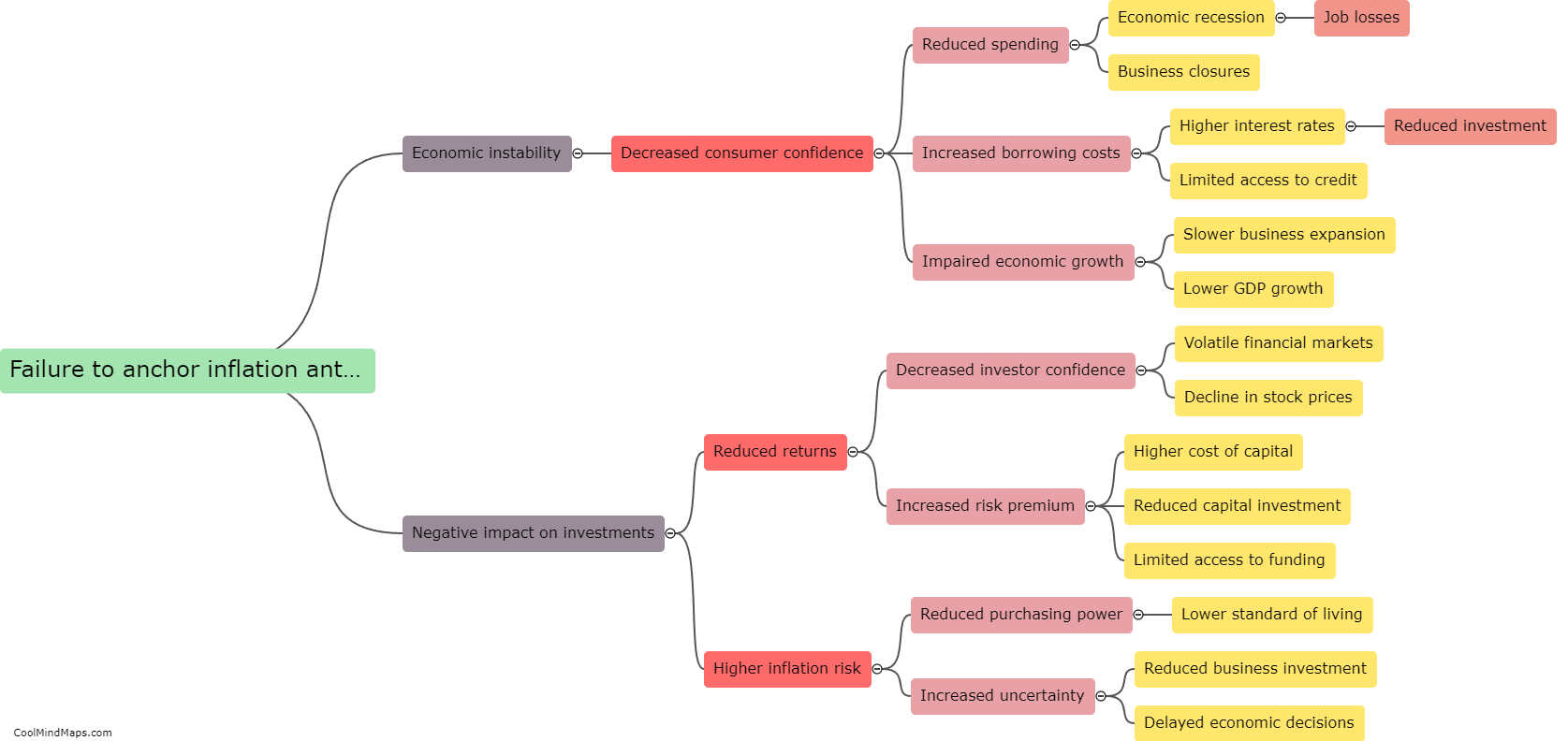

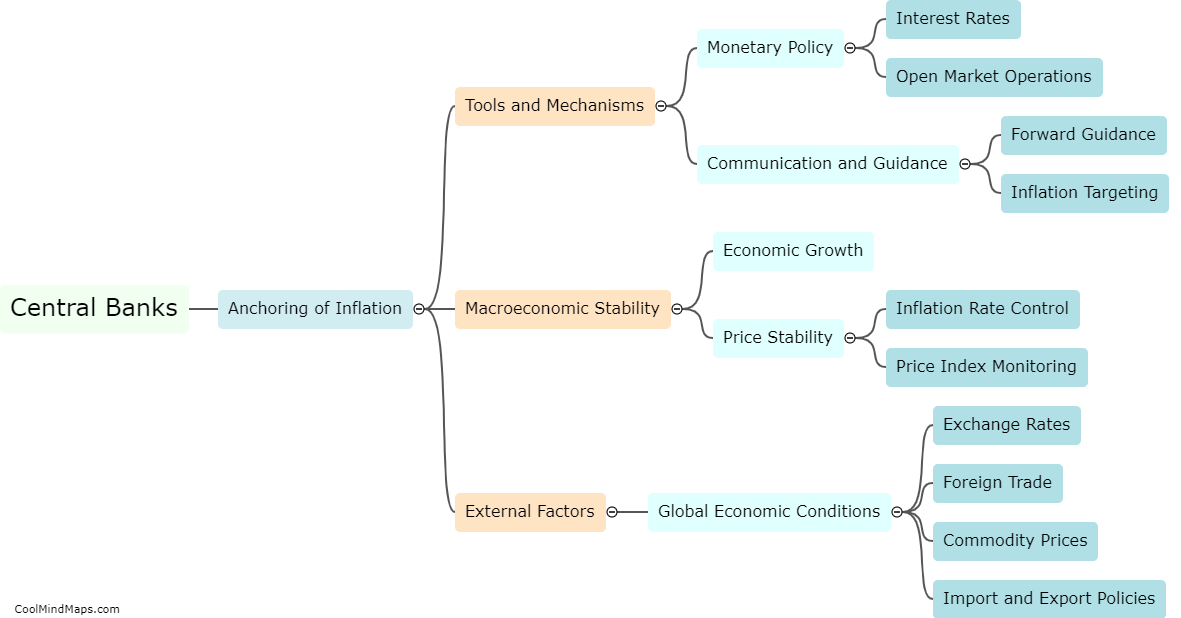

How can central banks ensure anchoring of inflation anticipation?

