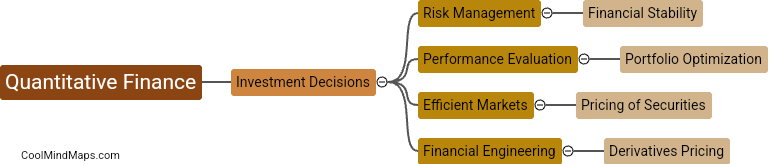

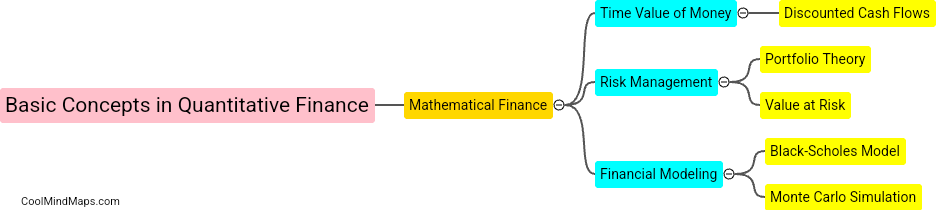

How does quantitative finance impact the financial industry?

Quantitative finance, also known as mathematical finance, plays a critical role in shaping the financial industry by utilizing mathematical models and data analysis to make informed decisions about investments, risk management, and trading strategies. The use of quantitative methods allows financial professionals to analyze complex financial instruments and market trends with more precision and accuracy, leading to better outcomes and improved efficiency in financial markets. By integrating quantitative finance techniques into their operations, financial institutions can stay competitive, identify profitable opportunities, and manage risks more effectively, ultimately leading to a more efficient and resilient financial system.

This mind map was published on 2 April 2024 and has been viewed 96 times.