How do financial markets exhibit changing dynamics over time?

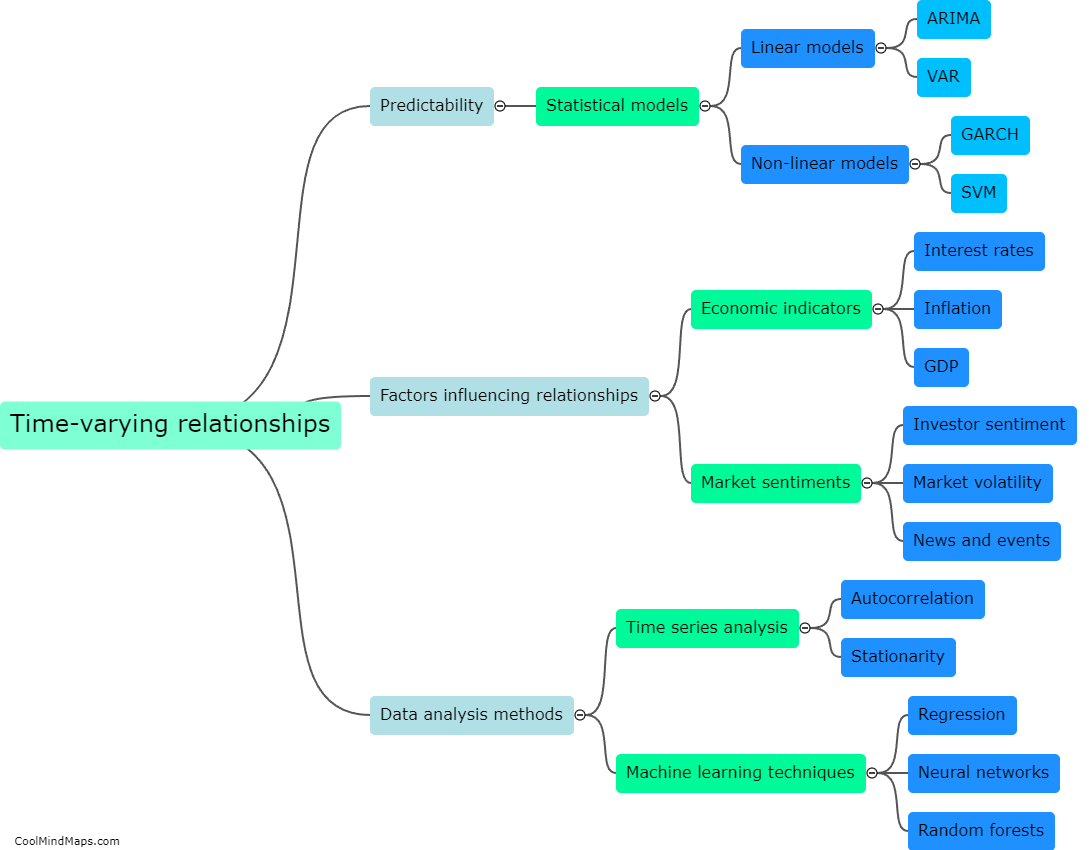

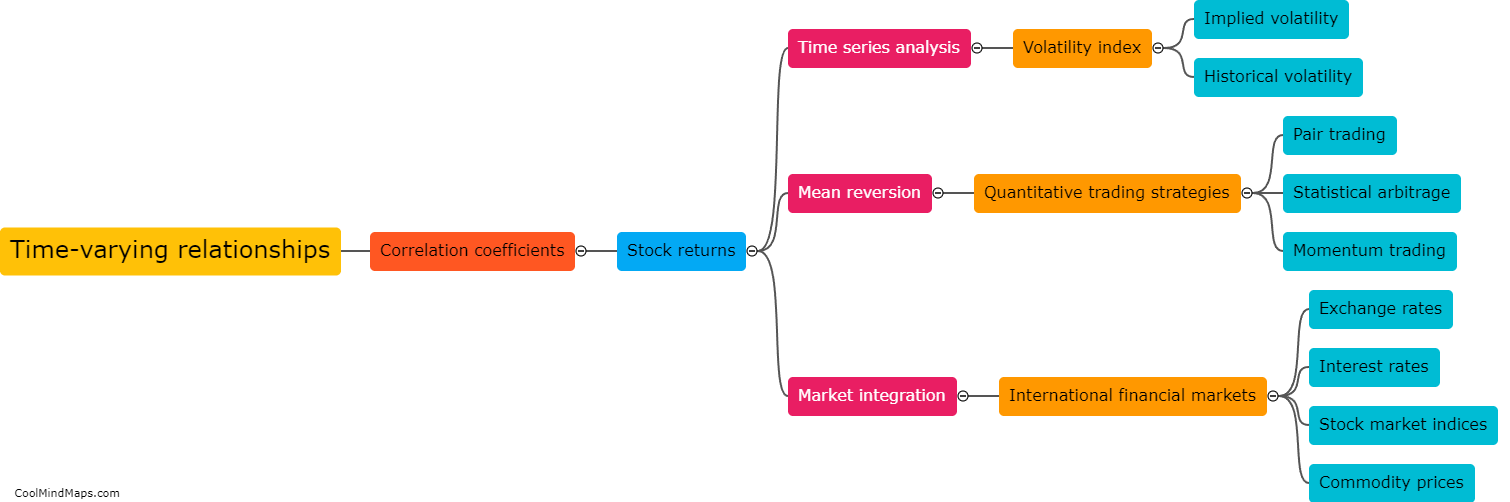

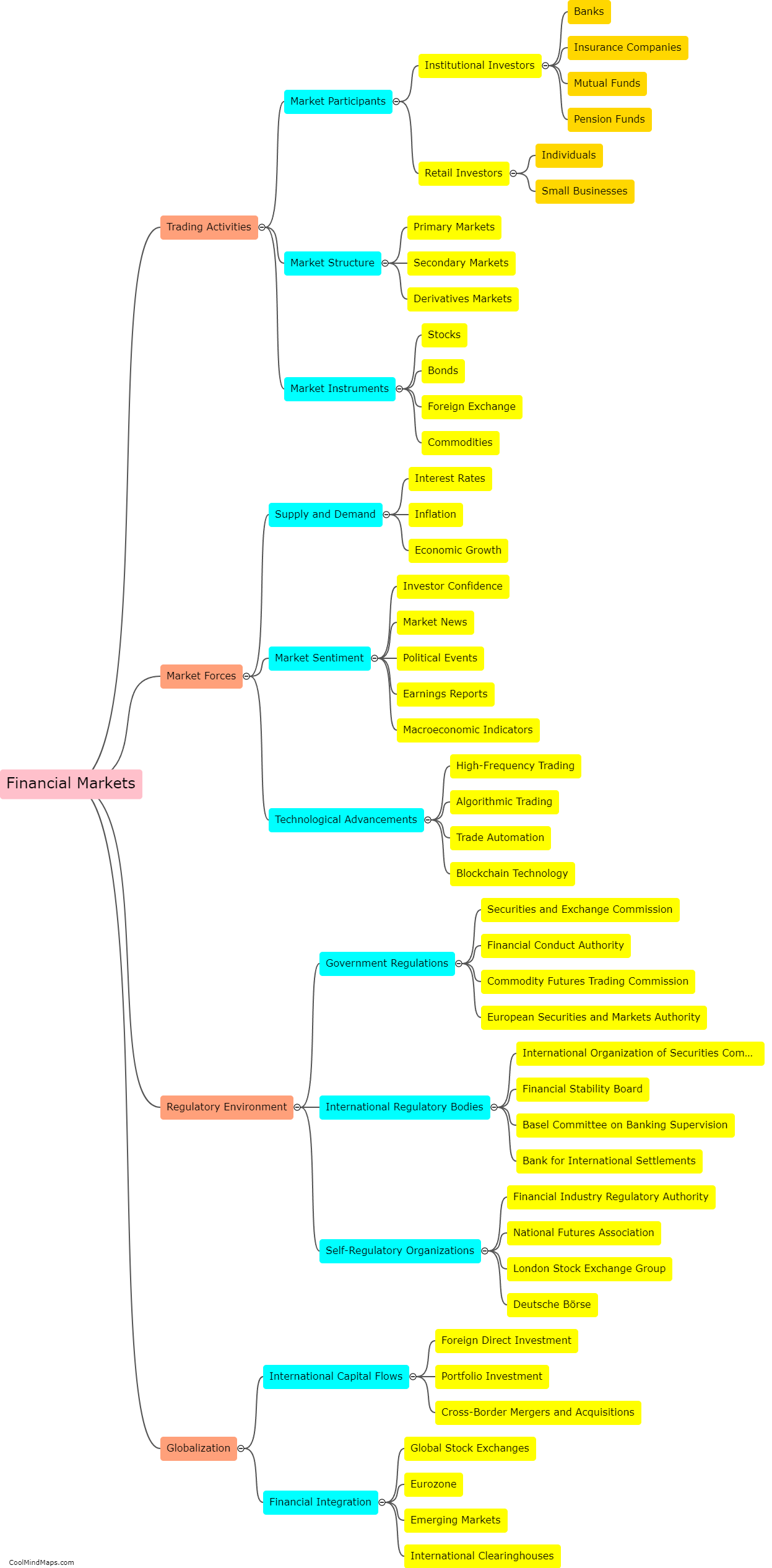

Financial markets exhibit changing dynamics over time due to various factors such as economic conditions, market trends, technological advancements, regulatory changes, and investor behavior. These dynamics can manifest in several ways. Firstly, market volatility fluctuates, influenced by economic indicators and global events, resulting in changes in asset prices. Additionally, evolving market trends like the rise of cryptocurrencies or the growing interest in sustainable investments can reshape the composition and structure of financial markets. Technological innovations, such as algorithmic trading or online platforms, have also transformed the speed and efficiency of market operations. Moreover, regulatory measures and reforms implemented by authorities can impact market dynamics, often aiming to enhance stability and safeguard investor interests. Lastly, investor behavior can shift over time, influenced by market sentiment, risk appetite, or changing demographics, consequently altering market dynamics. As such, financial markets are dynamic and ever-changing, adapting to a multitude of factors that shape their behavior over time.

This mind map was published on 22 December 2023 and has been viewed 98 times.