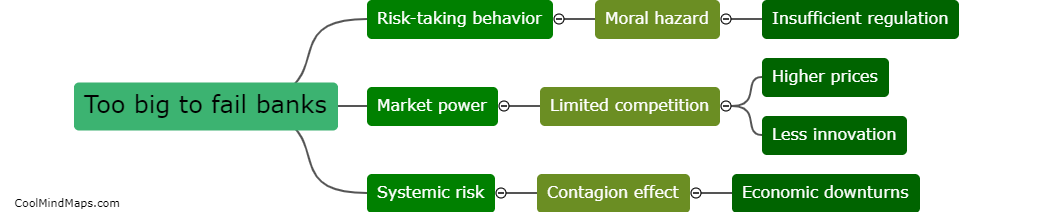

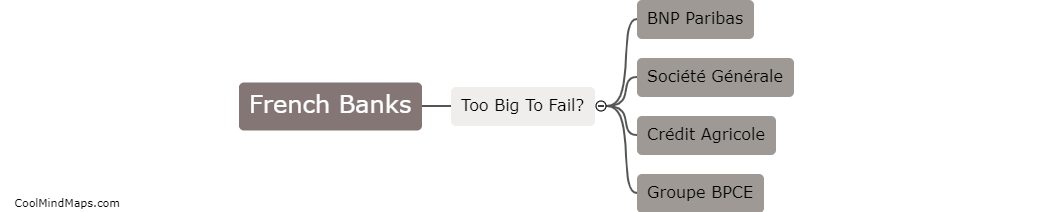

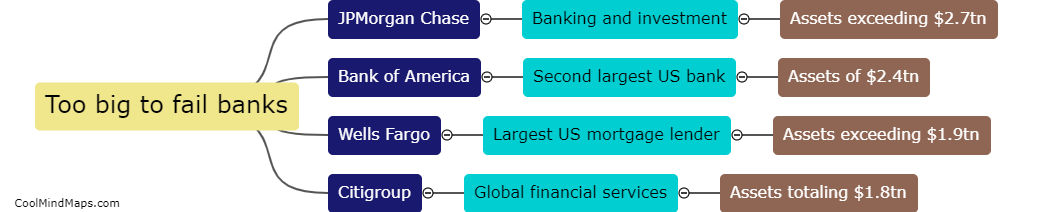

Examples of too big to fail banks?

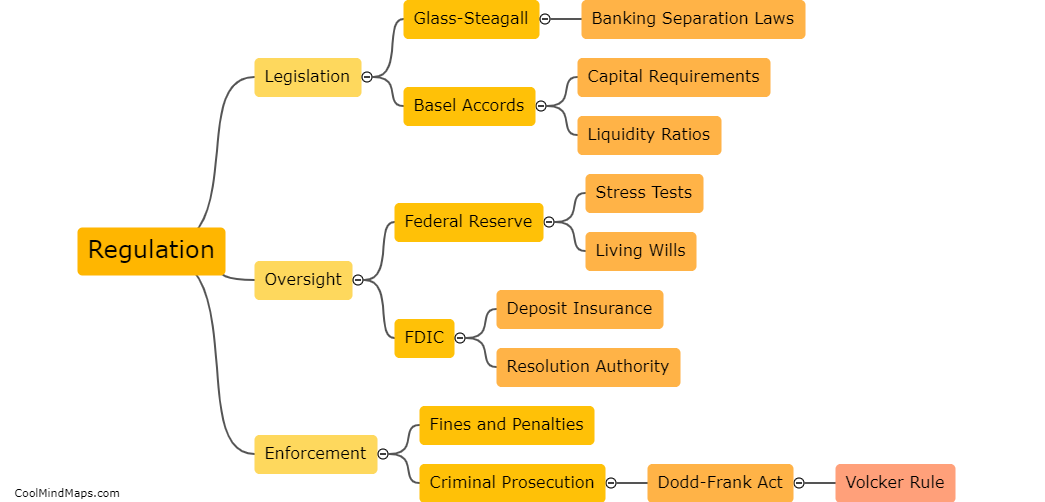

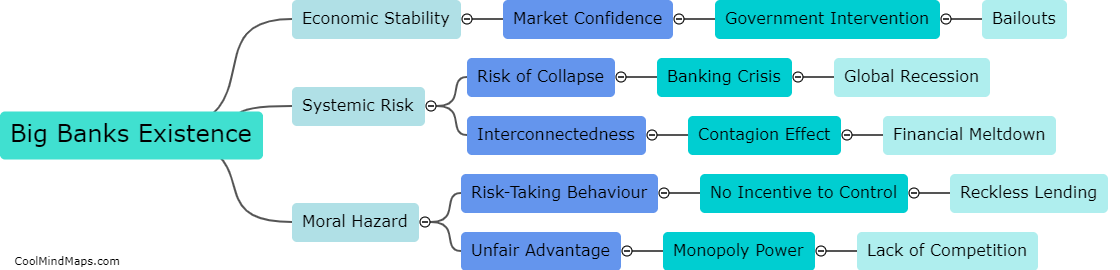

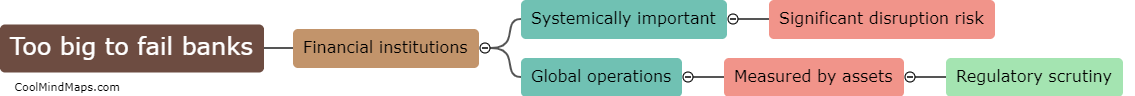

Examples of too big to fail banks include JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo in the United States, and HSBC and Barclays in Europe. These banks are considered systemically important by regulators due to their size, complexity, and interconnectedness with the global financial system. In the event of their failure, it could cause significant disruption to the global economy, making them too big to fail. As a result, governments around the world have implemented regulations and policies aimed at mitigating the risks associated with these banks.

This mind map was published on 23 May 2023 and has been viewed 100 times.