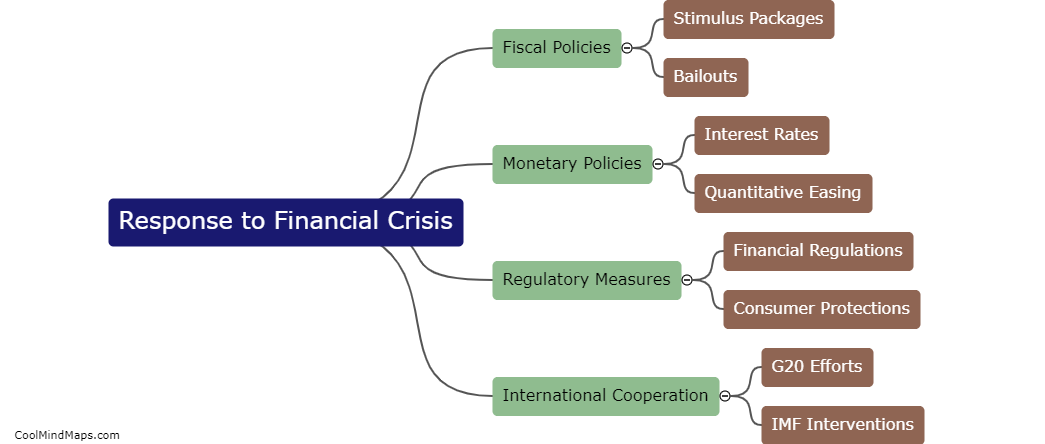

Definition of too big to fail banks?

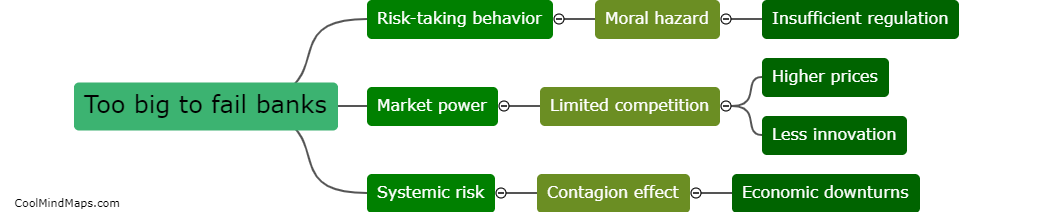

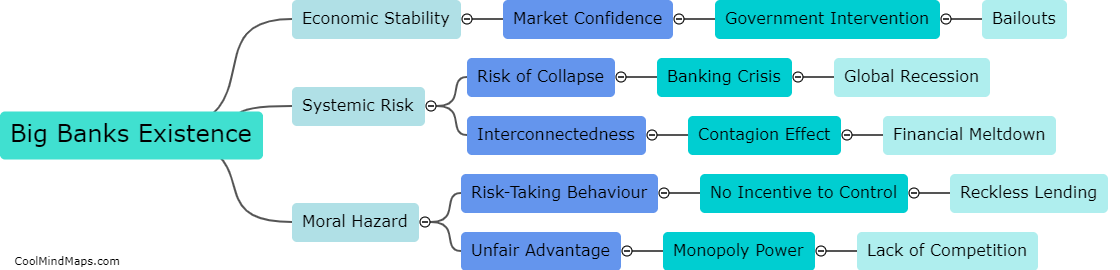

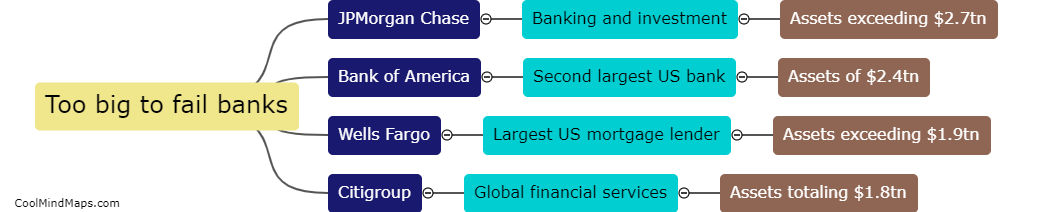

Too big to fail banks are financial institutions that are considered to be so large and interconnected with the wider financial system that their failure could potentially have catastrophic consequences for the economy as a whole. This term became particularly relevant during the 2008 financial crisis, wherein certain banks deemed too big to fail were bailed out by the government to avoid a potential collapse of the global financial system. The designation of a bank as too big to fail is subject to ongoing discussion and debate, with some arguing that it creates a moral hazard wherein these banks are incentivized to take on greater risks knowing that they will ultimately be bailed out.

This mind map was published on 23 May 2023 and has been viewed 104 times.