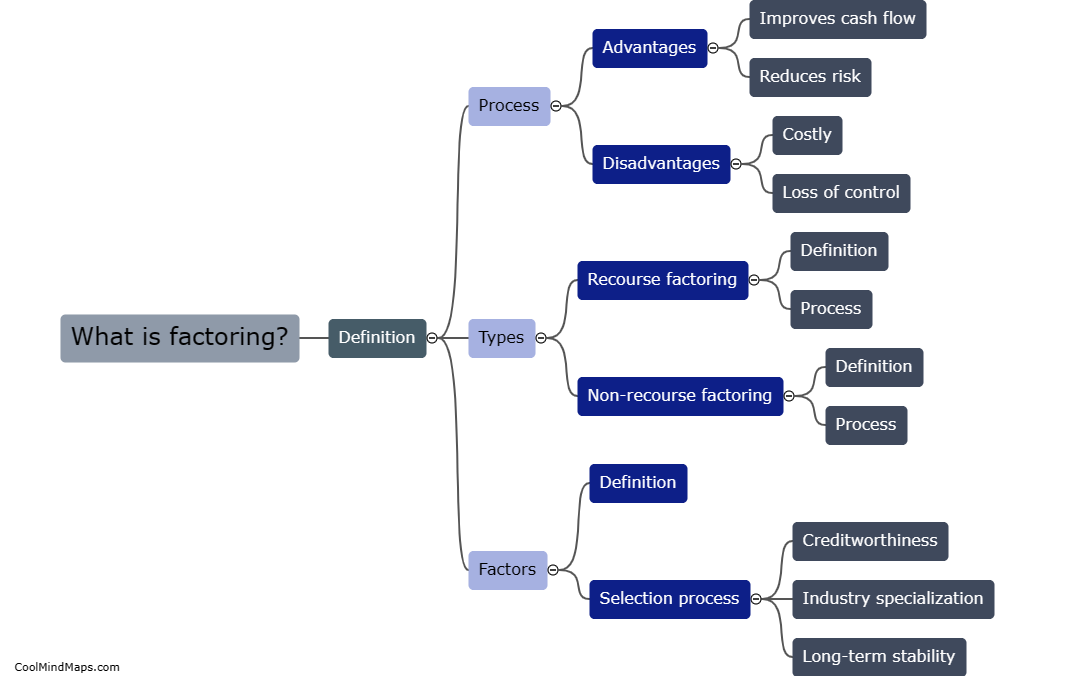

What is factoring?

Factoring, in the context of finance, refers to the process of selling accounts receivable or invoices to a third party known as a factor, at a discounted rate. This allows businesses to convert their accounts receivable into immediate cash, rather than waiting for customers to pay their outstanding invoices. Factoring provides businesses with a quick and efficient way to improve cash flow, as they receive immediate funds for their unpaid invoices. The factor then takes over the responsibility of collecting payments from the customers, assuming the risk of any bad debts. Factoring is frequently used by small businesses or those with limited access to traditional financing options, as it provides a viable alternative for obtaining working capital.

This mind map was published on 1 December 2023 and has been viewed 118 times.