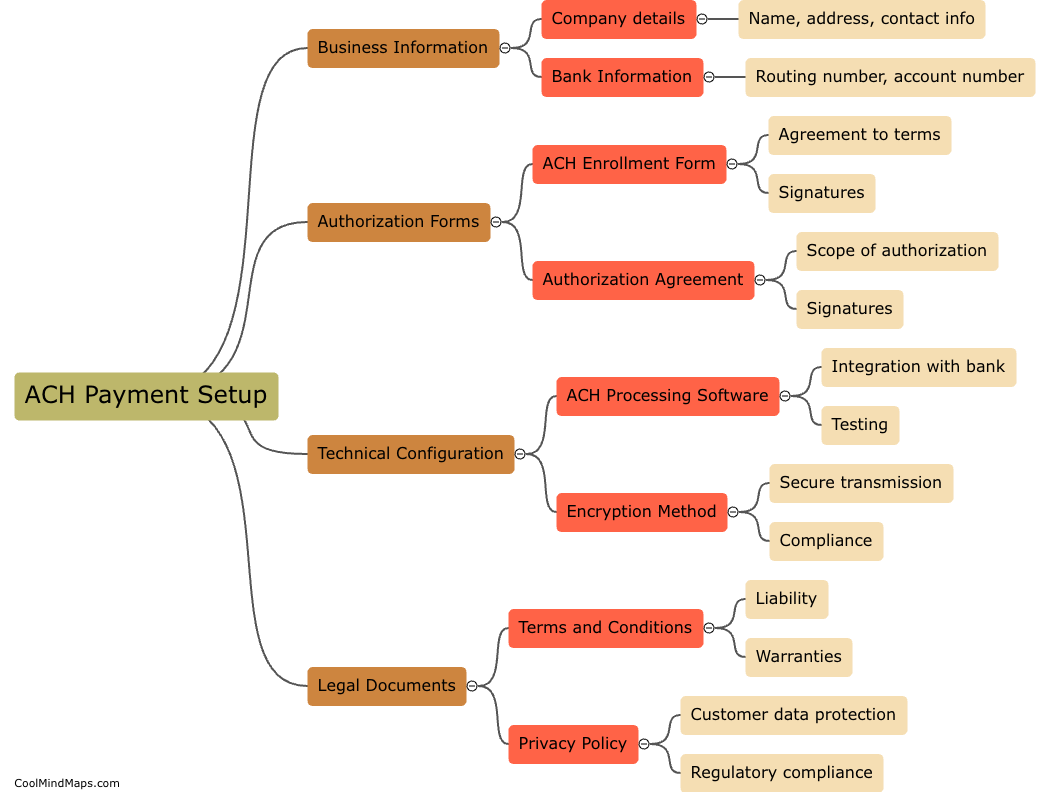

What documents are needed for ACH payment processing setup?

ACH payment processing, commonly used for business-to-business transactions, requires certain documents to be submitted to initiate the setup process. These documents may include a signed ACH authorization agreement, a voided check or a copy of a bank statement, tax identification numbers, and other business information such as company address and contact details. The purpose of these documents is to ensure that the correct business entity is authorized to initiate ACH payments, and that the banking information provided is accurate. Without the correct documentation, ACH payment processing cannot be initiated.

This mind map was published on 17 May 2023 and has been viewed 112 times.