, payment platforms have become increasingly popular and necessary in today's fast-paced and interconnected world.

This mind map was published on 5 December 2023 and has been viewed 88 times.