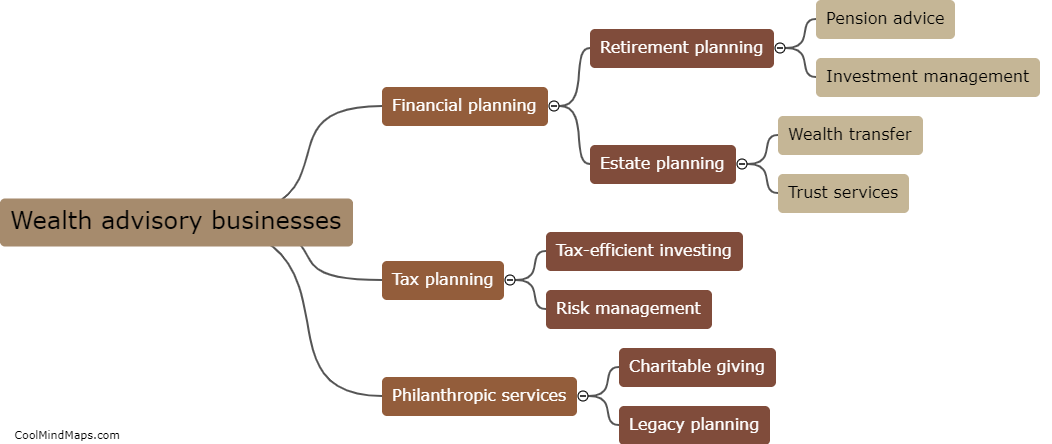

What services do wealth advisory businesses provide?

Wealth advisory businesses typically provide a wide range of services to help individuals manage their finances. These services can include investment management, financial planning, estate planning, tax planning, risk management, and retirement planning. Wealth advisory firms also offer guidance on managing personal wealth, such as asset allocation, portfolio management, and diversification strategies. Additionally, these firms can often provide specialized services such as trusts and estate planning, philanthropic planning, and business succession planning. Overall, wealth advisory businesses are designed to help individuals make informed financial decisions and achieve their long-term financial goals.

This mind map was published on 16 May 2023 and has been viewed 96 times.