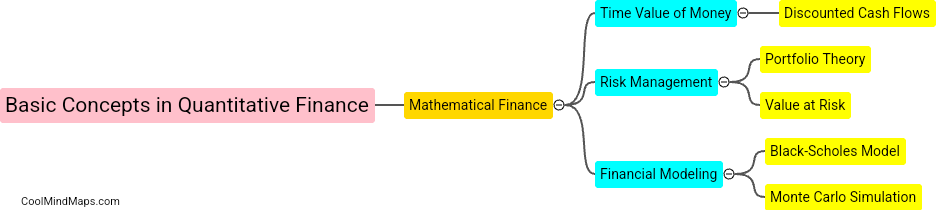

How can the Black-Scholes formula be applied?

The Black-Scholes formula is a mathematical model used to calculate the theoretical price of European-style options. It can be applied in financial markets to determine the fair value of options based on factors such as the underlying asset's price, the option's strike price, the time to expiration, the risk-free interest rate, and volatility. By inputting these variables into the formula, traders and investors can assess the potential value of options and make informed decisions on buying, selling, or hedging their positions. Additionally, the Black-Scholes formula can be used to estimate the probability of an option expiring in or out of the money, helping market participants manage their risk effectively.

This mind map was published on 2 April 2024 and has been viewed 100 times.