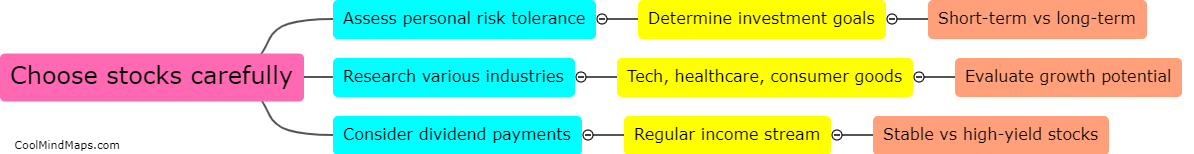

How do I create a diversified stock portfolio?

Creating a diversified stock portfolio involves spreading your investments across different sectors, industries, and asset classes to reduce risk and maximize returns. Start by researching and selecting a variety of stocks from sectors such as technology, healthcare, consumer goods, and energy. Consider adding international stocks and other asset classes like bonds or real estate investment trusts (REITs) to further diversify your portfolio. Regularly monitor and rebalance your portfolio to ensure that it remains diversified and aligned with your investment goals. By taking a strategic and thoughtful approach, you can build a portfolio that is resilient to market fluctuations and better positioned for long-term growth.

This mind map was published on 19 August 2024 and has been viewed 62 times.