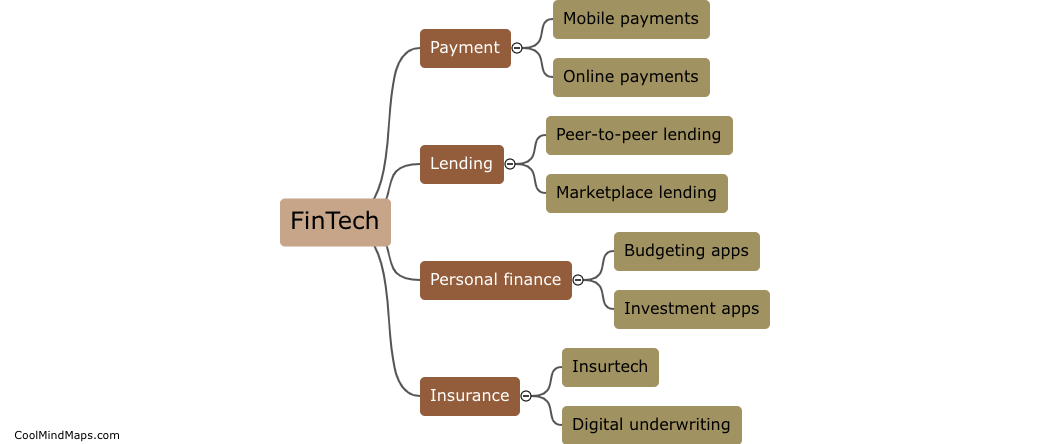

How is FinTech changing traditional financial services?

