What are the penalties for tax non-compliance?

The penalties for tax non-compliance can vary depending on the extent of the non-compliance and the level of intentionality. Common penalties include fines, interest payments, and even criminal charges in extreme cases. Fines can range from a percentage of the unpaid tax liability to a fixed amount for each day the tax remains unpaid. Interest payments are typically added to the unpaid tax liability and can accumulate over time. Criminal charges may be pursued if there is evidence of intentional or fraudulent activity, such as purposefully failing to report income or claiming false deductions. It is important for individuals and businesses to stay up-to-date on tax laws and regulations to avoid facing penalties for non-compliance.

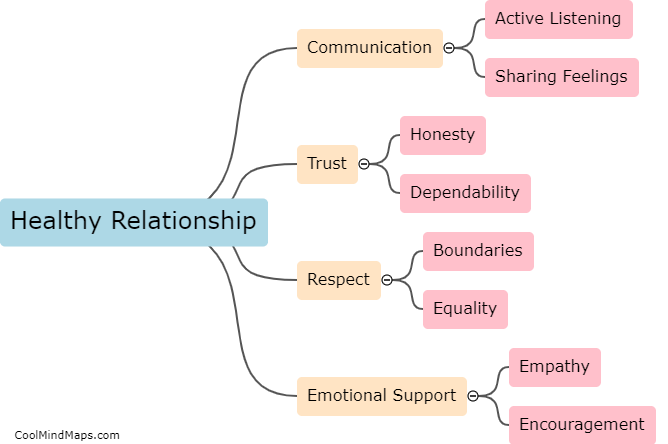

This mind map was published on 18 April 2023 and has been viewed 94 times.