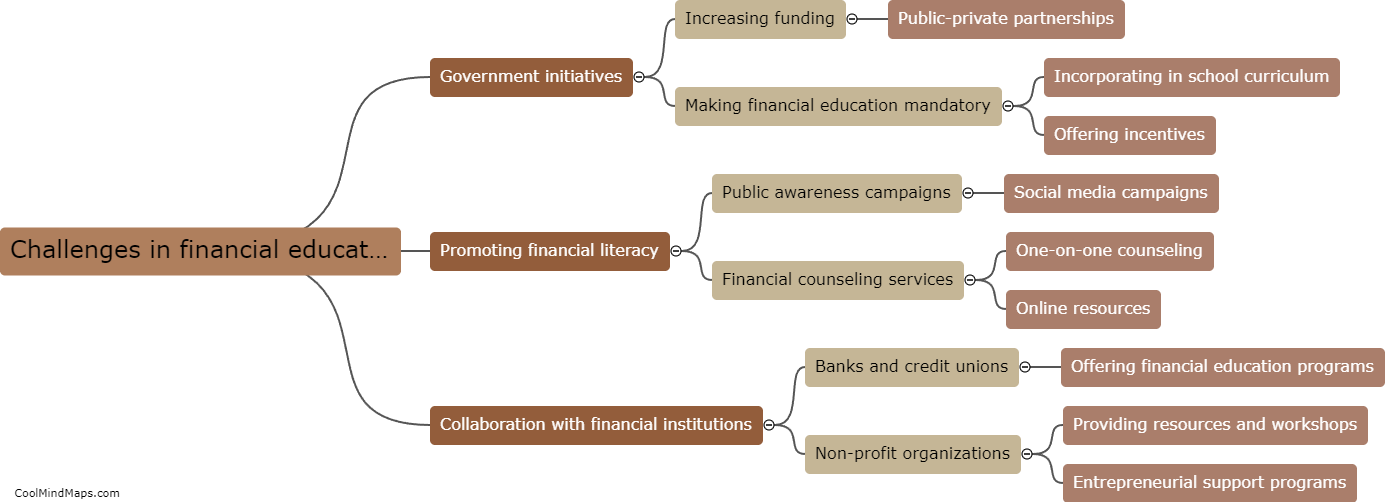

What strategies can help overcome challenges in financial education?

