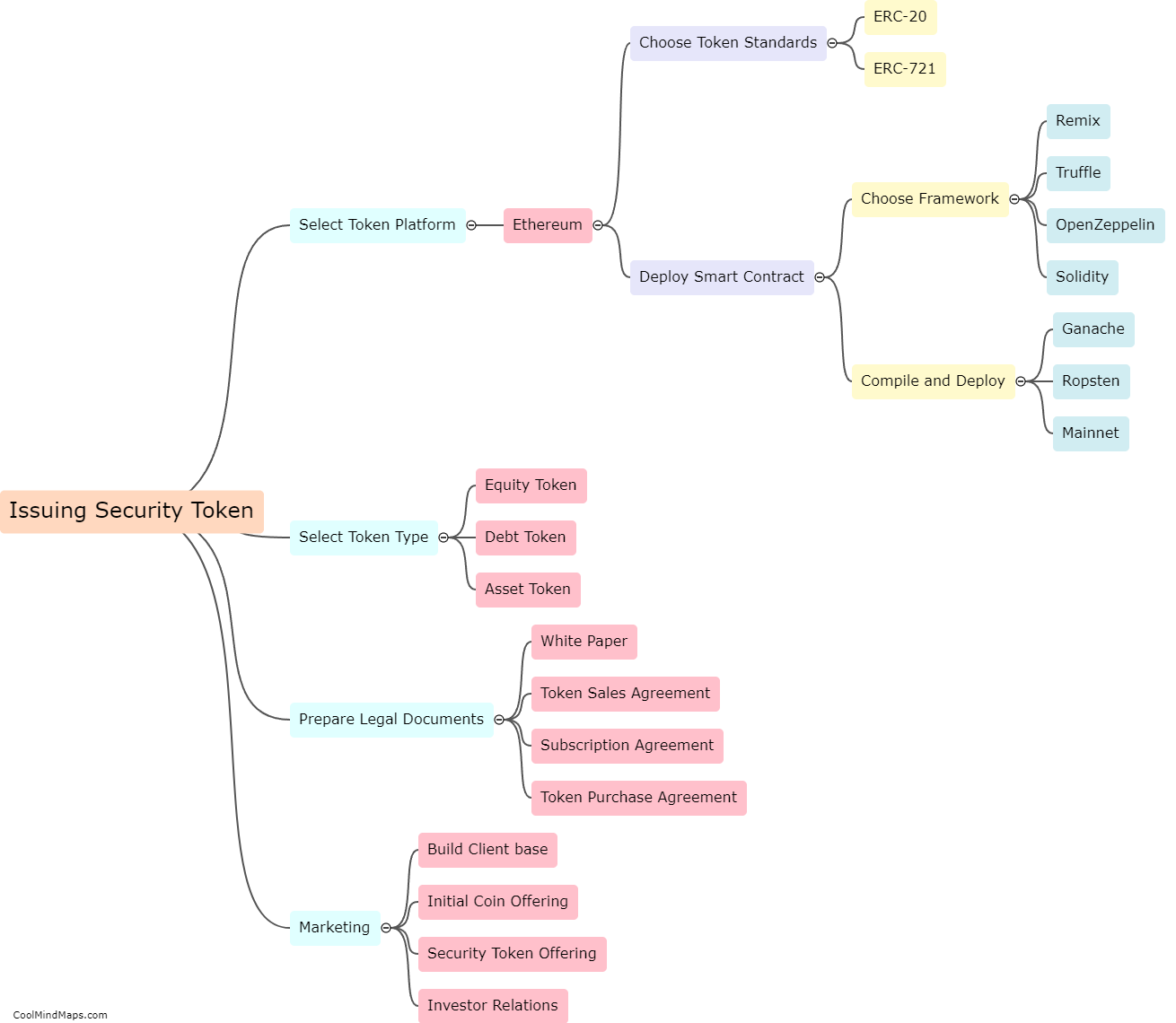

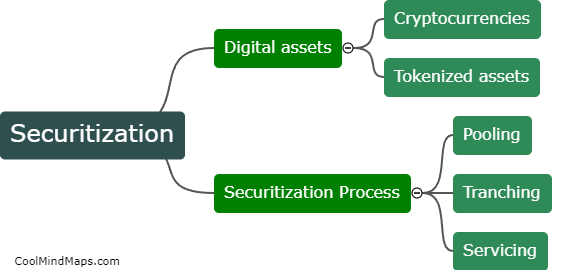

What is securitization in digital assets?

Securitization in digital assets refers to the process of converting an asset, such as a loan or mortgage, into a tradable security using digital technology. This allows investors to buy and sell fractional ownership of the asset, which can be transacted on a blockchain or other digital ledger. The benefits of securitizing digital assets include increased liquidity, reduced transaction costs, and the ability to diversify portfolios. However, there are also potential risks related to transparency, regulatory compliance, and cybersecurity that must be addressed. Overall, securitization in digital assets has the potential to transform traditional finance and create new opportunities for investors.

This mind map was published on 16 May 2023 and has been viewed 101 times.