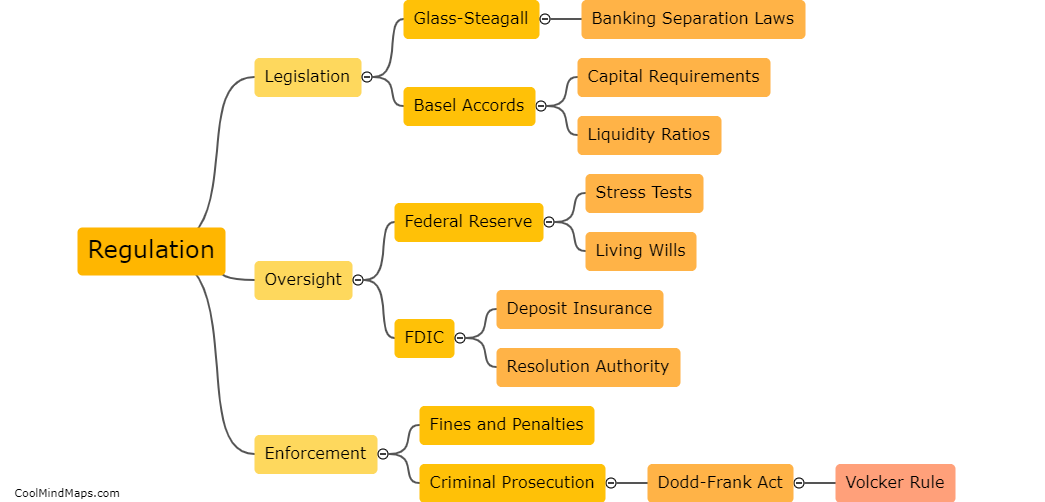

What measures are in place to regulate too big to fail banks?

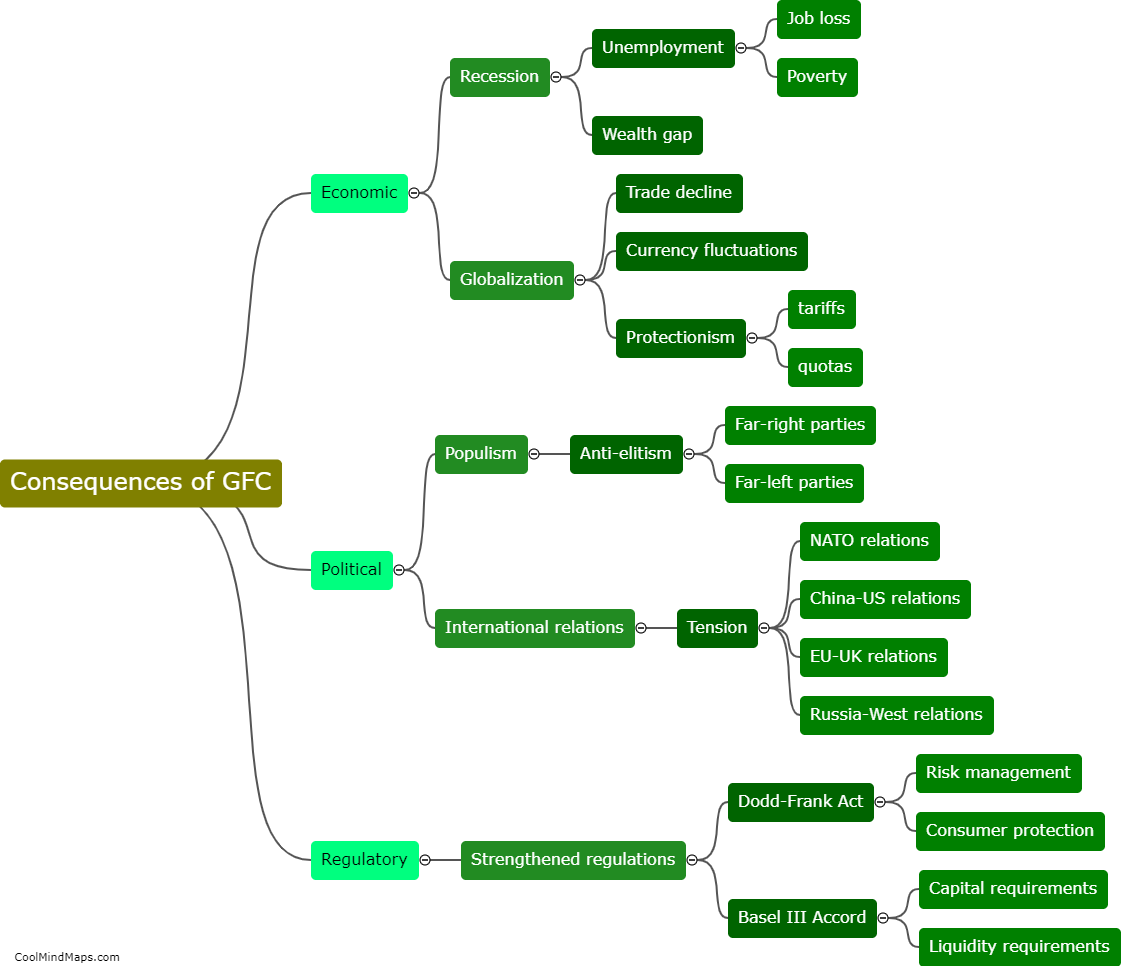

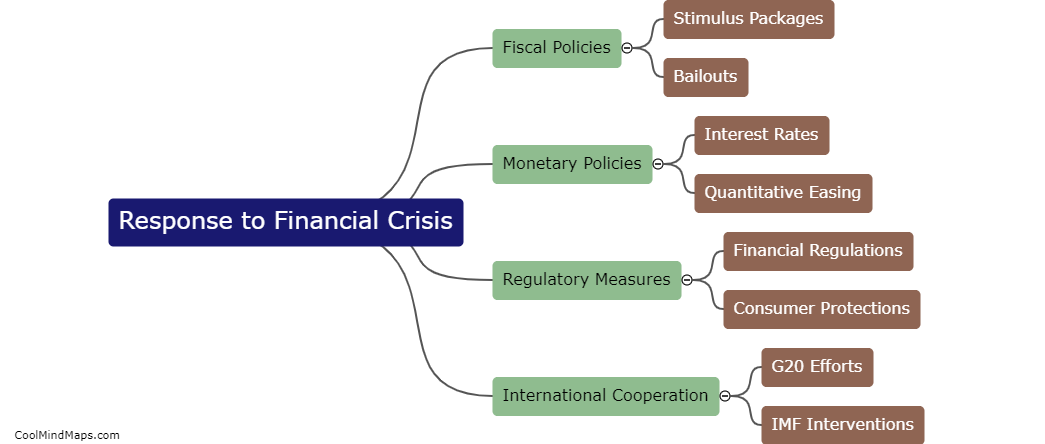

In response to the financial crisis of 2008, various measures have been put in place to regulate too big to fail banks. The Dodd-Frank Wall Street Reform and Consumer Protection Act, signed into law in 2010, aims to prevent another financial crisis by improving transparency and accountability within the financial industry. The act includes provisions for greater oversight of large banks, stress testing requirements, and the ability for regulators to dismantle failing banks in an orderly manner without disrupting the financial system. Additionally, the Financial Stability Board, an international body composed of regulators and central bankers, has established guidelines for regulating systemically important banks. These measures aim to ensure that the failure of large banks does not destabilize the entire financial system. Despite these efforts, some critics argue that too big to fail banks continue to pose a systemic risk to the financial system.

This mind map was published on 23 May 2023 and has been viewed 111 times.