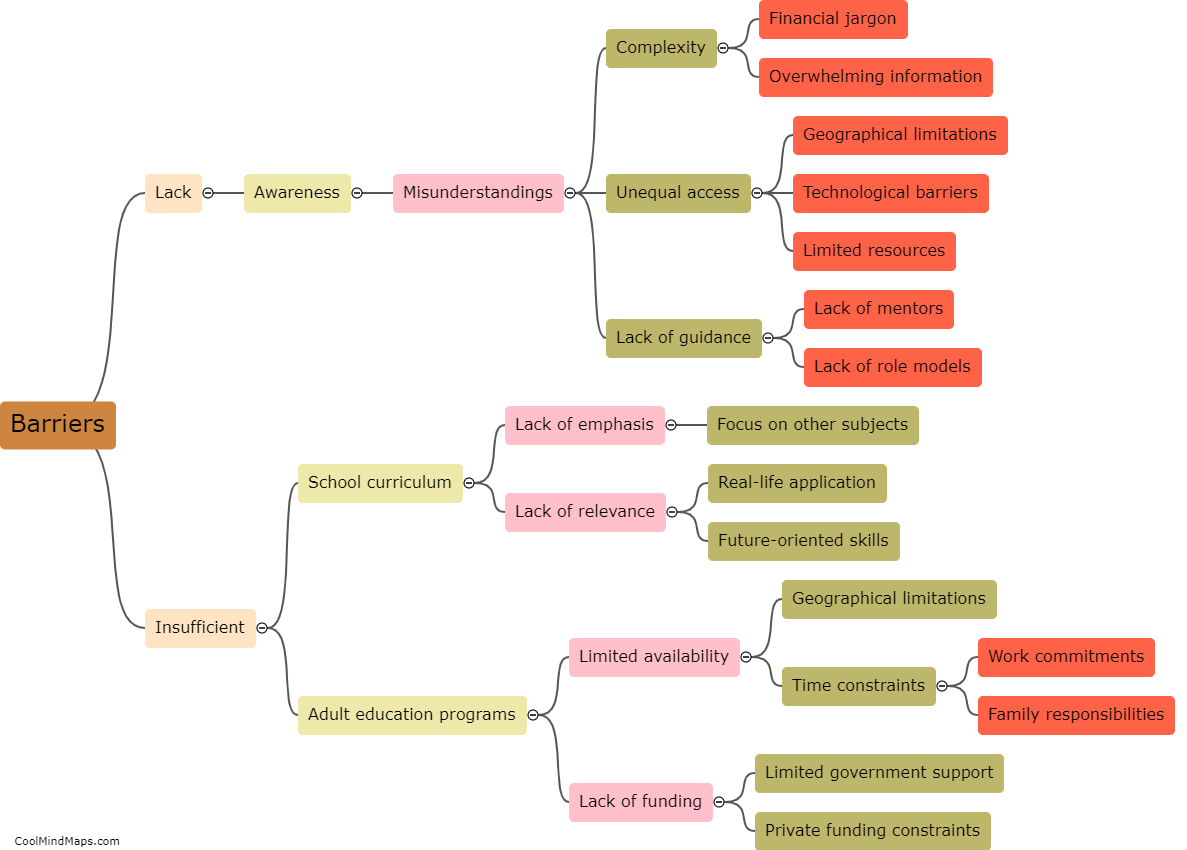

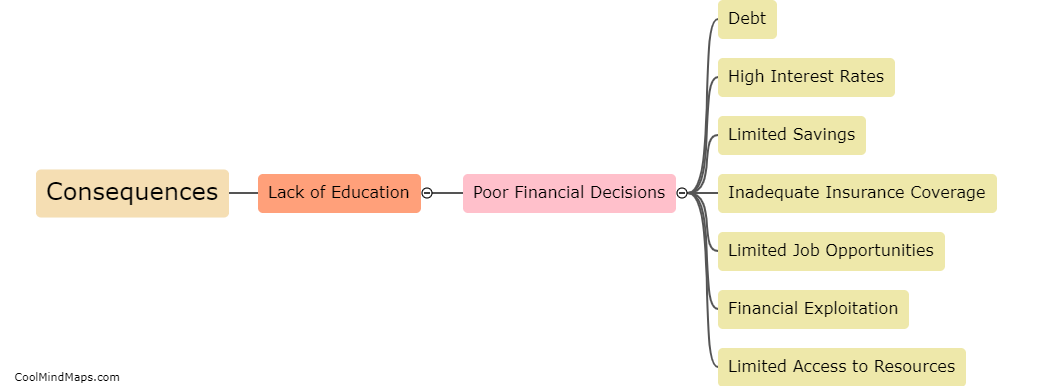

Overcoming challenges in financial education requires effective strategies that address the areas of limited access, engagement, and relevance. Firstly, improving access to financial education is vital. This can be achieved by implementing community-based programs, partnering with schools and universities, and leveraging technology platforms to reach a wider audience. Secondly, enhancing engagement is crucial to make financial education more interactive and relatable. Utilizing gamification techniques, interactive online resources, and experiential learning tools can help capture learners' attention and increase their participation. Finally, relevance is key to ensuring that financial education aligns with learners' specific needs and goals. Tailoring the content to diverse demographics, incorporating real-world examples, and offering practical application opportunities will enhance relevance and motivate learners to apply the knowledge gained. By implementing these strategies, the challenges in financial education can be effectively addressed, leading to improved financial literacy and decision-making skills among individuals.

This mind map was published on 29 November 2023 and has been viewed 95 times.