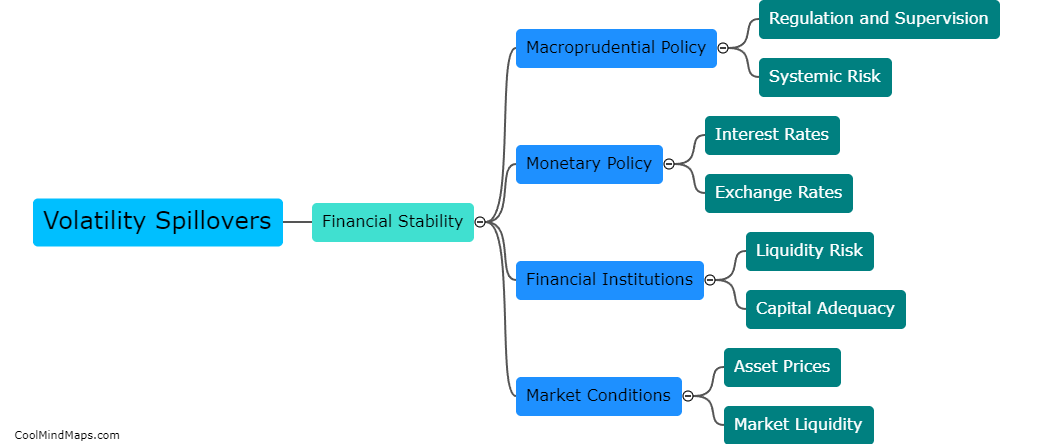

How do volatility spillovers affect financial stability?

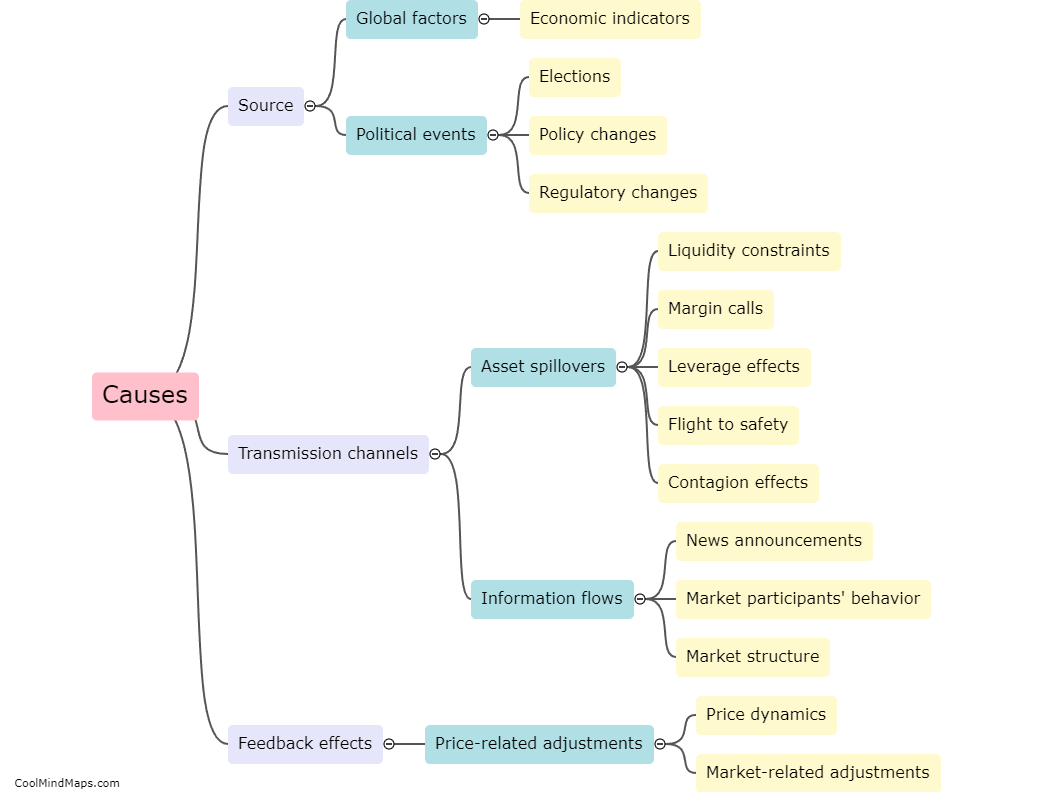

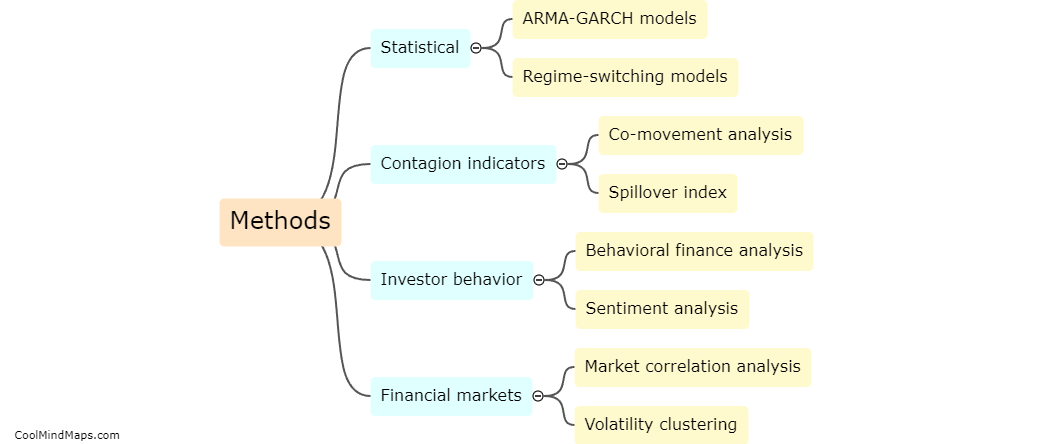

Volatility spillovers refer to the transmission of fluctuations in asset prices or market volatility across countries, sectors, or institutions. These spillovers can have a significant impact on financial stability. When volatility spills over from one market to another or from one institution to another, it can result in increased market uncertainties, heightened risk aversion, and potential disruptions in financial markets. This can lead to sharp declines in asset prices, liquidity crunches, and difficulties in raising capital. Volatility spillovers can also create contagion effects, where financial stress in one institution or market spreads to others, potentially leading to systemic risks and broader financial instability. Therefore, understanding and managing volatility spillovers is crucial for maintaining financial stability and safeguarding the functioning of global financial markets.

This mind map was published on 27 November 2023 and has been viewed 102 times.