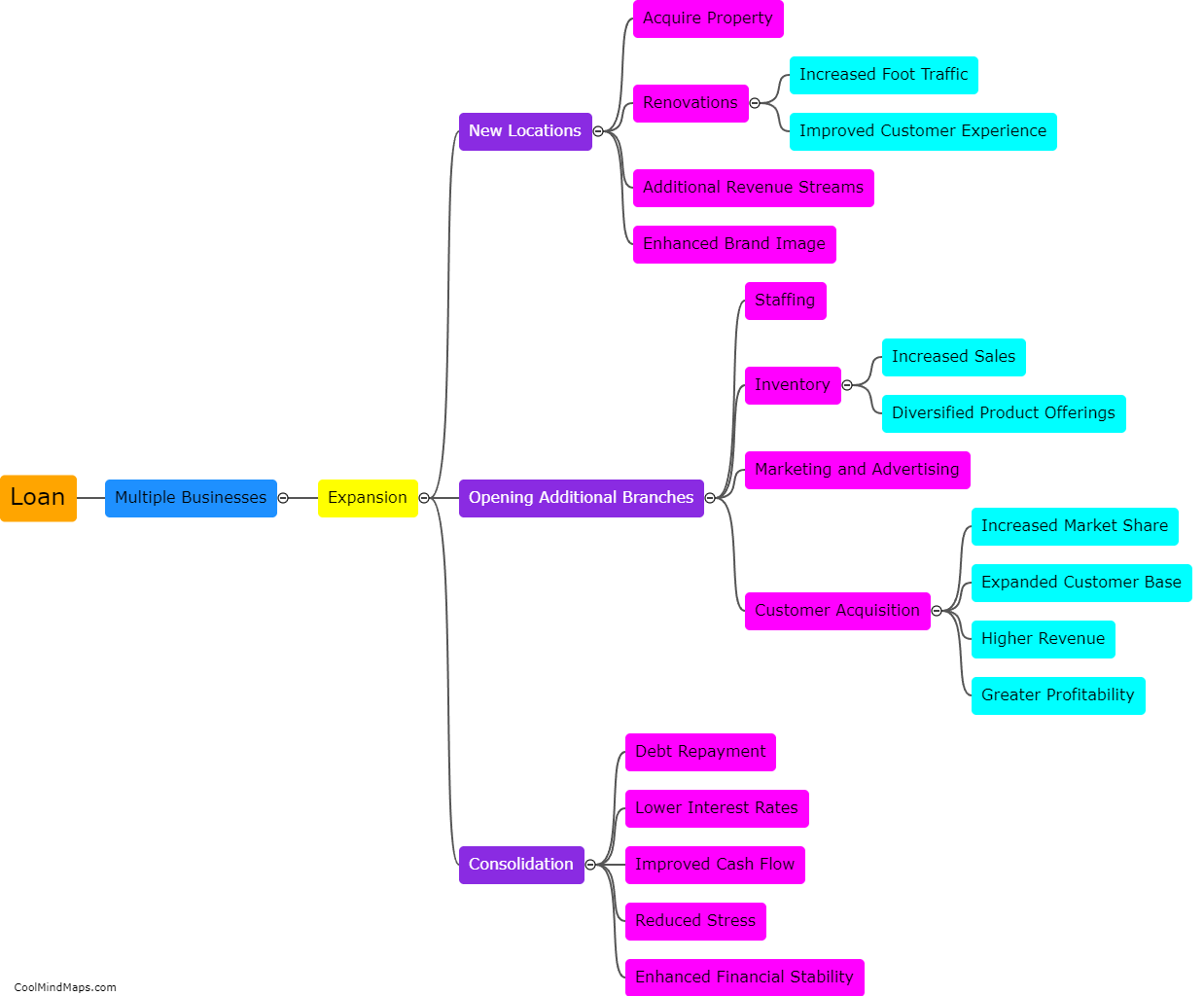

What are the advantages of using a loan to finance multiple businesses?

Using a loan to finance multiple businesses could offer several advantages for entrepreneurs. Firstly, it provides access to a substantial amount of capital that may not be readily available through personal funds or savings. This allows entrepreneurs to simultaneously invest in multiple business ventures, diversifying their revenue streams and spreading their risk. Furthermore, by consolidating multiple loans into one, entrepreneurs can simplify their financial management, with a single repayment schedule and potentially lower interest rates. Additionally, taking out a loan can help establish creditworthiness and build a strong financial foundation for future business ventures. Overall, utilizing loans to finance multiple businesses enables entrepreneurs to seize opportunities, expand their operations, and achieve long-term growth.

This mind map was published on 5 October 2023 and has been viewed 92 times.