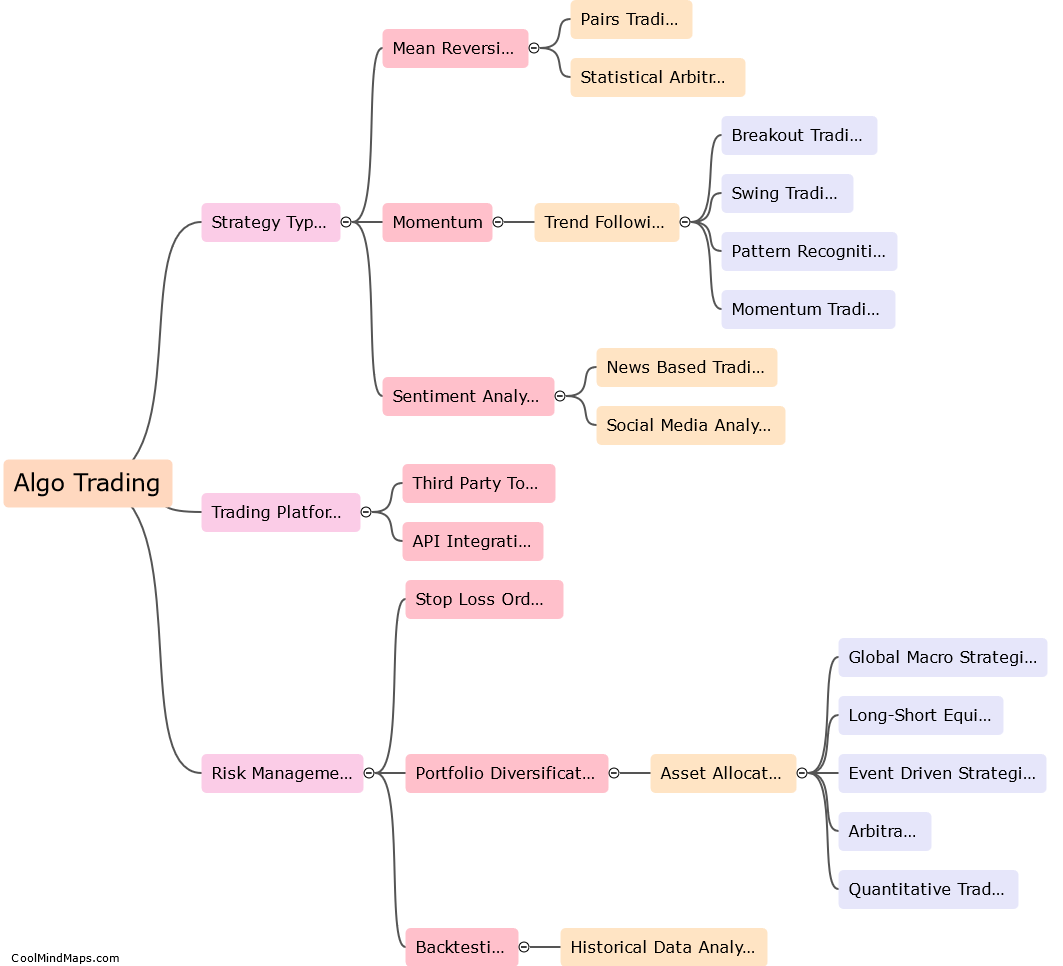

What are the popular practices in algo trading?

Algo trading, also known as algorithmic trading, is a popular practice in financial markets. There are many popular practices in algo trading, including statistical arbitrage, trend following, and mean reversion. Statistical arbitrage involves exploiting mispricings in the market by buying and selling correlated assets. Trend following involves buying or selling assets based on their trends and momentum. Mean reversion involves buying assets that are undervalued or selling assets that are overvalued, with the expectation that they will eventually revert to their mean value. Other popular practices in algo trading include high-frequency trading and machine learning based trading. These practices are all aimed at maximizing profits while minimizing risk in financial markets.

This mind map was published on 1 June 2023 and has been viewed 267 times.