How do you analyze a cash flow statement?

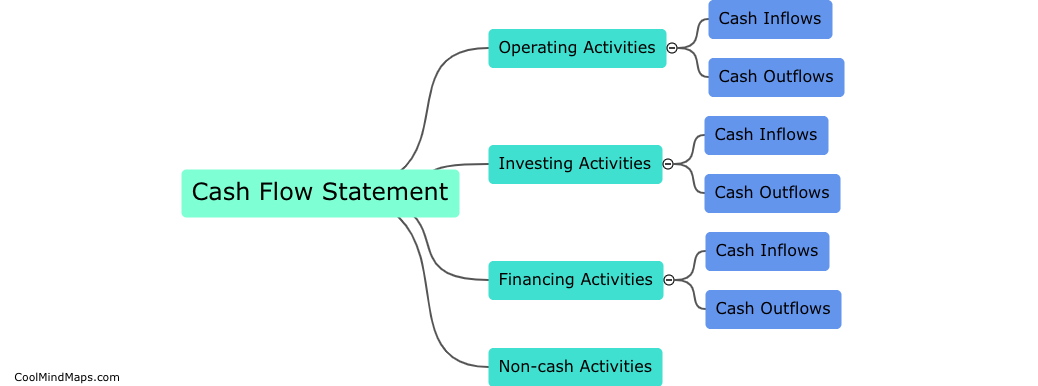

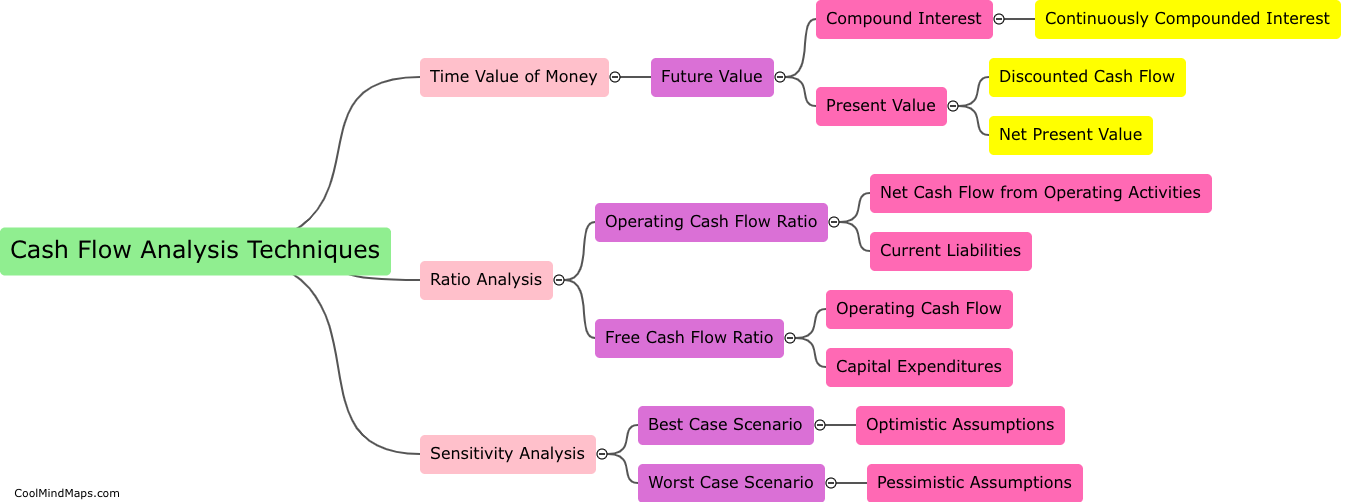

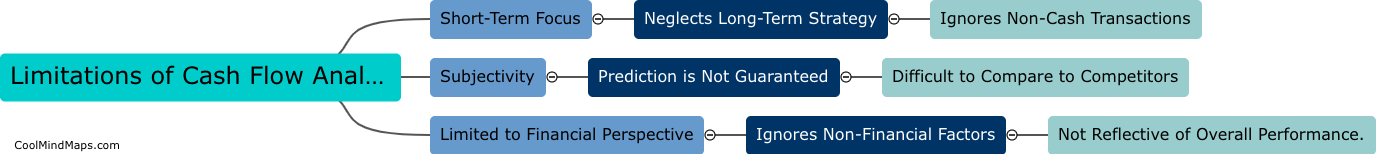

Analyzing a cash flow statement involves examining the inflows and outflows of cash from an organization's operating, investing, and financing activities. The statement should be studied in conjunction with the income statement and balance sheet to identify changes in cash flow patterns over time. Key metrics to consider include net cash flow, free cash flow, and cash flow ratios such as the cash conversion cycle and Operating Cash Flow to Sales Ratio. By evaluating cash flow trends and comparing them to industry standards, entity goals, and capital market expectations, it is possible to gain insights into an organization's financial health, long-term viability, and capacity to meet future obligations.

