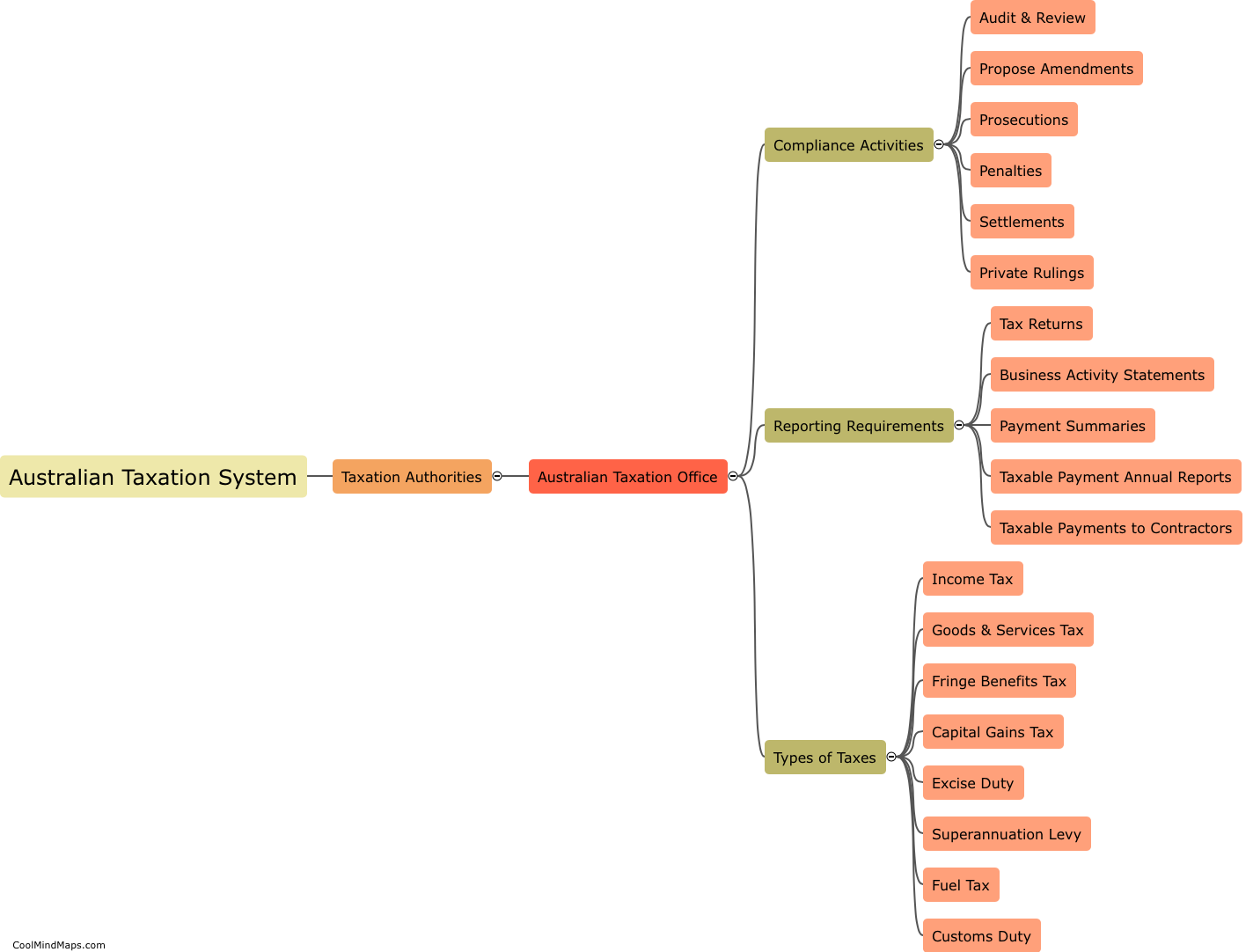

What are the tax rates in Australia?

