How can insurance claims technology contribute to reducing losses?

Insurance claims technology can play a significant role in reducing losses by streamlining and improving the entire claims process. Advanced software and technology tools allow for more efficient claims management, enabling faster processing and resolution of claims. This helps prevent delays and minimize losses that may occur due to extended claim settlement periods. Additionally, automated systems can assist in detecting fraudulent claims, reducing the chances of losses resulting from fraudulent activities. Moreover, analytics and data-driven technologies can be employed to identify patterns and trends, enabling insurance companies to make proactive decisions and take preventive measures to reduce potential losses. By harnessing the power of insurance claims technology, insurers can enhance their risk management strategies and ultimately reduce their overall losses.

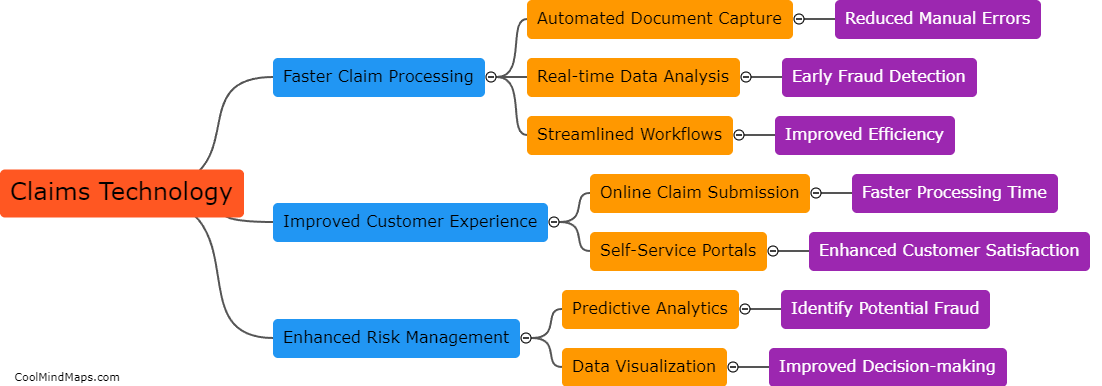

This mind map was published on 18 September 2023 and has been viewed 116 times.