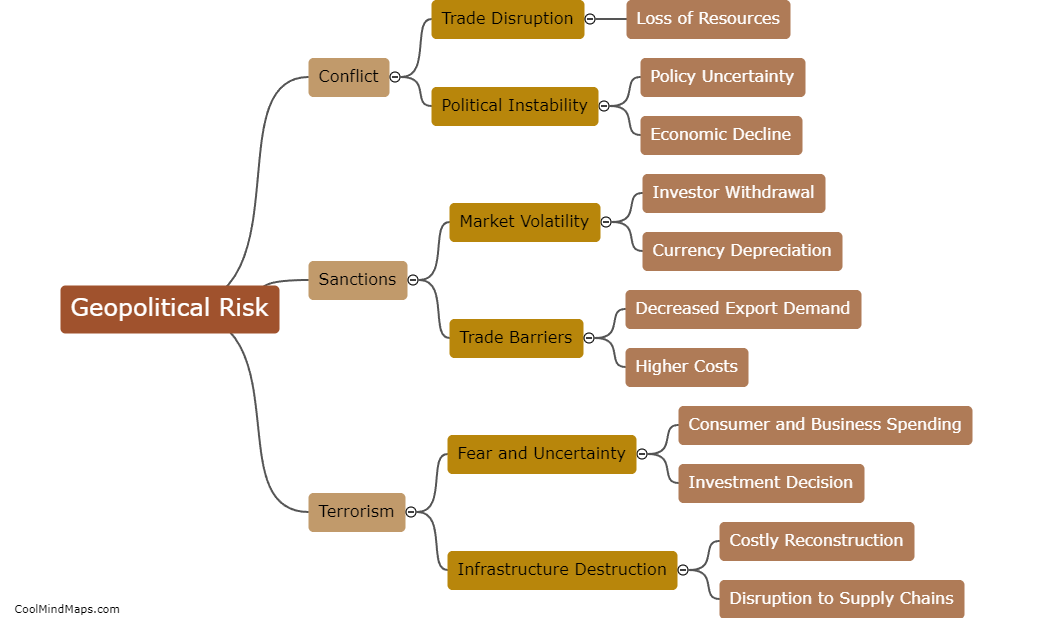

How does geopolitical risk impact financial markets?

Geopolitical risk refers to the potential impact of political, social, and economic events, conflicts, and dynamics on financial markets. It can include factors such as changes in government policies, military conflicts, terrorism, trade disputes, and regime changes. Geopolitical risk has a significant impact on financial markets as it can create uncertainty and volatility. Investors become cautious and tend to reassess their investment decisions, leading to shifts in asset prices and market trends. For example, when geopolitical tensions rise, such as during a trade war or military conflict, investors may flock towards safe-haven assets like gold or government bonds, leading to a decrease in demand for riskier assets like stocks. Moreover, geopolitical risk can also affect specific sectors and industries, depending on the nature of the events. Overall, geopolitical risk is a crucial consideration for investors, as it influences market sentiment, investor behavior, and ultimately, the performance of financial markets.

This mind map was published on 21 November 2023 and has been viewed 108 times.