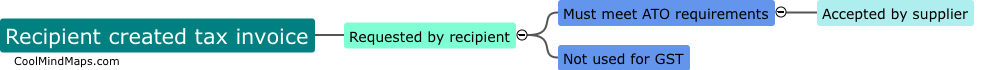

What is a recipient created tax invoice?

A recipient created tax invoice (RCTI) is a document generated by the recipient of a good or service rather than the supplier. This type of invoice is typically used in business-to-business transactions where the recipient is responsible for calculating and reporting the tax payable on the transaction. RCTIs are common in industries where the recipient has a better understanding of the goods or services provided, such as construction or manufacturing. By creating their own tax invoice, recipients can streamline the invoicing process and ensure accurate reporting of taxes owed.

This mind map was published on 25 August 2024 and has been viewed 75 times.