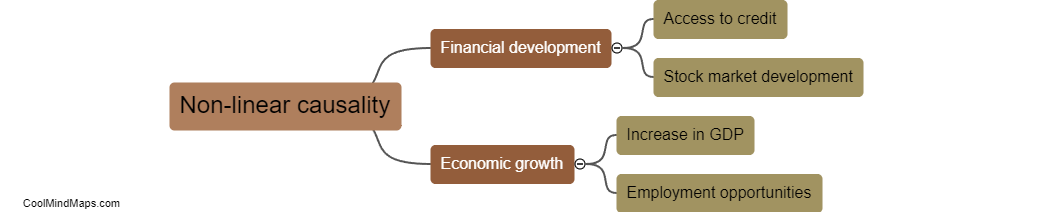

How does non-linear causality impact economic growth?

Non-linear causality can have a significant impact on economic growth as it introduces complexities and uncertainties into the system. In a non-linear causal relationship, small changes in one variable can lead to disproportionate effects on other variables, creating feedback loops and tipping points that can either accelerate or decelerate economic growth. This nonlinear nature of causality can make it difficult for policymakers and businesses to predict and respond to changes in the economy, potentially leading to volatile and unstable growth patterns. Additionally, non-linear causality can also result in unexpected shocks and crises that can have severe consequences for economic growth if not managed effectively.

This mind map was published on 21 February 2024 and has been viewed 110 times.