How do investment policy, capital structure policy, and dividend policy impact the cost of capital?

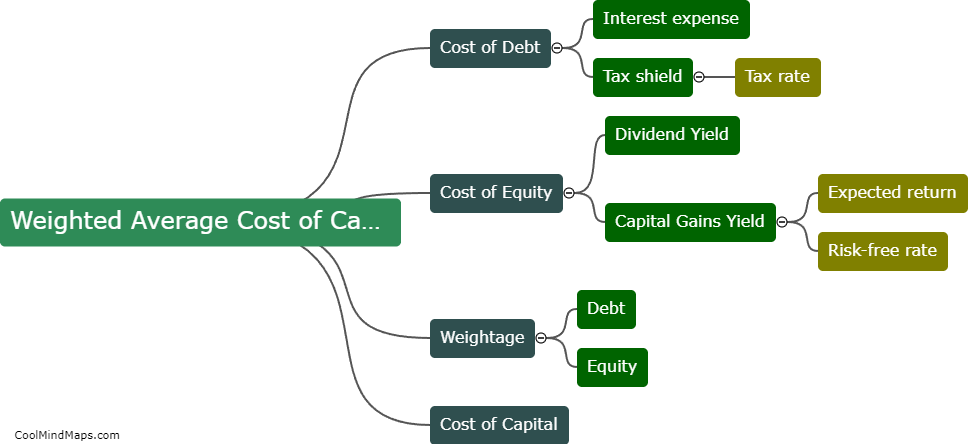

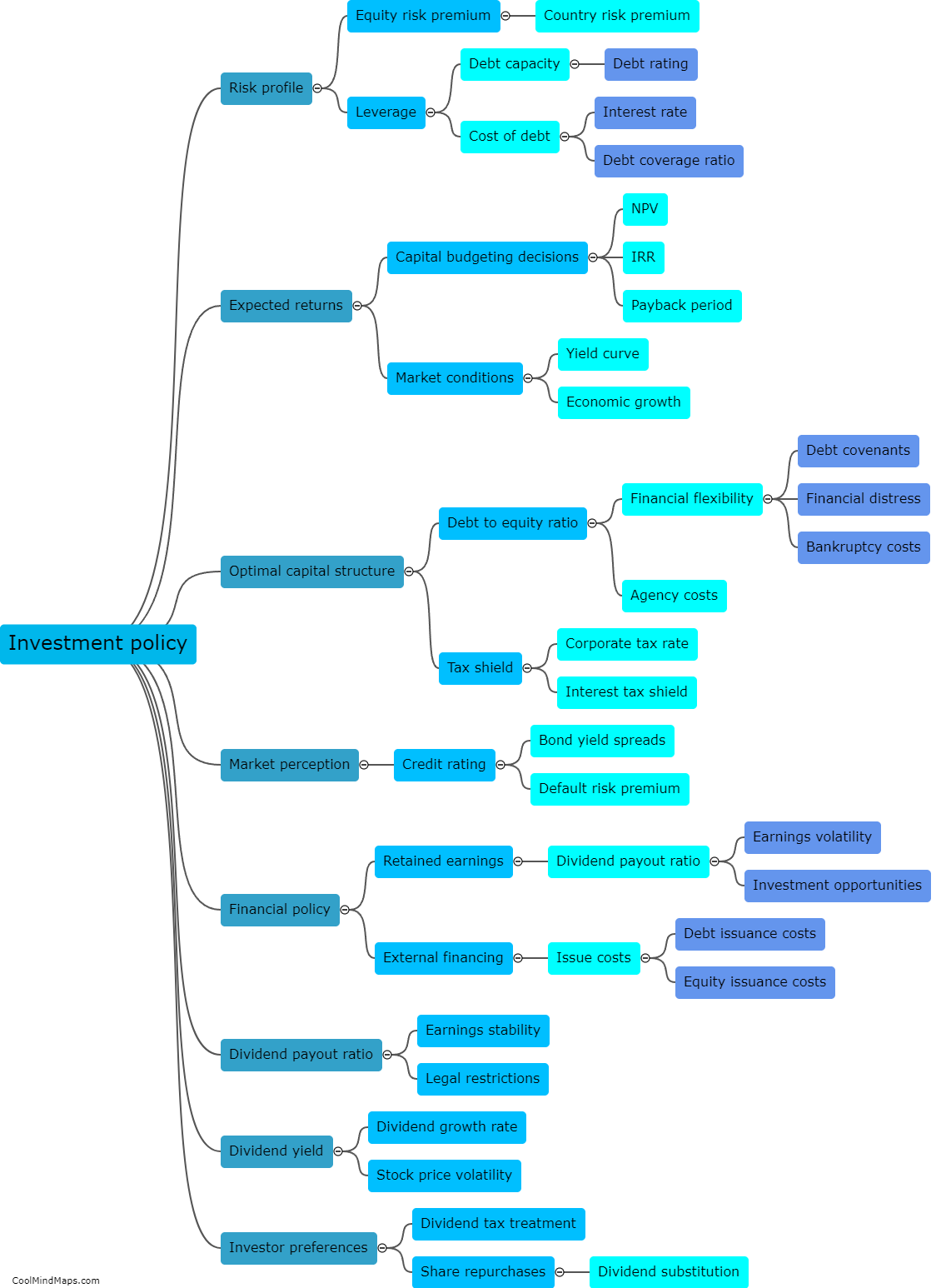

Investment policy, capital structure policy, and dividend policy are all crucial factors that can significantly impact the cost of capital for a company. Investment policy refers to the decisions made by a company regarding where to allocate its funds for various projects and initiatives. If a company follows a conservative investment policy and only invests in low-risk projects, it may result in a lower cost of capital, as investors perceive the company to have lower risk. On the other hand, if a company pursues aggressive investment policies and invests in high-risk projects, it may lead to a higher cost of capital due to the increased risk associated with the investments. Capital structure policy refers to the mix of debt and equity that a company uses to finance its operations. A company with a higher proportion of debt in its capital structure is often considered to have a higher risk, leading to a higher cost of capital. Conversely, a company that relies more on equity financing may have a lower cost of capital as it is perceived as less risky. Dividend policy is the decision made by a company regarding the distribution of profits to shareholders. If a company has a higher dividend payout ratio, it may result in a higher cost of capital as investors expect a higher return to compensate for the reduced retained earnings. On the other hand, a lower dividend payout ratio may lead to a lower cost of capital as investors perceive it as a sign of future growth opportunities. Overall, these three policies directly influence the risk perception of the company, which in turn impacts the cost of capital.

This mind map was published on 5 December 2023 and has been viewed 79 times.