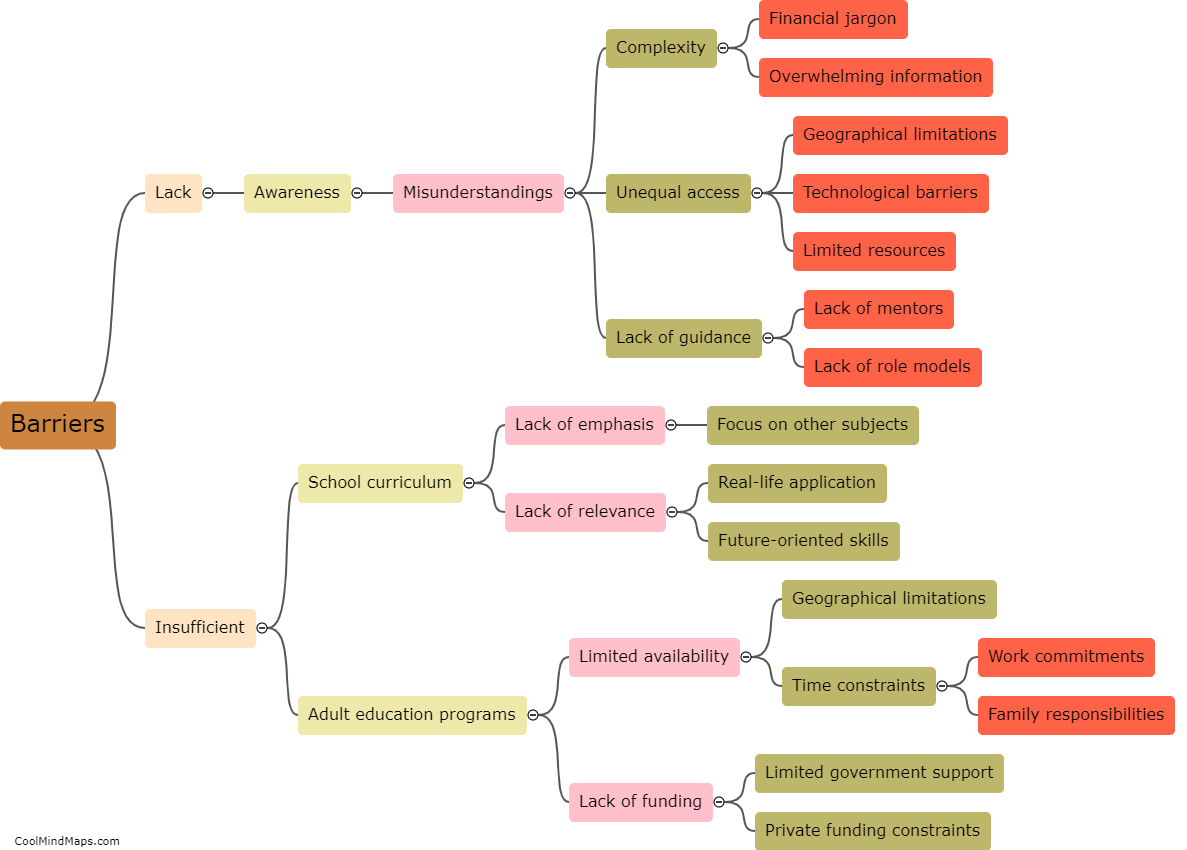

What are the barriers to financial education?

There are several barriers that hinder financial education. Firstly, a lack of access to education is a significant obstacle. Many individuals, especially those from low-income backgrounds, may not have the resources or opportunities to access financial education programs. Additionally, financial jargon and complexity can often be overwhelming and deter people from seeking out financial knowledge. Cultural and societal factors, such as a lack of emphasis on financial literacy or a taboo surrounding money discussions, can also contribute to the barriers. Moreover, the lack of integration of financial education into school curriculums and the absence of mandatory financial literacy courses further exacerbate the problem. Finally, behavioral biases and personal attitudes towards money can impede individuals' willingness to engage in financial education. Addressing these barriers is crucial for promoting financial literacy and empowering individuals to make informed financial decisions.

This mind map was published on 28 November 2023 and has been viewed 160 times.