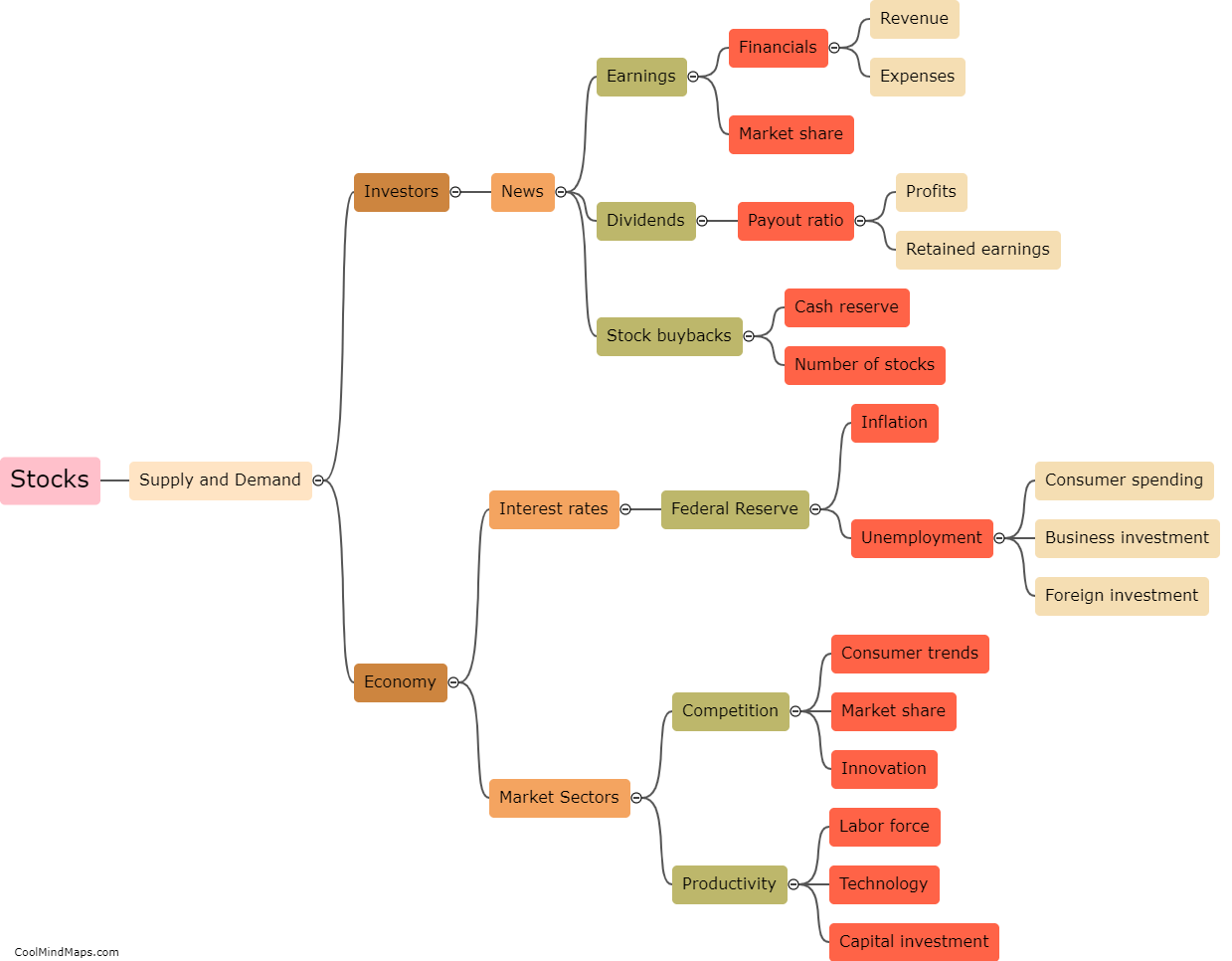

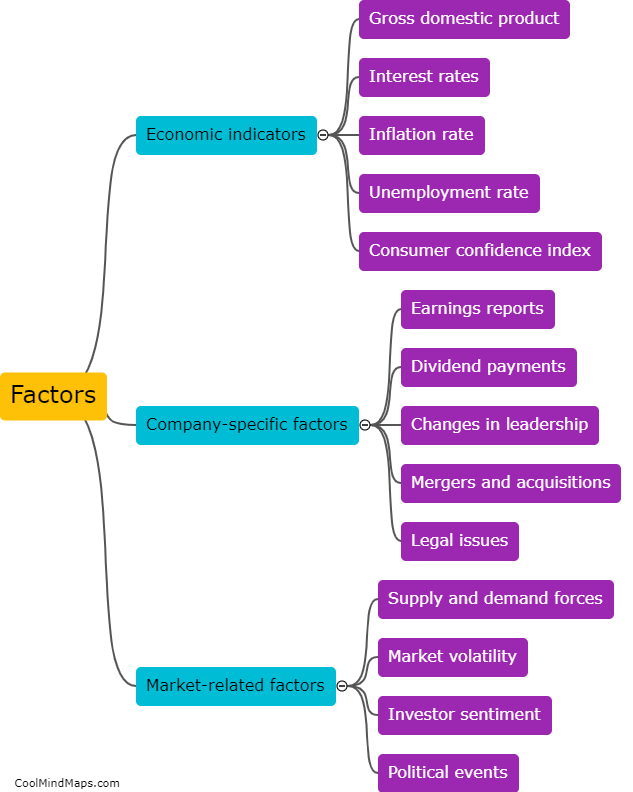

What factors influence stock prices?

There are several factors that can influence stock prices, including economic indicators, company earnings and performance, news and events, investor sentiment, and political and regulatory changes. Economic indicators such as inflation, interest rates, and GDP can impact stock prices as they reflect the overall health of the economy. Company earnings and performance can also have a significant impact by affecting investor confidence and expectations for future growth. News and events, such as mergers and acquisitions, regulatory changes, and natural disasters, can cause immediate fluctuations in stock prices. Investor sentiment and perception of a company's future prospects can also influence stock prices. Finally, political and regulatory changes, such as changes in trade policies or tax laws, can have a significant impact on specific industry sectors and individual stocks.

This mind map was published on 18 April 2023 and has been viewed 94 times.