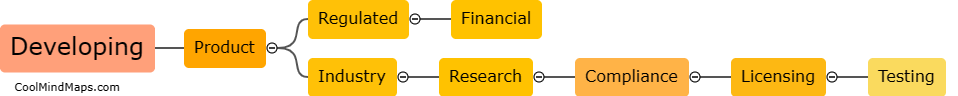

What are the steps involved in developing a product in a regulated financial industry?

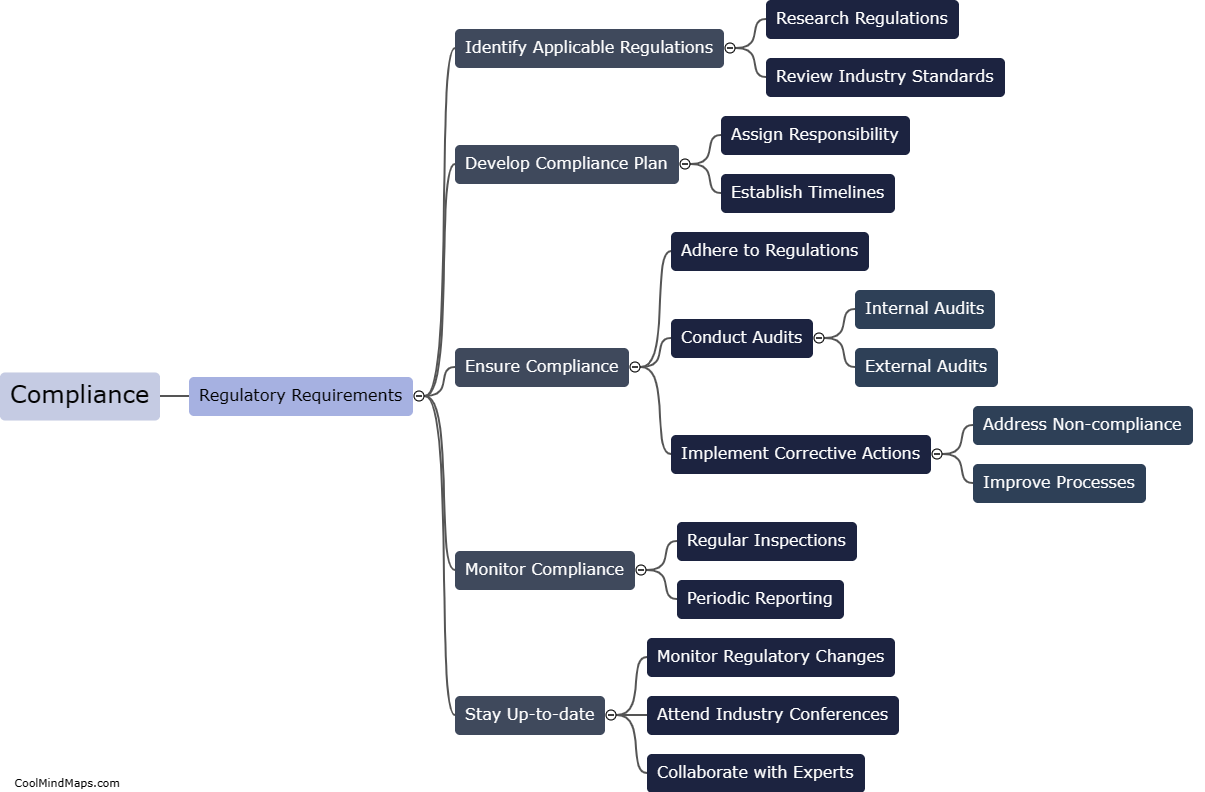

Developing a product in a regulated financial industry involves a series of crucial steps to comply with the stringent regulations governing the sector. Firstly, extensive research and analysis are conducted to identify market opportunities and assess the feasibility of the product. Once the concept is refined, teams focus on designing and prototyping the product, ensuring that it meets all regulatory requirements. To ensure compliance, rigorous testing and risk assessments are conducted, often involving third-party audits. Additionally, thorough documentation and reporting are maintained throughout the development process. Finally, the product undergoes scrutiny by regulatory authorities, who assess its compliance with laws and guidelines. Constant communication and collaboration with legal and compliance teams are vital during each step of the development process. Overall, developing a product in a regulated financial industry requires meticulous attention to detail, adherence to regulations, and an unwavering commitment to ensuring customer protection and market integrity.

This mind map was published on 8 January 2024 and has been viewed 86 times.