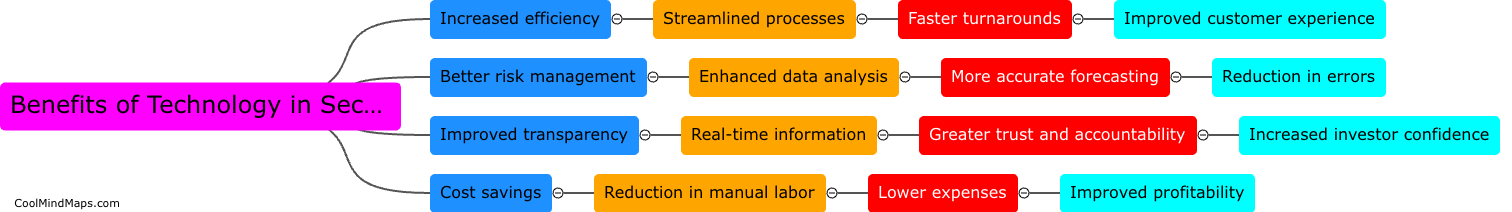

What are the benefits of using technology in secondary mortgage markets?

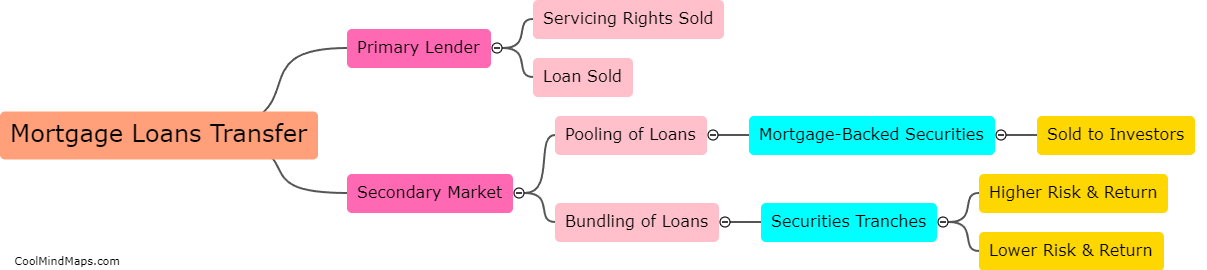

The secondary mortgage market is an integral part of the housing finance system, and technology has greatly improved its efficiency and effectiveness. The benefits of technology in the secondary mortgage market include accelerated loan processing times, reduced costs, and improved transparency. Automated underwriting systems, electronic loan documents, and real-time data analytics have streamlined the secondary market and reduced risk for investors. Additionally, technology has brought about new mortgage products and structures that give borrowers more financing options and increase liquidity in the market. Ultimately, the use of technology in the secondary mortgage market has expedited the buying and selling of mortgages, leading to a more liquid, transparent, and profitable market for all parties involved.

This mind map was published on 28 May 2023 and has been viewed 95 times.