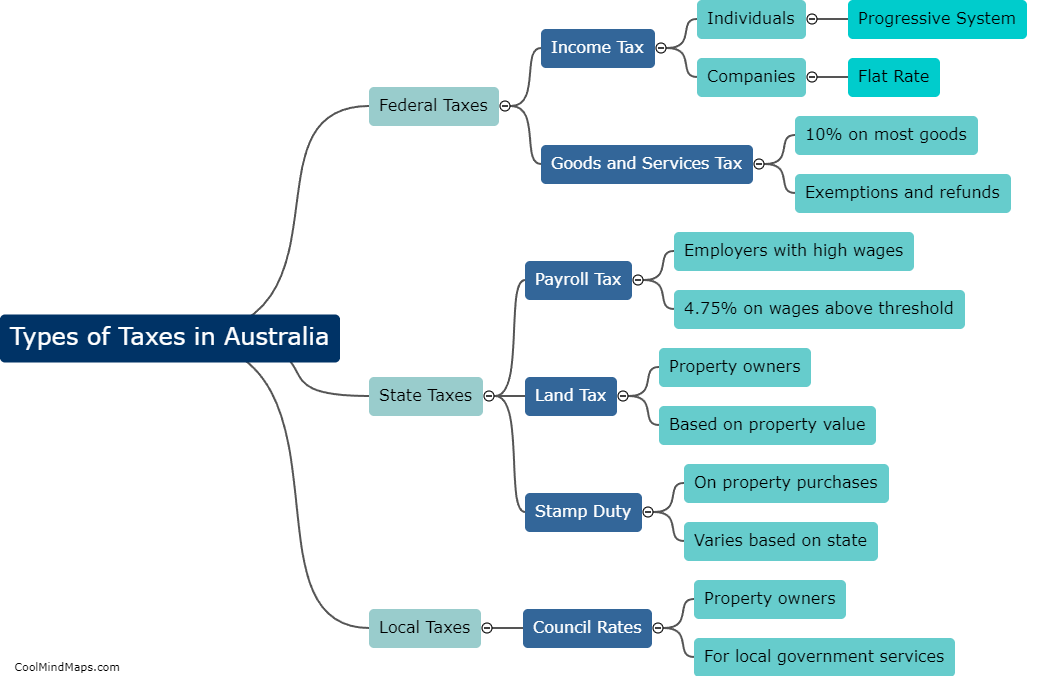

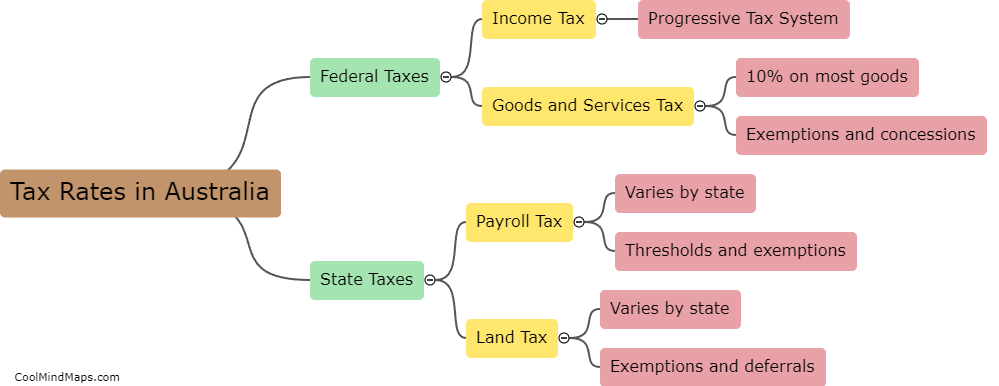

The tax rates in Australia vary depending on an individual's income, residency status, and other factors. Australian residents are subject to a progressive income tax system, where the more they earn, the higher percentage they pay in taxes. The tax rates range from 0% for those who earn up to AU$18,200 per year, to 45% for those who earn over AU$180,000 per year. In addition to income tax, Australians also pay goods and services tax (GST), which is currently set at 10%. Other taxes may also apply, such as property tax, capital gains tax, and stamp duty.

This mind map was published on 22 May 2023 and has been viewed 100 times.