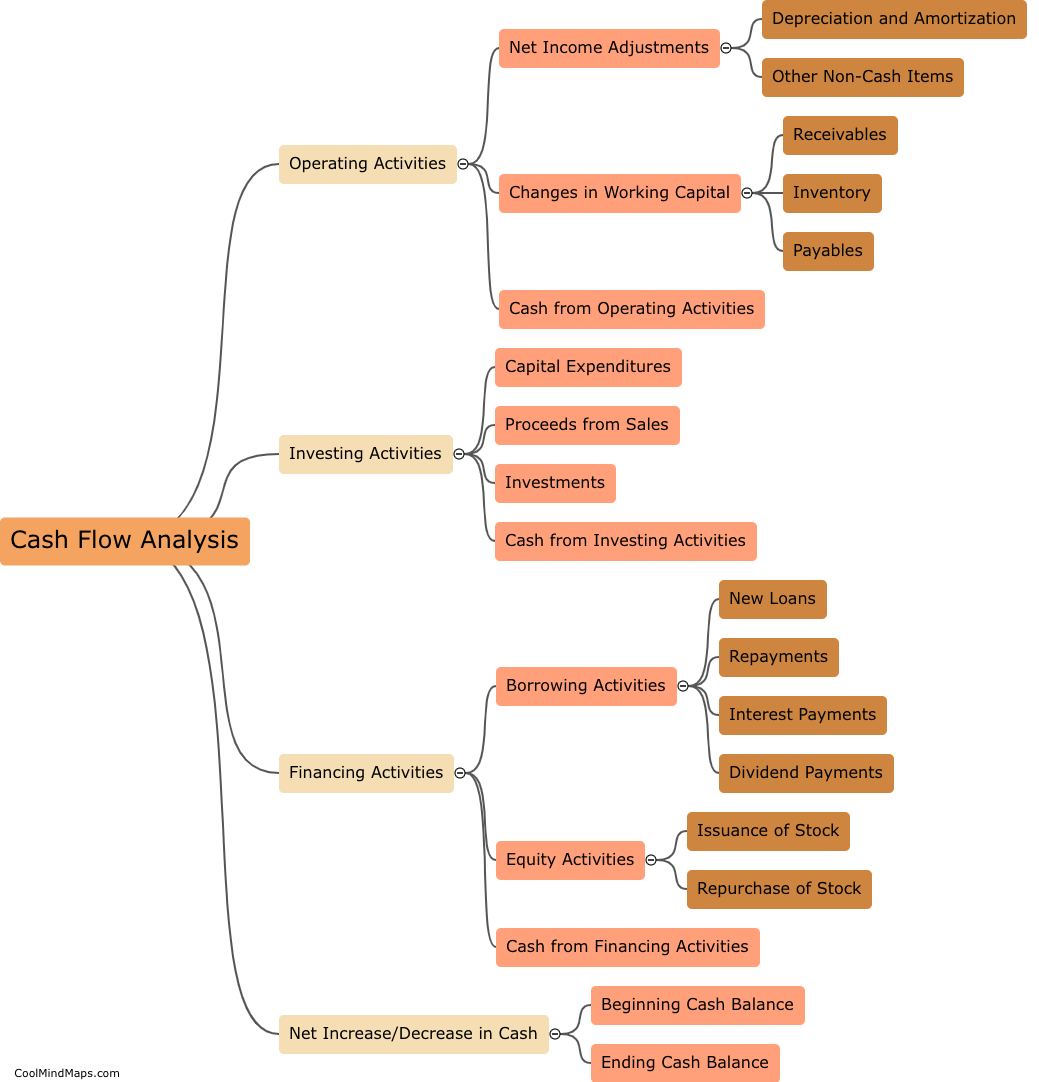

This mind map was published on 24 April 2023 and has been viewed 103 times.