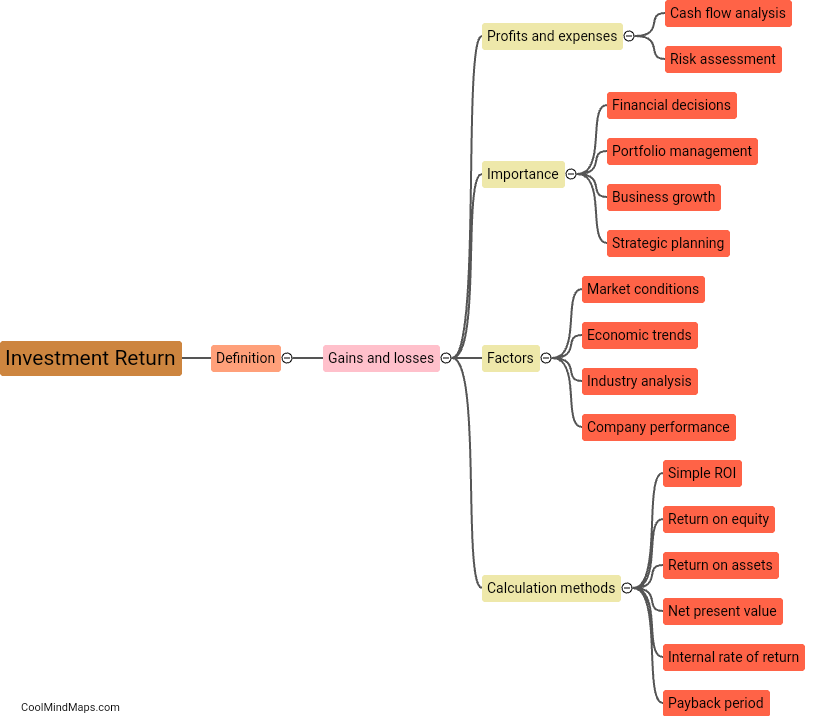

How can I finance the purchase of real estate in Germany?

When it comes to financing the purchase of real estate in Germany, there are several options available. Homebuyers can choose to obtain a mortgage loan from a German bank or financial institution. Unlike some countries, German banks typically require a significant down payment, often around 20-30% of the property's purchase price. Additionally, buyers should be prepared to provide proof of income stability and have a good credit history. Another option is to explore funding through government programs, such as the KfW Bank's promotional loans, which offer attractive interest rates and favorable terms. Additionally, some buyers may consider leveraging their existing assets, such as equity in another property, or seeking funds from family or friends for a private loan. It is advisable to consult with a financial advisor or mortgage specialist to evaluate the best financing options based on individual circumstances.

This mind map was published on 26 January 2024 and has been viewed 77 times.