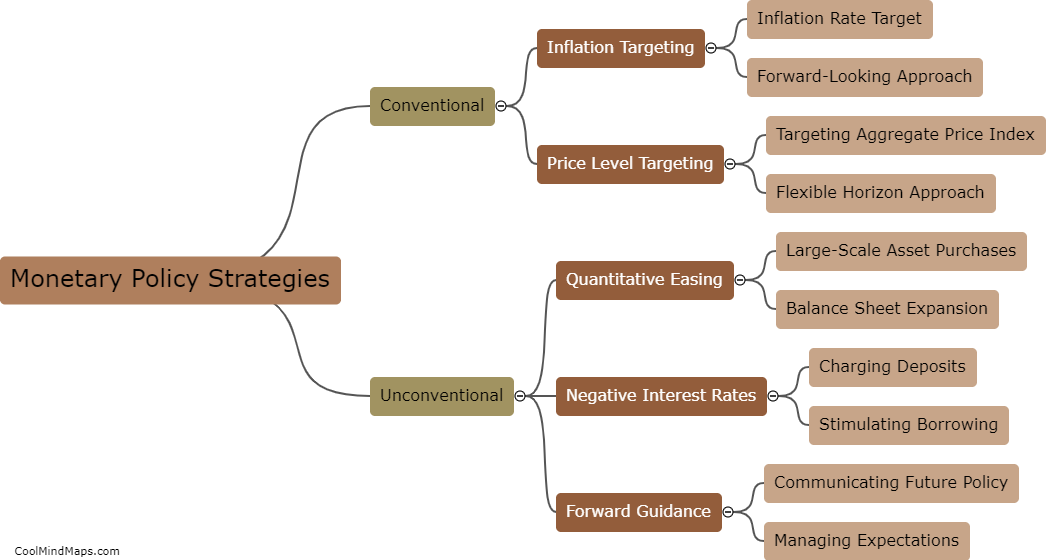

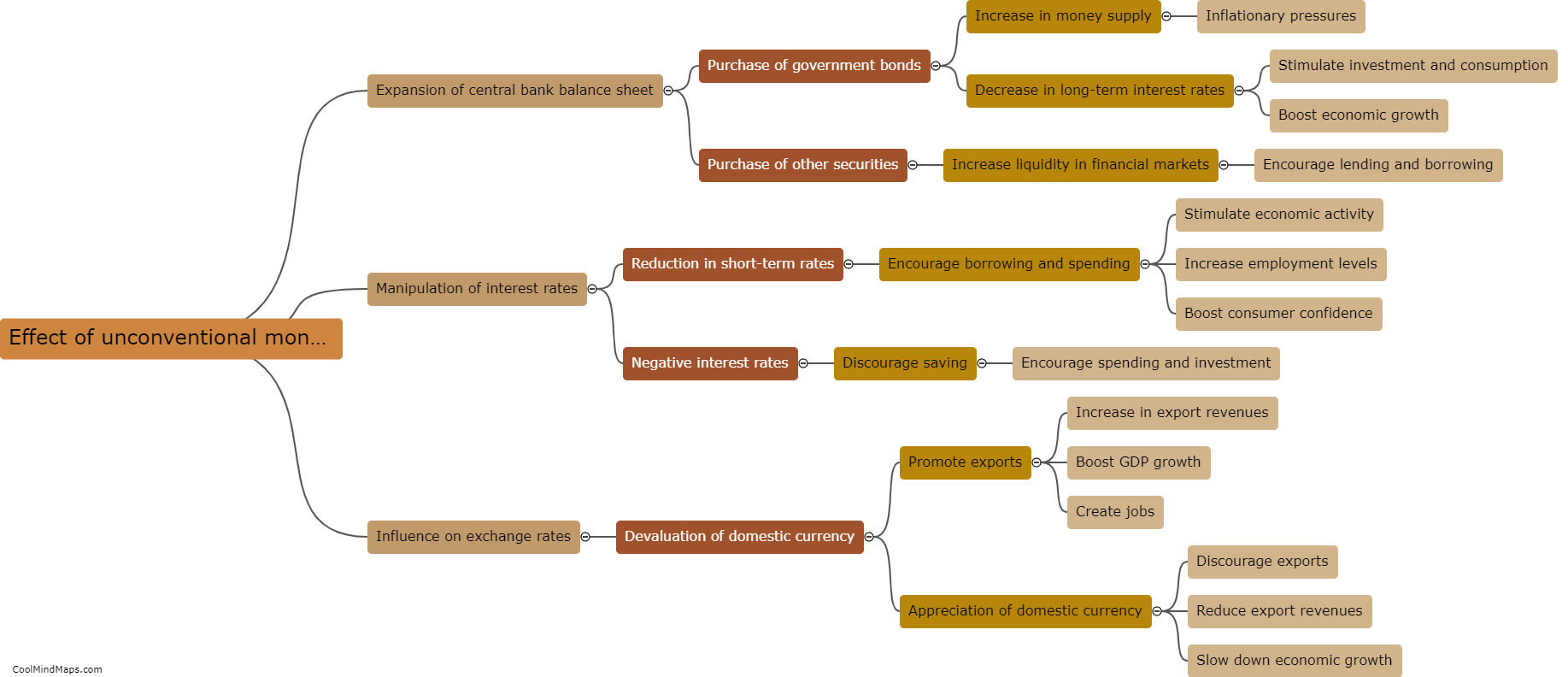

How do unconventional monetary policies affect an economy?

Unconventional monetary policies, also known as unconventional tools or measures, refer to non-traditional actions taken by central banks to stimulate an economy. These policies are implemented when conventional measures like interest rate adjustments are no longer effective. The primary objective of unconventional policies, such as quantitative easing (QE) or negative interest rates, is to provide additional monetary stimulus to encourage borrowing, spending, and investment. By increasing the money supply or reducing borrowing costs, these measures aim to boost aggregate demand, increase inflation, and drive economic growth. However, the impact of unconventional policies on an economy can vary. While they can help in times of economic crisis or when traditional policies fall short, there are also potential risks such as distorted asset prices, currency devaluation, or unintended consequences for savers and retirees. Therefore, the effectiveness and consequences of unconventional monetary policies need to be carefully evaluated and balanced with other economic factors for sustainable long-term growth.

This mind map was published on 18 September 2023 and has been viewed 56 times.