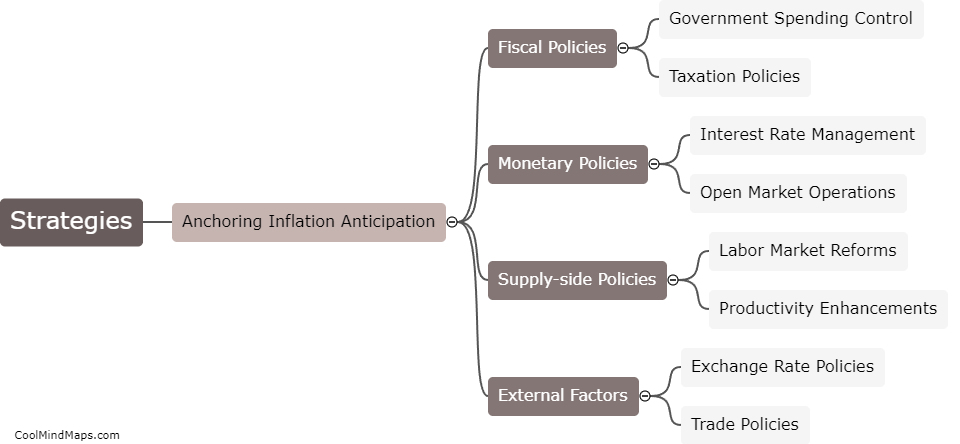

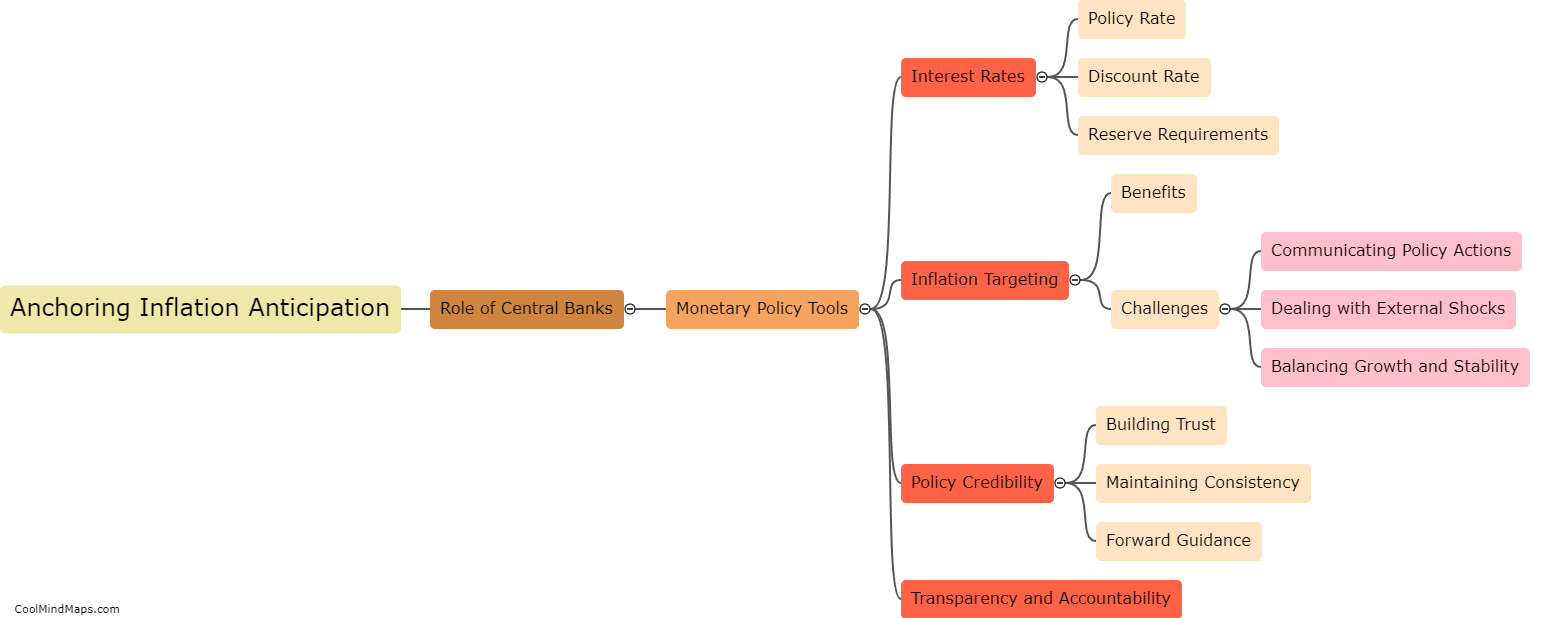

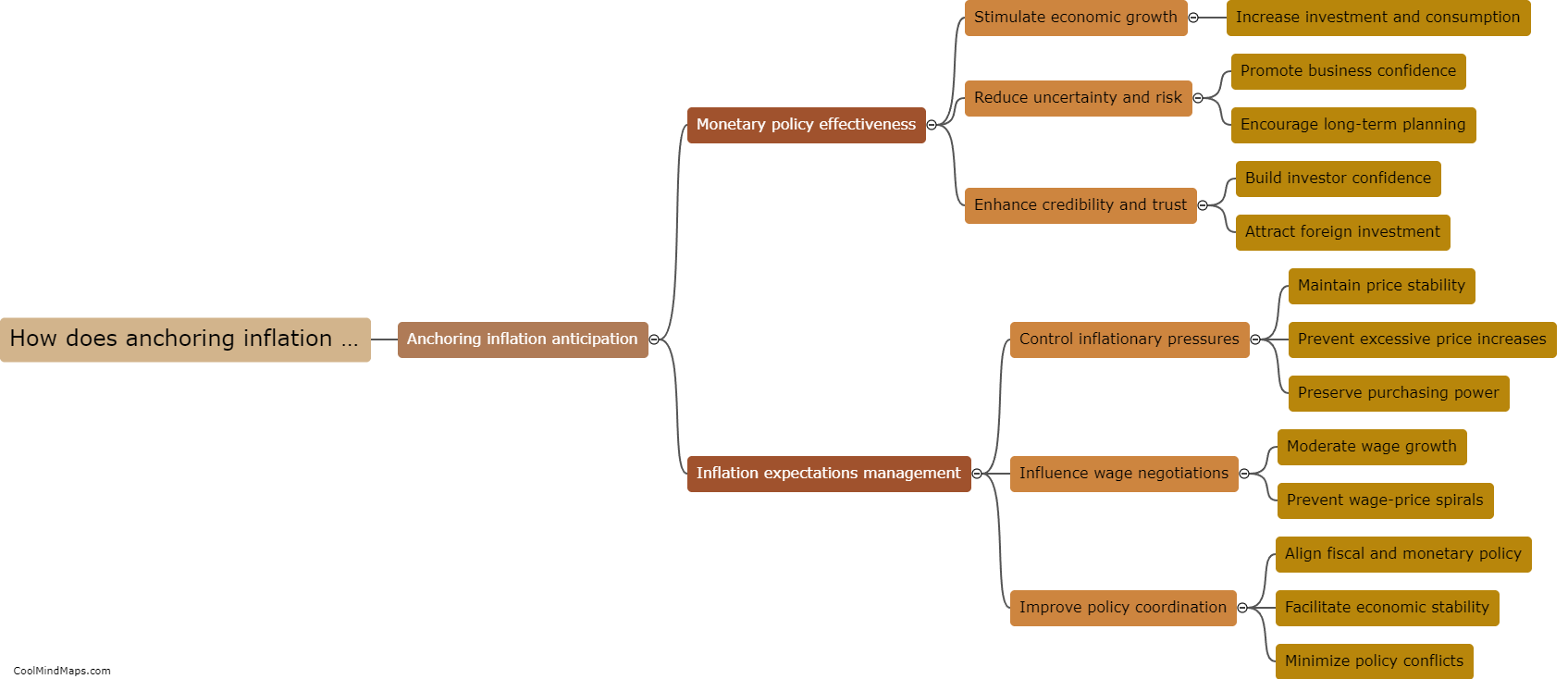

Central banks can ensure the anchoring of inflation anticipation through various measures. One effective approach is through clear and transparent communication of their inflation targets and monetary policy actions. By providing regular updates on their objectives, central banks can build credibility and influence market expectations. Additionally, implementing strong and consistent monetary policy frameworks, such as inflation targeting or price level targeting, can help guide market participants' inflation anticipation. Central banks also need to closely monitor and respond to any deviation from their inflation targets, adjusting their policy actions, if necessary, to maintain credibility and ensure that inflation expectations remain well-anchored. Finally, central banks can collaborate with other monetary authorities, such as fiscal policy makers, to coordinate actions and promote a comprehensive approach towards stabilizing inflation expectations.

This mind map was published on 17 September 2023 and has been viewed 102 times.