What are the main departments of a commercial bank?

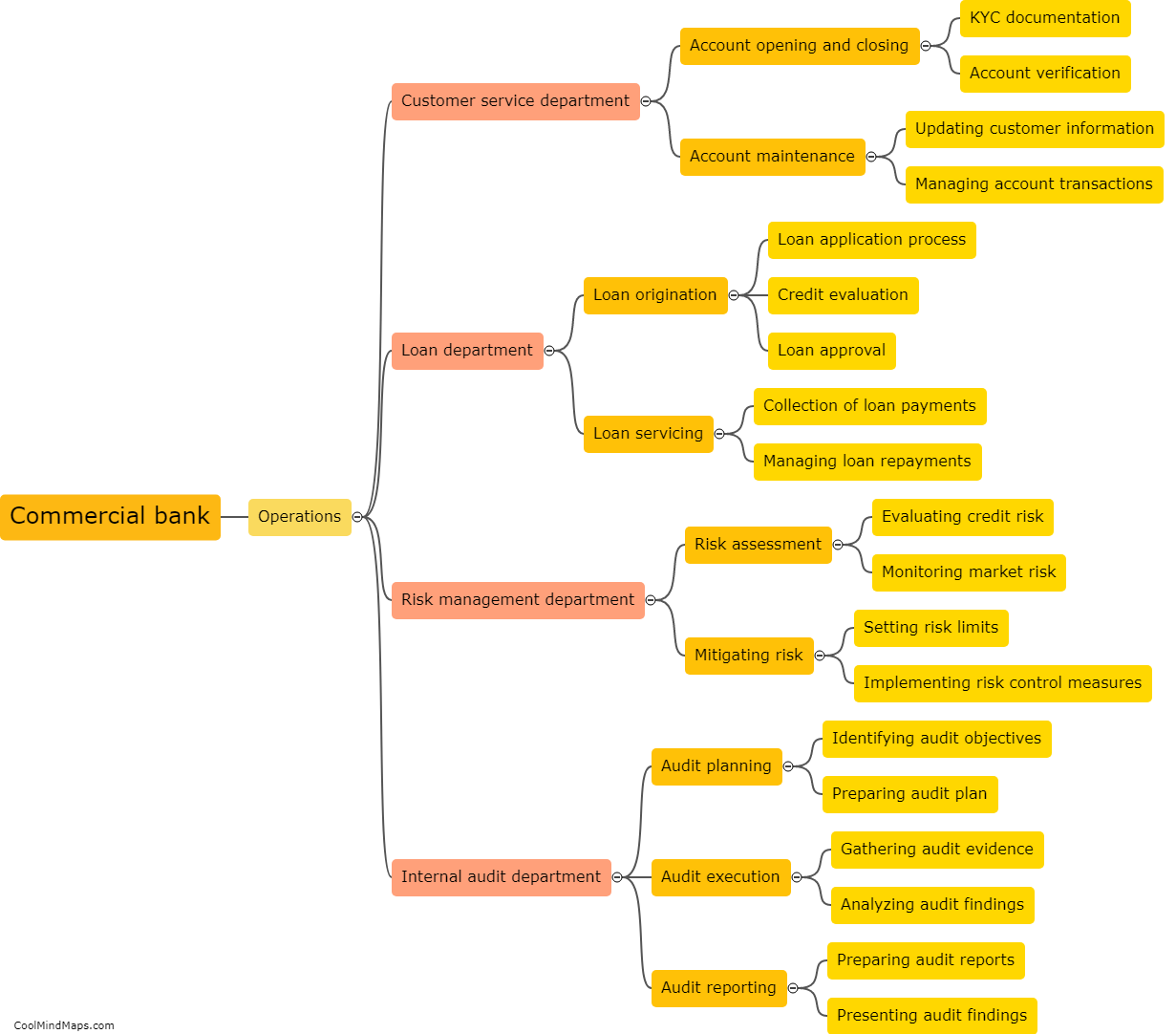

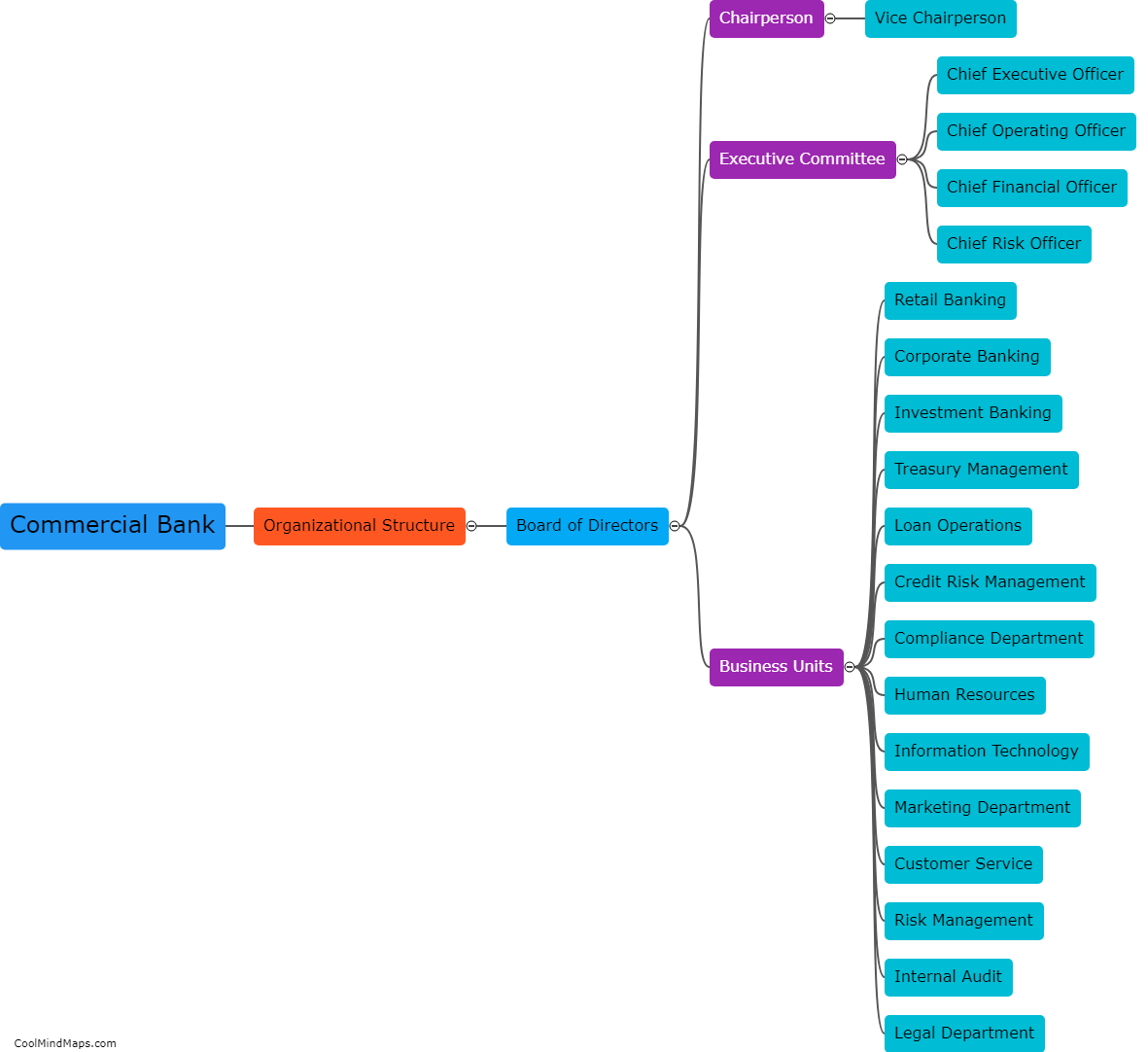

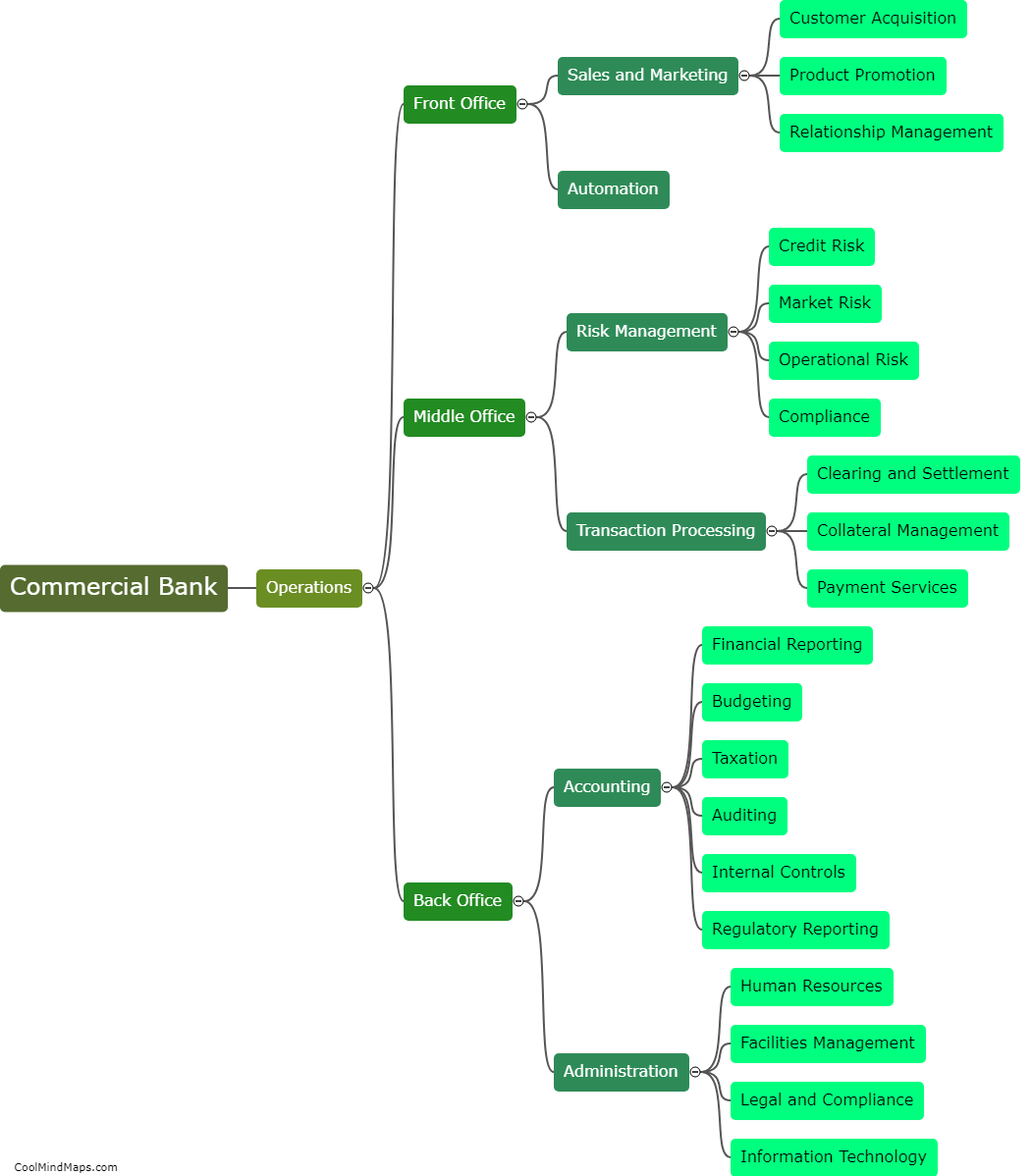

The main departments of a commercial bank typically include the retail banking department, commercial banking department, investment banking department, and operations and technology department. The retail banking department focuses on providing services to individual customers, such as savings and checking accounts, loans, credit cards, and mortgages. The commercial banking department primarily serves businesses and provides services such as business loans, trade finance, cash management, and treasury services. The investment banking department deals with capital raising, mergers and acquisitions, underwriting, and financial advisory services. Lastly, the operations and technology department manages the day-to-day operations of the bank, including processing transactions, maintaining IT systems, and ensuring regulatory compliance. These departments work together to ensure the smooth functioning and profitability of a commercial bank.

This mind map was published on 19 July 2023 and has been viewed 122 times.