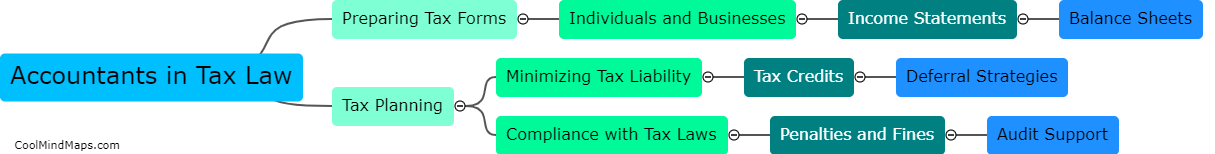

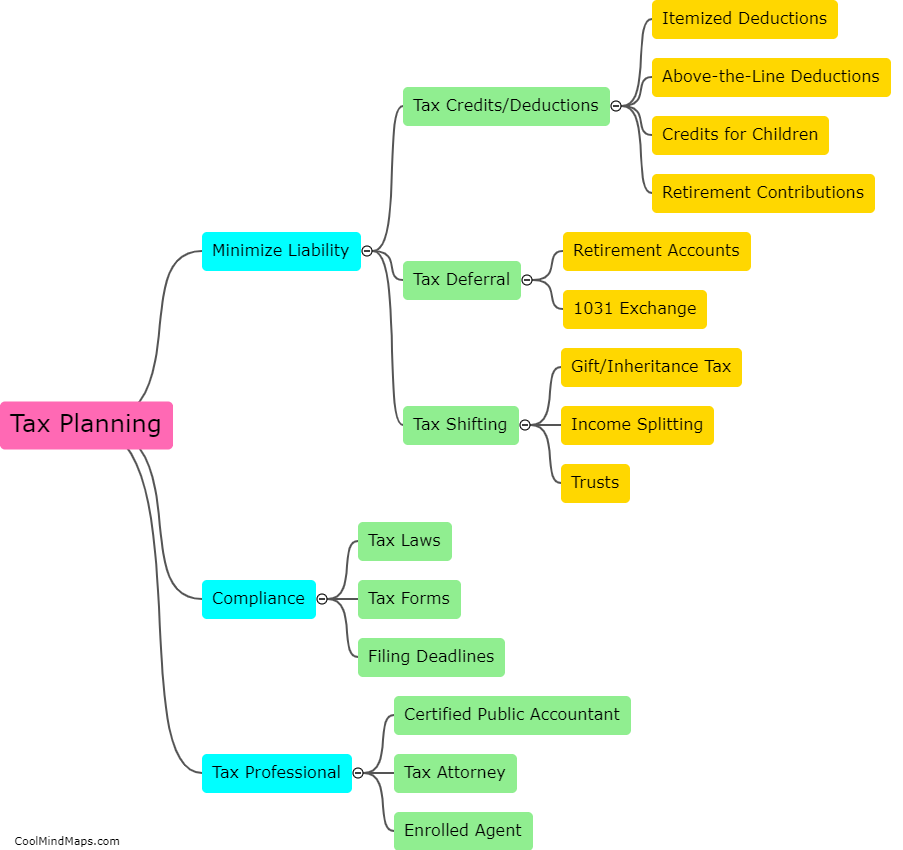

What is tax planning?

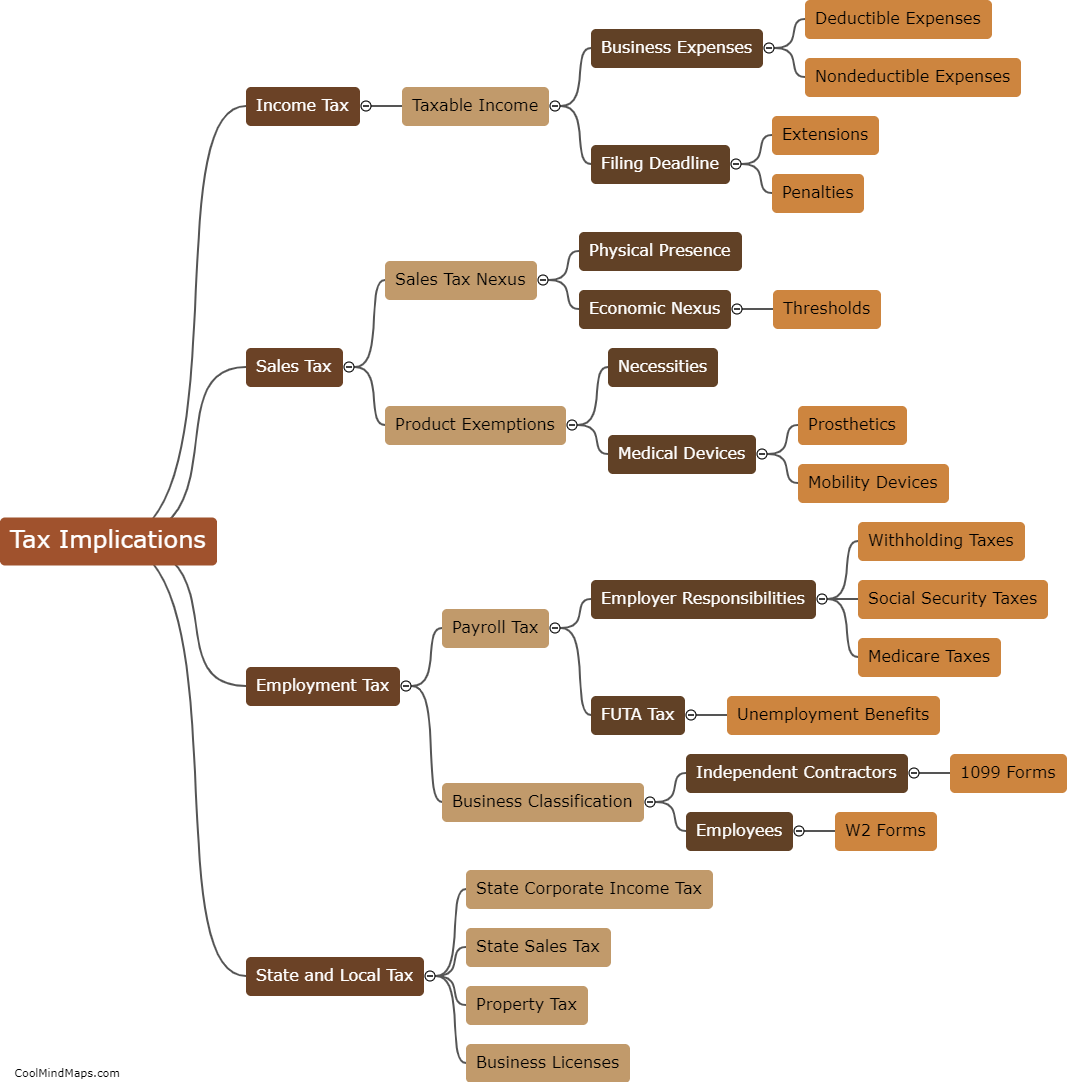

Tax planning refers to the process of analyzing a person's or company's financial situation to identify tax-efficient methods for managing their tax liability. The goal of tax planning is to reduce the amount of tax that one has to pay or to defer tax payments to a later date. Tax planning uses a variety of techniques, such as maximizing deductions, tax credits, exemptions, and deferral of income, to lower the total tax bill. It involves keeping track of changes in the tax code and being aware of new legislation that might affect one's tax rate or the tax treatment of investments. By effectively managing their tax liability, individuals and businesses can save money and achieve their financial goals more easily.

This mind map was published on 18 April 2023 and has been viewed 100 times.