What are the causes of volatility spillovers across markets?

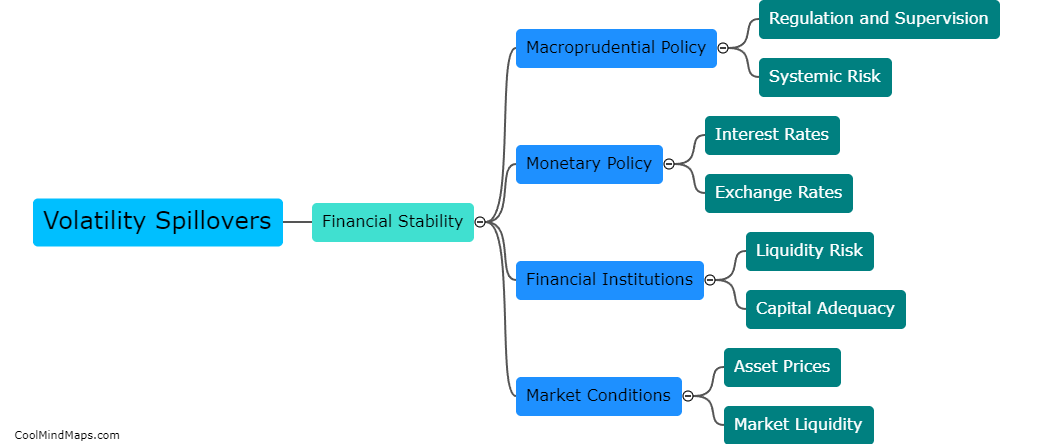

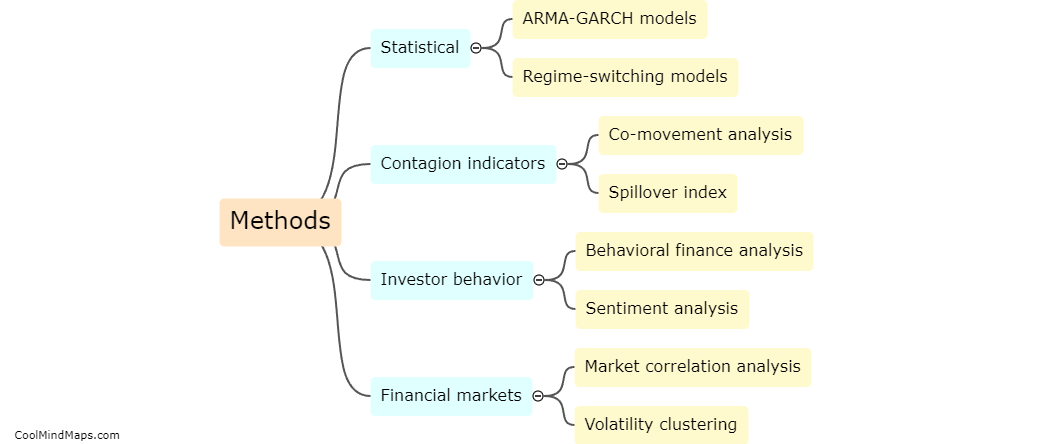

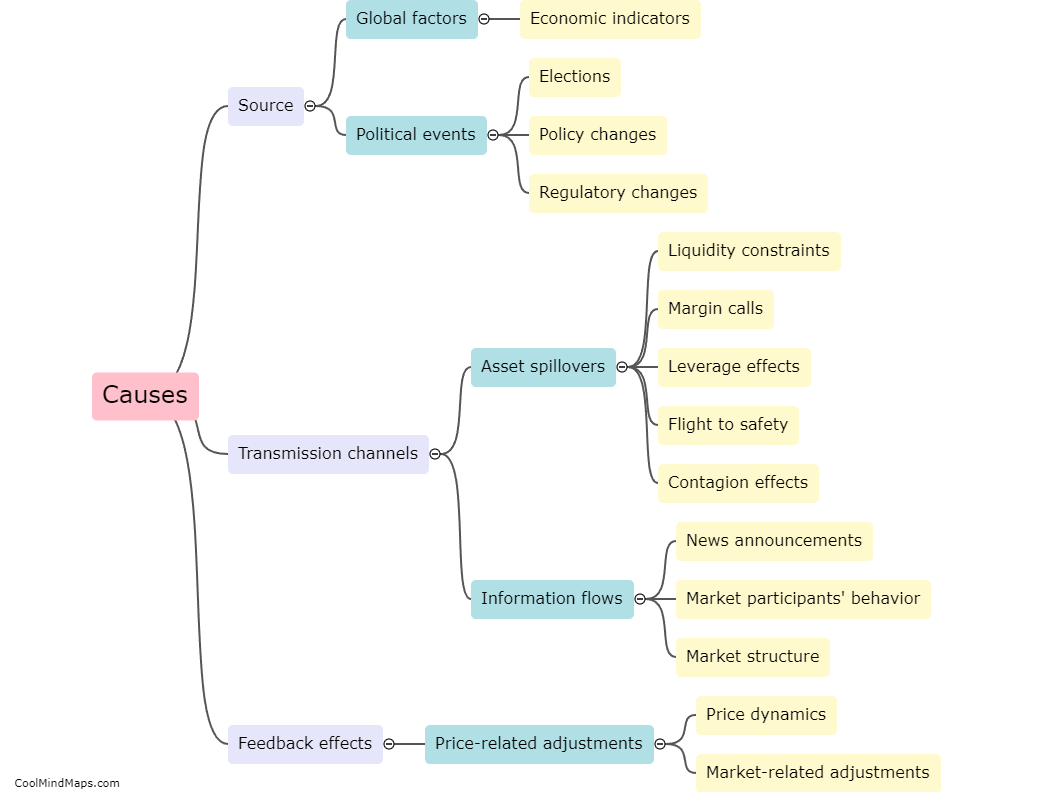

Volatility spillovers across markets refer to the transmission of volatility from one market to another. There are several causes for these spillovers to occur. Firstly, interconnectedness among markets can lead to the propagation of volatility. If markets are highly integrated and interdependent, a shock or disturbance in one market can quickly spread to others, amplifying the overall volatility. Secondly, macroeconomic factors and global events can also drive volatility spillovers. Economic indicators, geopolitical tensions, and monetary policy decisions can reverberate through multiple markets, affecting investor sentiment and triggering volatility transmission. Finally, the actions and behavior of investors themselves can contribute to volatility spillovers. Herding behavior, heightened risk aversion, and speculative trading can all amplify volatility and enable it to spread across different markets. Overall, a complex combination of market structure, macroeconomic factors, and investor behavior contributes to the phenomenon of volatility spillovers across markets.

This mind map was published on 27 November 2023 and has been viewed 99 times.