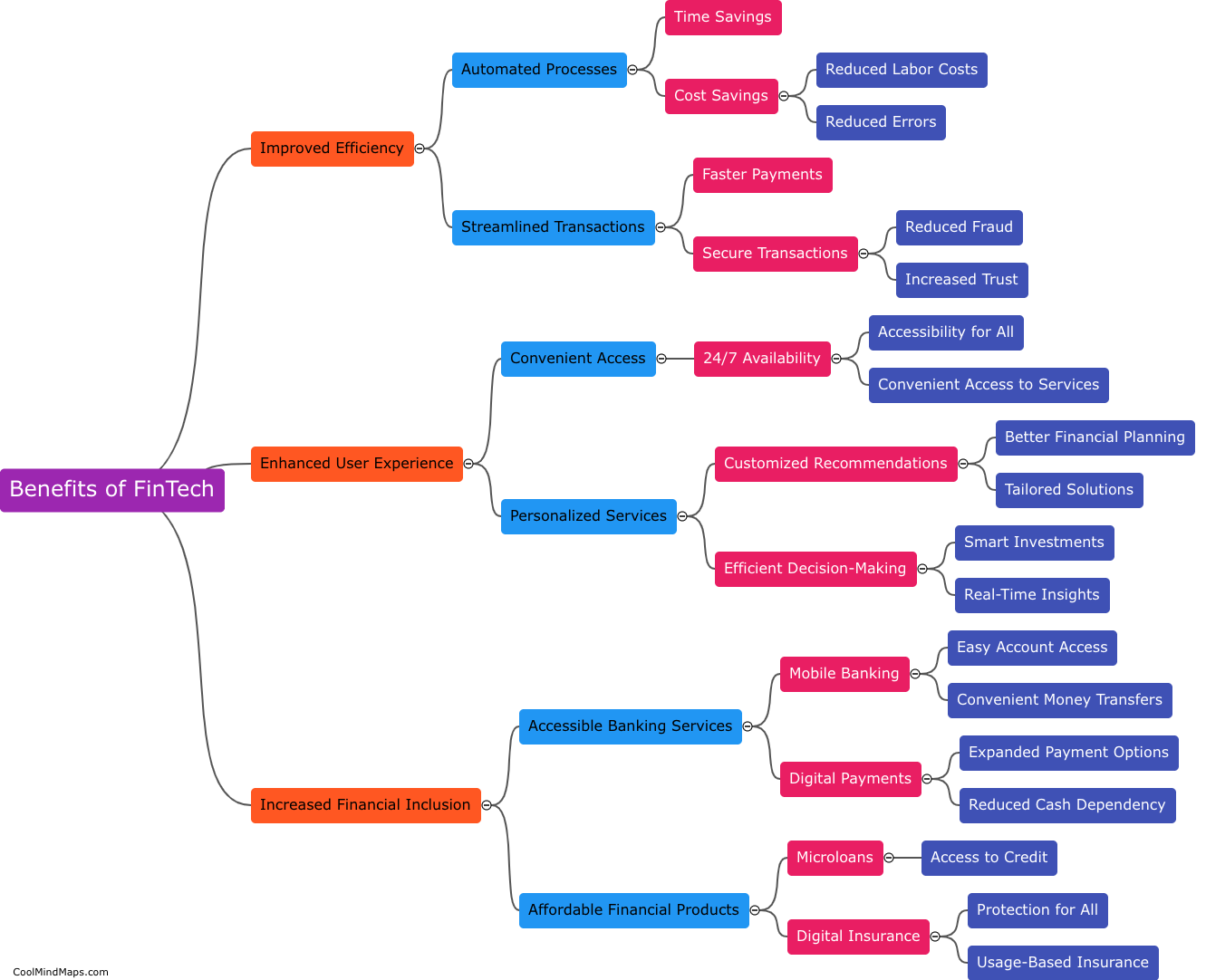

FinTech, a rapidly growing industry that combines technology and innovation in financial services, is revolutionizing traditional financial services in numerous ways. One significant change brought by FinTech is the enhanced accessibility and convenience it offers to consumers. With the advent of mobile banking apps, online payment platforms, and digital wallets, financial services have become more readily available, allowing customers to manage their finances anytime and anywhere. Moreover, FinTech has improved the speed and efficiency of transactions, reducing the need for physical interactions and paperwork. The emergence of peer-to-peer lending and crowdfunding platforms has also disrupted traditional banking by offering alternative sources of financing for individuals and small businesses. Overall, FinTech is reshaping the financial landscape by providing innovative solutions that challenge the status quo and bring greater accessibility, efficiency, and inclusiveness to traditional financial services.

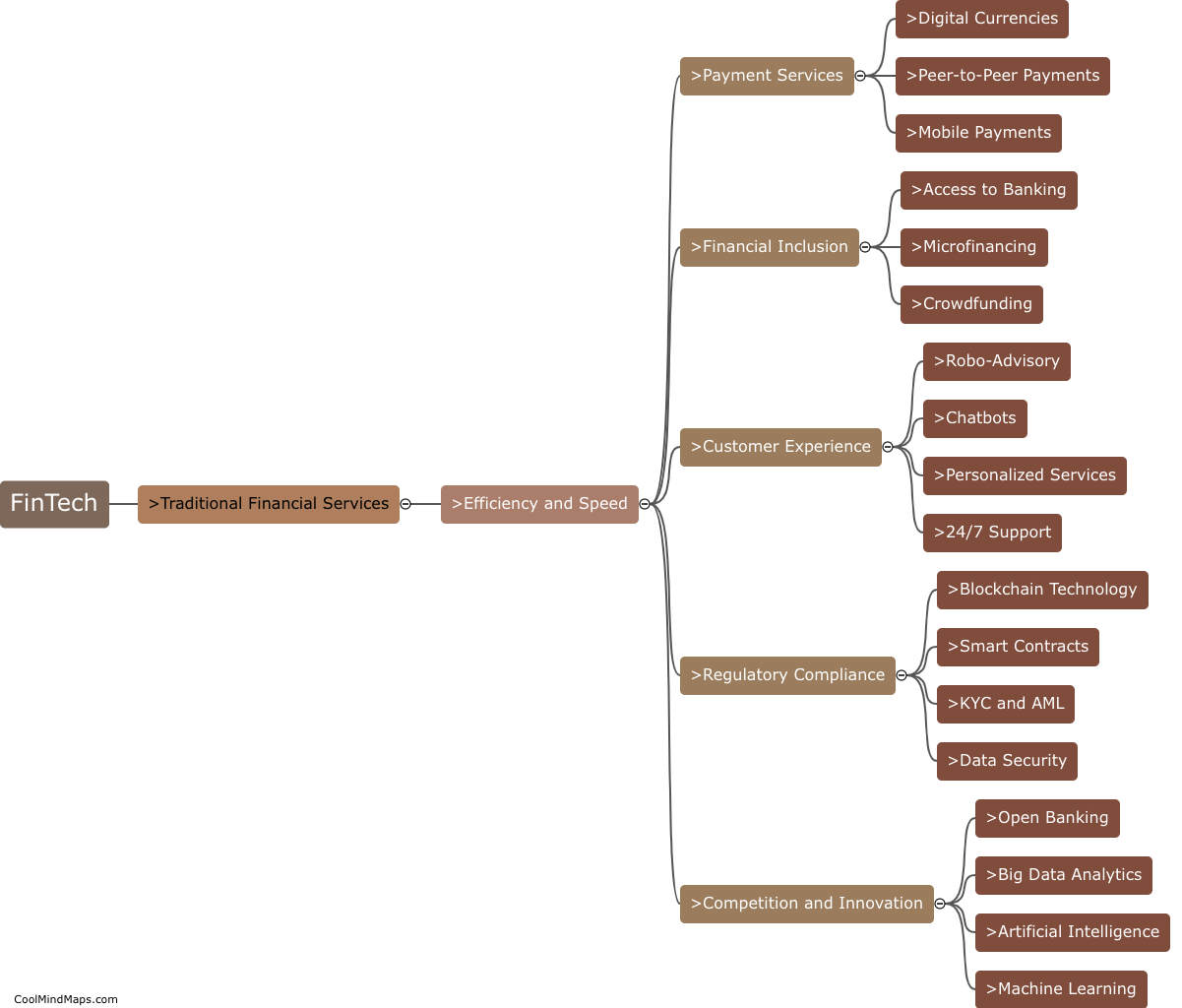

This mind map was published on 21 November 2023 and has been viewed 95 times.