How do non-profit organizations differ from for-profit organizations?

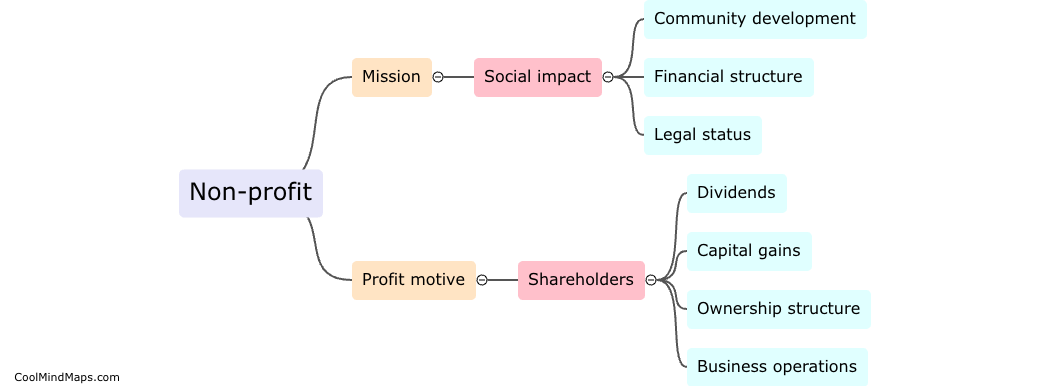

Non-profit organizations and for-profit organizations differ in various ways. Firstly, the purpose of non-profit organizations is to serve a specific cause or a social good, while for-profit organizations are focused on generating profit for their owners, shareholders, or investors. Non-profit organizations typically rely on donations, grants, and fundraising efforts to sustain their operations, whereas for-profit organizations generate revenue through sales of goods or services. Additionally, non-profit organizations are tax-exempt, meaning they do not pay income taxes, while for-profit organizations are subject to taxation. Furthermore, non-profit organizations are governed by a board of directors or trustees, and any surplus funds are reinvested back into the organization's mission rather than being distributed as profits. Overall, the key distinction lies in the fundamental goals and methods of operation between non-profit and for-profit organizations.

This mind map was published on 19 August 2023 and has been viewed 108 times.