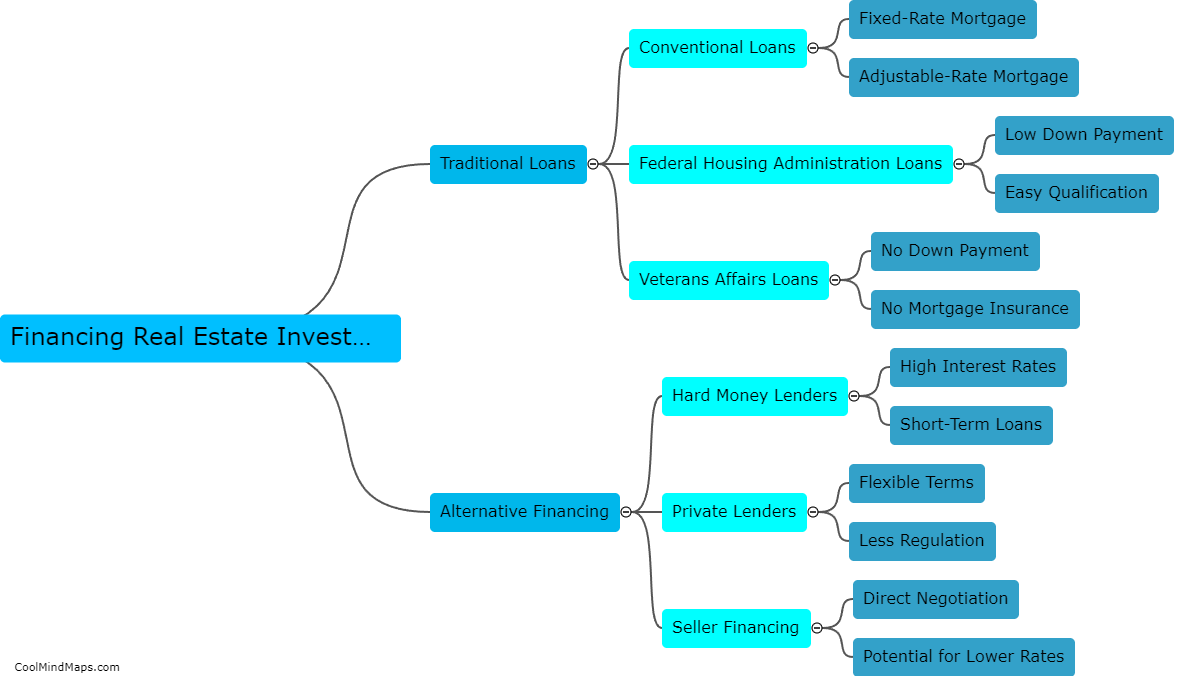

How to finance a real estate investment?

Financing a real estate investment depends on several factors, such as the investor's credit score, the property's location, its value, and its income potential. The most common ways to finance a real estate investment are through a mortgage, cash, or private lending. A mortgage usually requires a down payment of at least 20% of the property value, satisfactory credit scores, and income verification. Cash buyers can purchase a property outright without incurring any interest rates or mortgage payments. Private lending options usually offer faster approval and less strict criteria but are typically more expensive than traditional mortgage financing. Ultimately, the financing option chosen should align with the investor's financial goals and risk tolerance.

This mind map was published on 19 April 2023 and has been viewed 101 times.