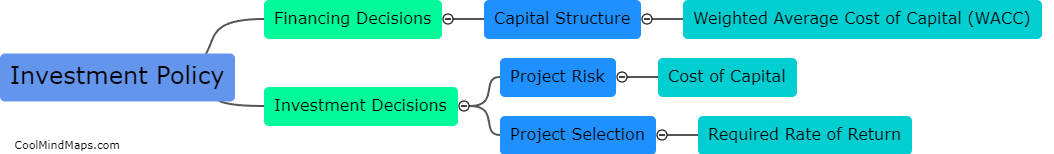

How does the firm's investment policy affect WACC?

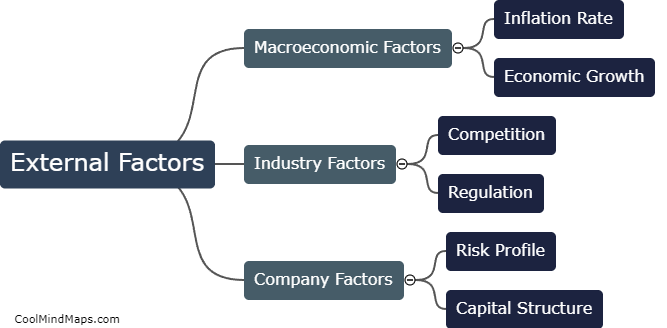

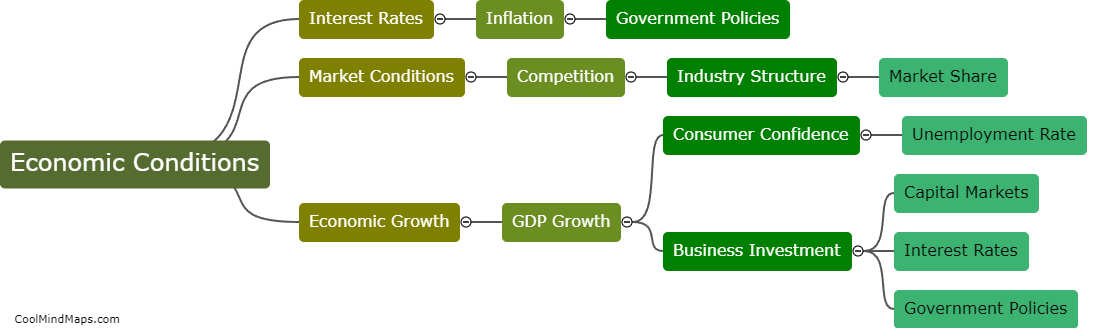

A firm's investment policy can significantly impact its weighted average cost of capital (WACC). The WACC represents the average cost of financing for a company and is a crucial metric in determining the feasibility of investment projects. A firm's investment policy influences WACC through two main channels. Firstly, the level and composition of investments affect the risk profile of the firm, which in turn impacts the cost of capital. Riskier investments generally require higher return expectations, leading to a higher cost of capital and consequently increasing the WACC. Secondly, the timing and duration of investments affect the firm's capital structure and debt levels. A more aggressive investment policy may require additional financing, potentially increasing the proportion of debt in the capital structure and leading to higher interest expense and a higher WACC. Therefore, a firm's investment policy must be carefully considered to ensure it aligns with the desired risk and financing profile, ultimately influencing the WACC.

This mind map was published on 5 December 2023 and has been viewed 91 times.