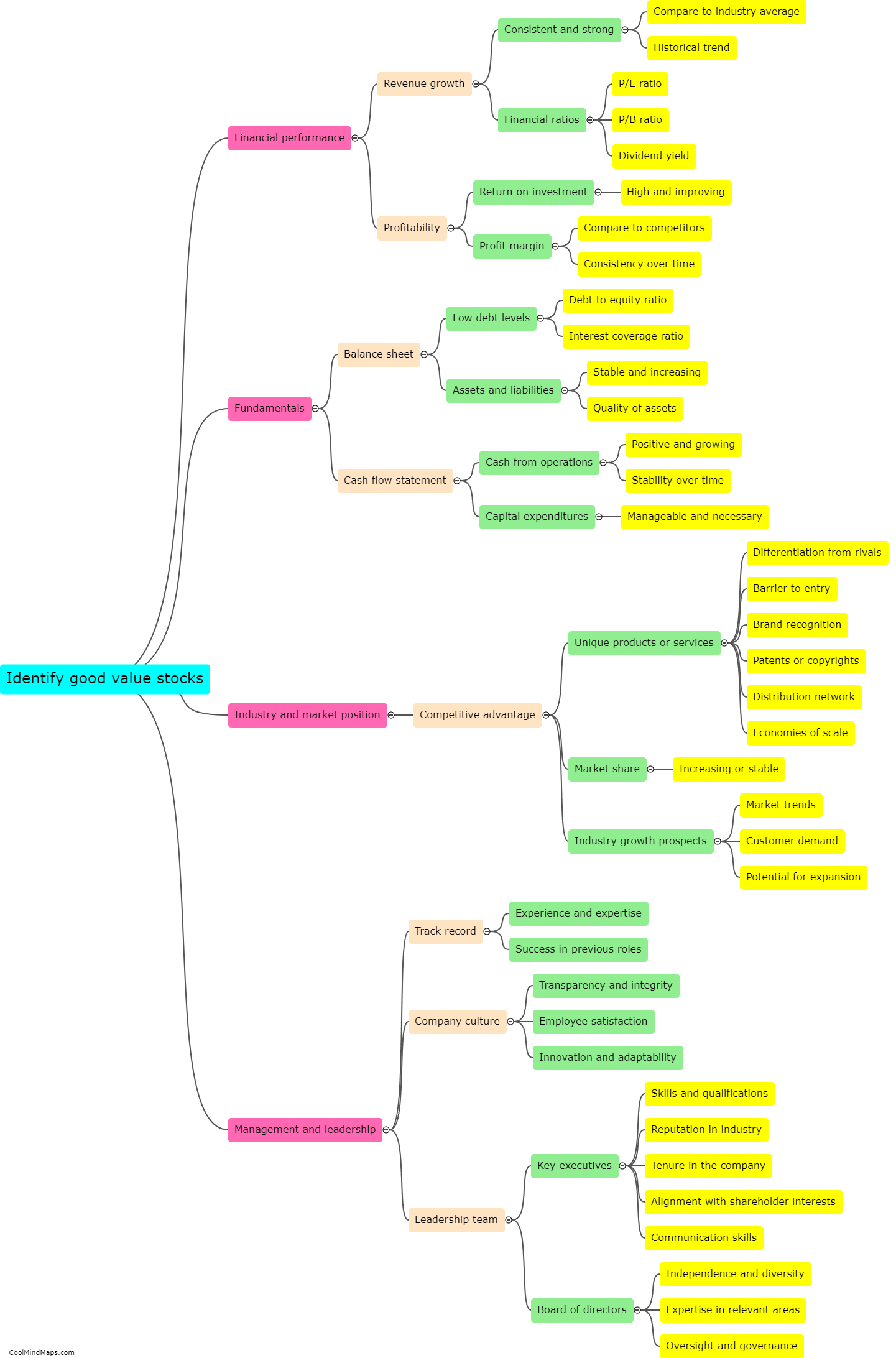

How to identify good value stocks?

Identifying good value stocks requires a combination of thorough research, analysis, and understanding of the stock market. Firstly, one should consider the company's financial health by examining key financial ratios such as price-to-earnings ratio, price-to-book ratio, and dividend yield. Low ratios compared to industry peers may indicate undervaluation. Secondly, assessing the company's fundamentals, including its competitive position, revenue growth, profitability, and potential for future growth is crucial. Additionally, analyzing market trends, macroeconomic factors, and industry conditions are essential for identifying stocks that are well-positioned for long-term success. Conducting qualitative research, like reading analyst reports and monitoring news and industry developments, can further provide insights into a company's future prospects. By combining these quantitative and qualitative evaluation methods, investors can identify good value stocks that have the potential to yield strong returns over time.

This mind map was published on 15 December 2023 and has been viewed 98 times.